Photo Credit: fizkes / Shutterstock

By a variety of metrics, women’s economic power has increased significantly in recent decades. The labor force participation rate for women has increased dramatically in the postwar era: only around one in three women were working or seeking work in the late 1940s, compared to three out of five women now. Educational attainment has also grown, as the percentage of working women with a four-year degree has grown nearly fourfold since 1970. And factors like these have also contributed to a growth in earnings for women. While women still only earn around 80% of what men do on average, the gender wage gap has grown smaller over time.

Together, improving economic conditions for women have made it possible for more women to pursue one of the most significant purchases many people will make in life: a home. According to data from the National Association of Realtors, the homeownership rate for women was around 61.2% in 2019, compared to 50.9% in 1990. And this trend further adds to women’s economic progress, as homeownership is a key strategy for wealth-building.

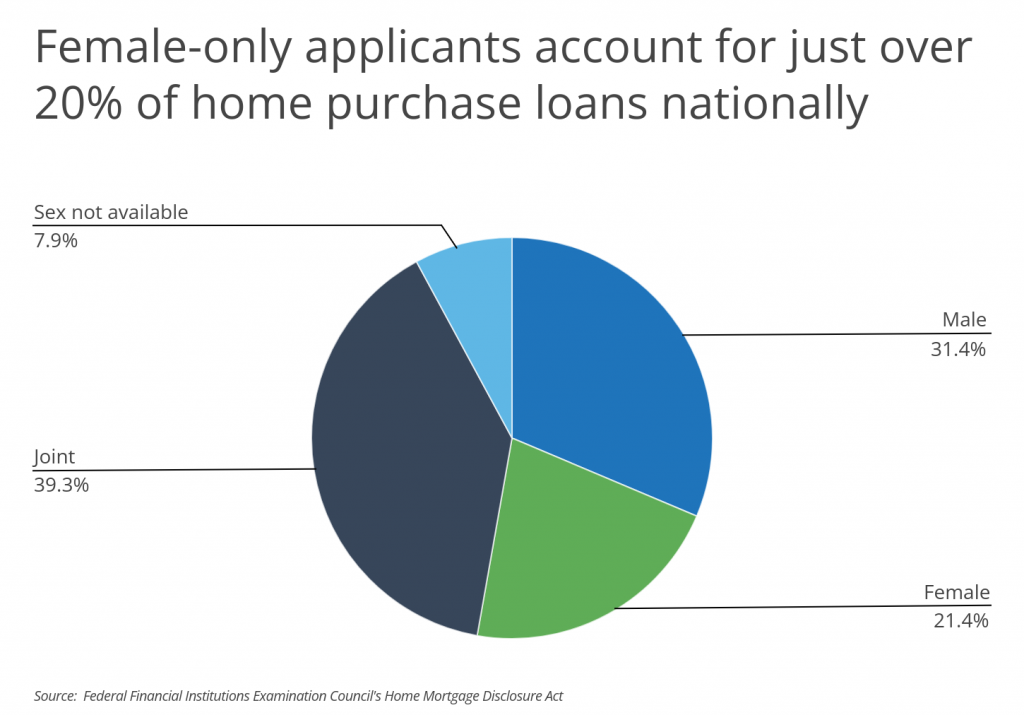

By some measures, however, women are still underrepresented among homeowners. Out of all applicants for home purchase loans, only 21.4% originate from females alone compared to 31.4% from males alone, according to Home Mortgage Disclosure Act data. While nearly half of home purchase loans come from joint applicants (39.3%) or applicants for whom sex data is not available (7.9%), which could include female applicants, the data suggests that homeownership remains more common among men.

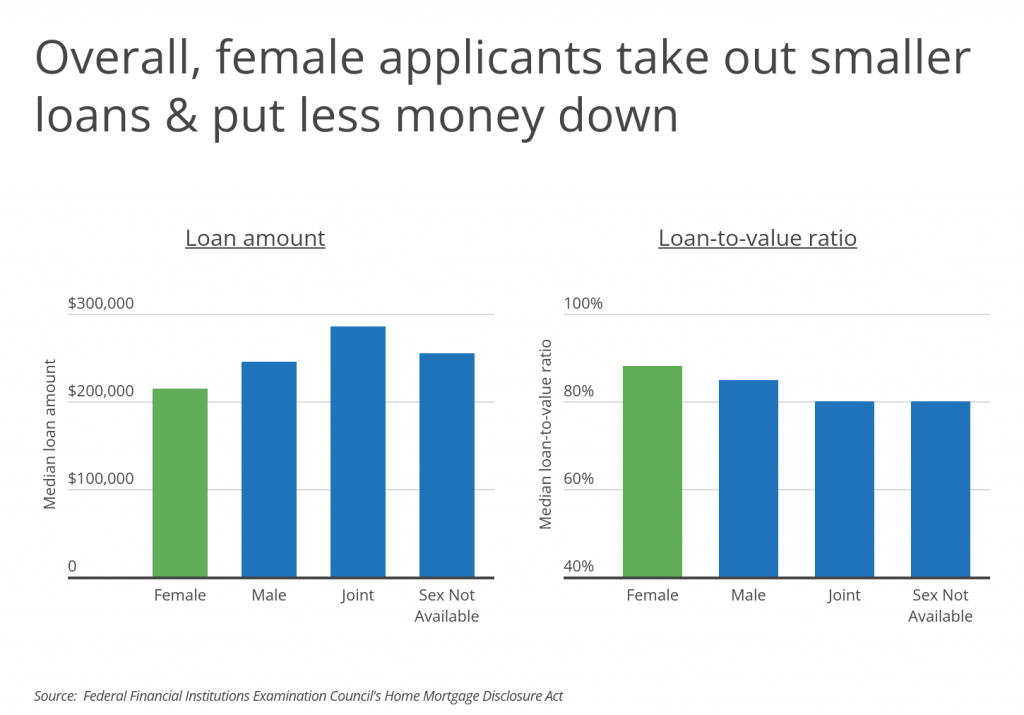

Data on the financing available to homebuyers also shows different experiences for female buyers. Female loan applicants receive a median home loan of $215,000, while a typical loan for male applicants is $245,000 and joint applicants have a median loan amount of $285,000. The average loan-to-value ratio for female loan applicants is 88%, compared to 85% for male applicants and 80% for joint applicants. This suggests that female buyers are putting less money down when they purchase a home than their male or joint counterparts.

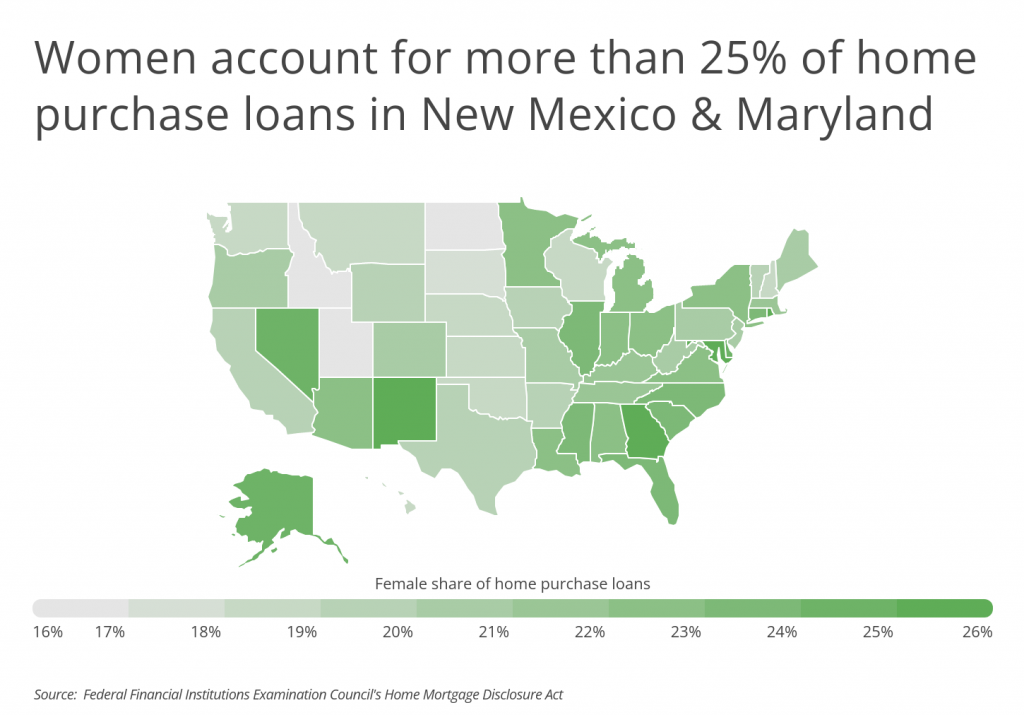

Female homebuyers are also unevenly distributed geographically, with some locations having a greater share of female buyers than others. In four states—New Mexico, Maryland, Georgia, and Rhode Island—women account for 25% or more of home purchase loans. Many of the metro areas located in these states are also among the top cities for women buying homes. Conversely, 18 total states had values below 20% for their share of female home purchase loans. Most of the latter group were found in the Plains states and Mountain West region, led by Utah at 16.2% and Idaho at 16.5%.

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional home purchase loans approved in 2020 were considered. To determine the locations with the most buyers that are women, researchers at Inspection Support Network calculated the female share of home purchase loans. This includes both single female applicants and female applicants with a female co-applicant(s). In the event of a tie, the location with the greater total female home purchase loans was ranked higher.

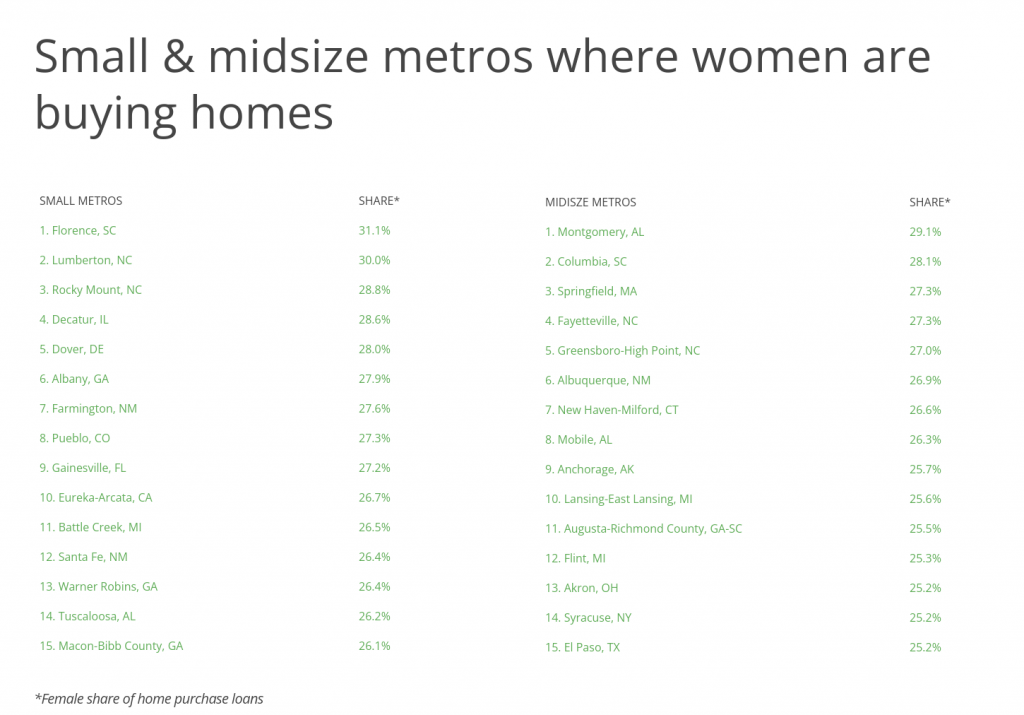

Here are the metropolitan areas with the most women buying homes.

Large Metros Where Women Are Buying Homes

Photo Credit: dorinser / Shutterstock

15. Miami-Fort Lauderdale-Pompano Beach, FL

- Female share of home purchase loans: 24.3%

- Total female home purchase loans: 14,241

- Median loan amount for female borrowers: $245,000

- Median loan-to-value ratio for female borrowers: 80.0%

- Median interest rate for female borrowers: 3.25%

Photo Credit: f11photo / Shutterstock

14. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Female share of home purchase loans: 24.4%

- Total female home purchase loans: 17,592

- Median loan amount for female borrowers: $345,000

- Median loan-to-value ratio for female borrowers: 90.0%

- Median interest rate for female borrowers: 3.13%

Photo Credit: Sean Pavone / Shutterstock

13. Birmingham-Hoover, AL

- Female share of home purchase loans: 24.6%

- Total female home purchase loans: 3,325

- Median loan amount for female borrowers: $185,000

- Median loan-to-value ratio for female borrowers: 95.0%

- Median interest rate for female borrowers: 3.25%

Photo Credit: Sean Pavone / Shutterstock

12. Tucson, AZ

- Female share of home purchase loans: 24.7%

- Total female home purchase loans: 3,015

- Median loan amount for female borrowers: $195,000

- Median loan-to-value ratio for female borrowers: 85.0%

- Median interest rate for female borrowers: 3.25%

Photo Credit: Sean Pavone / Shutterstock

11. Hartford-East Hartford-Middletown, CT

- Female share of home purchase loans: 24.7%

- Total female home purchase loans: 3,093

- Median loan amount for female borrowers: $195,000

- Median loan-to-value ratio for female borrowers: 90.0%

- Median interest rate for female borrowers: 3.13%

Photo Credit: Sean Pavone / Shutterstock

10. Cleveland-Elyria, OH

- Female share of home purchase loans: 24.7%

- Total female home purchase loans: 5,434

- Median loan amount for female borrowers: $145,000

- Median loan-to-value ratio for female borrowers: 90.0%

- Median interest rate for female borrowers: 3.19%

Photo Credit: Jon Bilous / Shutterstock

9. Virginia Beach-Norfolk-Newport News, VA-NC

- Female share of home purchase loans: 24.9%

- Total female home purchase loans: 4,144

- Median loan amount for female borrowers: $195,000

- Median loan-to-value ratio for female borrowers: 95.0%

- Median interest rate for female borrowers: 3.25%

Photo Credit: Sean Pavone / Shutterstock

8. Louisville/Jefferson County, KY-IN

- Female share of home purchase loans: 24.9%

- Total female home purchase loans: 4,165

- Median loan amount for female borrowers: $155,000

- Median loan-to-value ratio for female borrowers: 92.0%

- Median interest rate for female borrowers: 3.25%

Photo Credit: Sean Pavone / Shutterstock

7. Baltimore-Columbia-Towson, MD

- Female share of home purchase loans: 25.0%

- Total female home purchase loans: 7,691

- Median loan amount for female borrowers: $245,000

- Median loan-to-value ratio for female borrowers: 95.0%

- Median interest rate for female borrowers: 3.13%

Photo Credit: Sean Pavone / Shutterstock

6. Tampa-St. Petersburg-Clearwater, FL

- Female share of home purchase loans: 25.9%

- Total female home purchase loans: 10,934

- Median loan amount for female borrowers: $205,000

- Median loan-to-value ratio for female borrowers: 86.7%

- Median interest rate for female borrowers: 3.25%

Photo Credit: ESB Professional / Shutterstock

5. Richmond, VA

- Female share of home purchase loans: 26.1%

- Total female home purchase loans: 4,375

- Median loan amount for female borrowers: $215,000

- Median loan-to-value ratio for female borrowers: 94.7%

- Median interest rate for female borrowers: 3.13%

Photo Credit: Andrew Zarivny / Shutterstock

4. Rochester, NY

- Female share of home purchase loans: 26.2%

- Total female home purchase loans: 2,589

- Median loan amount for female borrowers: $135,000

- Median loan-to-value ratio for female borrowers: 90.3%

- Median interest rate for female borrowers: 3.13%

Photo Credit: Sean Pavone / Shutterstock

3. Las Vegas-Henderson-Paradise, NV

- Female share of home purchase loans: 26.4%

- Total female home purchase loans: 7,080

- Median loan amount for female borrowers: $255,000

- Median loan-to-value ratio for female borrowers: 89.7%

- Median interest rate for female borrowers: 3.24%

Photo Credit: Daniel Novak / Shutterstock

2. Buffalo-Cheektowaga, NY

- Female share of home purchase loans: 26.5%

- Total female home purchase loans: 2,461

- Median loan amount for female borrowers: $145,000

- Median loan-to-value ratio for female borrowers: 90.0%

- Median interest rate for female borrowers: 3.13%

Photo Credit: ESB Professional / Shutterstock

1. Atlanta-Sandy Springs-Alpharetta, GA

- Female share of home purchase loans: 26.5%

- Total female home purchase loans: 20,460

- Median loan amount for female borrowers: $235,000

- Median loan-to-value ratio for female borrowers: 90.0%

- Median interest rate for female borrowers: 3.25%

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional home purchase loans approved in 2020 were considered. To determine the locations with the most buyers that are women, researchers calculated the female share of home purchase loans. This includes both single female applicants and female applicants with a female co-applicant(s). In the event of a tie, the location with the greater total female home purchase loans was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more).