Photo Credit: ASDF_MEDIA / Shutterstock

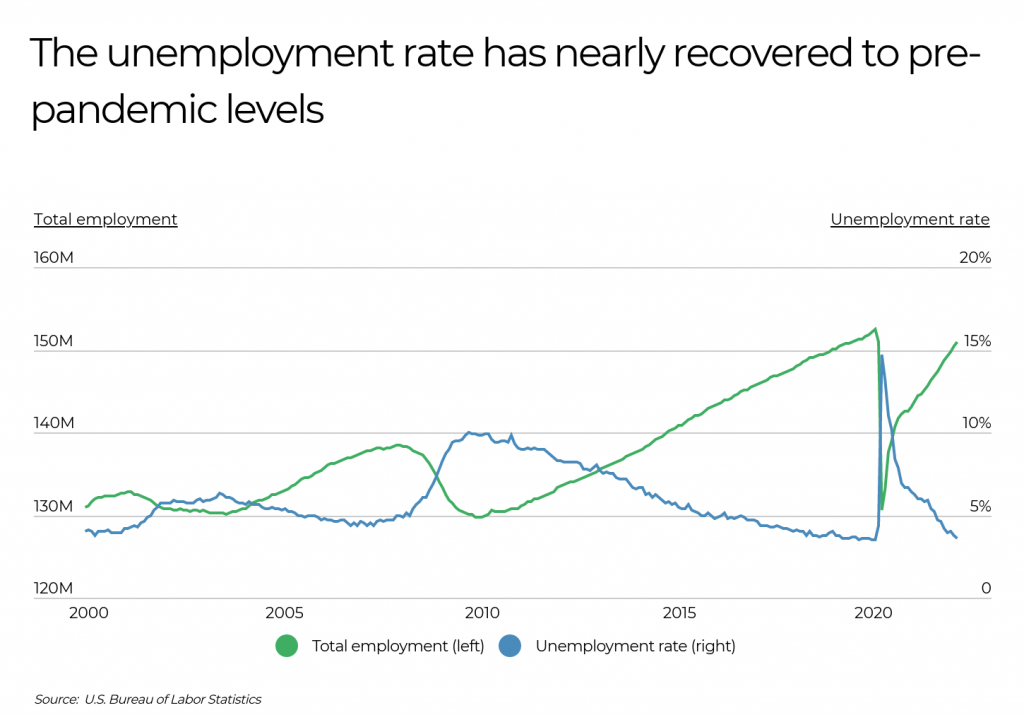

At the national level, many key employment indicators in the U.S. look similar to before the COVID-19 pandemic, and robust employment growth plays a part in that. But the impact the coronavirus had on employment can’t be understated. Data from the U.S. Bureau of Labor Statistics shows that job losses in the spring of 2020 were comparable to those of the Great Depression. The unemployment rate hit almost 15% at that time; however, unlike prior recessions, the rebound was swift. Over 60% of jobs lost returned a year later, and total employment today is just a percentage point lower than the pre-COVID peak.

According to new data from the U.S. Bureau of Labor Statistics, from March 2021 to March 2022 there were reductions in unemployment rates in 386 of America’s 389 metropolitan areas, and 108 of those areas had jobless rates under 3.0%. In March 2022, the national seasonally-adjusted unemployment rate was 3.6%, down 2.4 percentage points from the year prior. Similarly, data from the Economic Innovation Group shows that over half of all U.S. metros that experienced job losses during the coronavirus pandemic are on target for full recoveries in the next year.

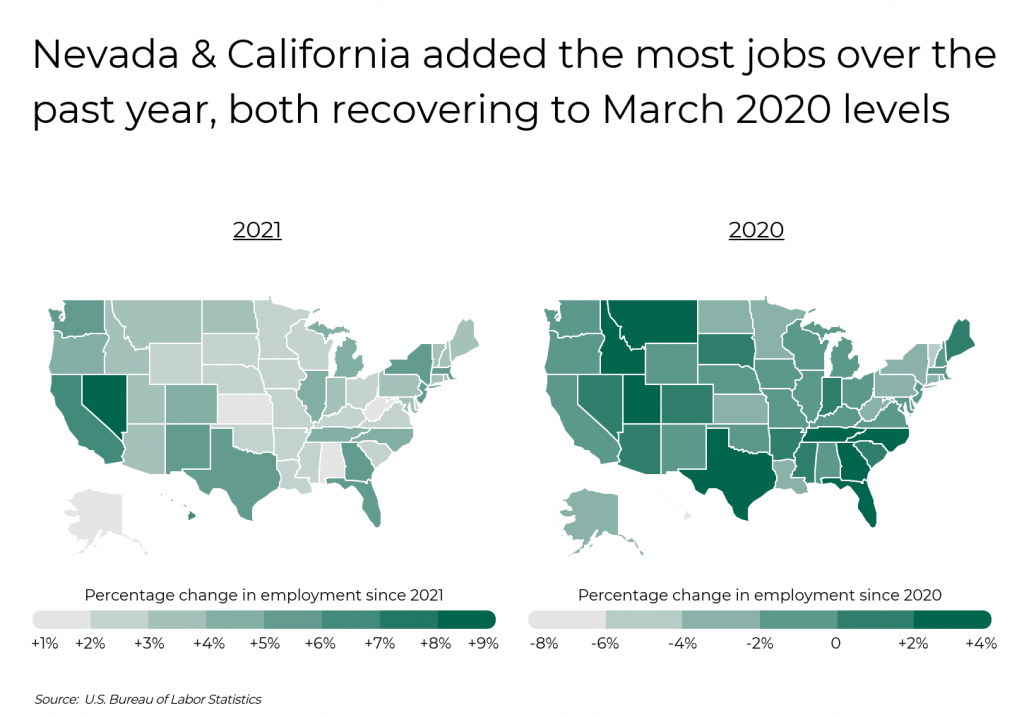

On the state level, Nevada and California added the most jobs last year, with respective 9.1% and 6.4% increases, each showing a significant rise over the year prior. From March 2022 to March 2020, Nevada had a 0.1% increase in employment, while California had a 0.6% decrease during that two-year period. This means that when compared to the start of the pandemic, employment numbers in these two states are relatively flat. Hawaii also had a dramatic rebound over the past year, with a 6.3% increase from March 2021 to 2022; however, its total employment numbers are still 8.5% below March 2020 levels.

Unlike the three states listed above, which were hit especially hard by declines in travel and tourism, Texas and Florida experienced notable and steady growth over both periods. Employment in each state grew by 5.7–5.9% over the past year, and both are about 2.5% above March 2020 figures. Although to a lesser extent, the same is the case for Georgia, which reported a 5.2% increase in employment over the past year and a 2.2% increase over the past two years.

Similar trends hold at the local level with select cities in Nevada, California, Texas, Florida, and Georgia reporting robust employment growth. On the other hand, many locations in the South and Midwest have experienced little to no employment growth over the past year, and remain well below March 2020 numbers.

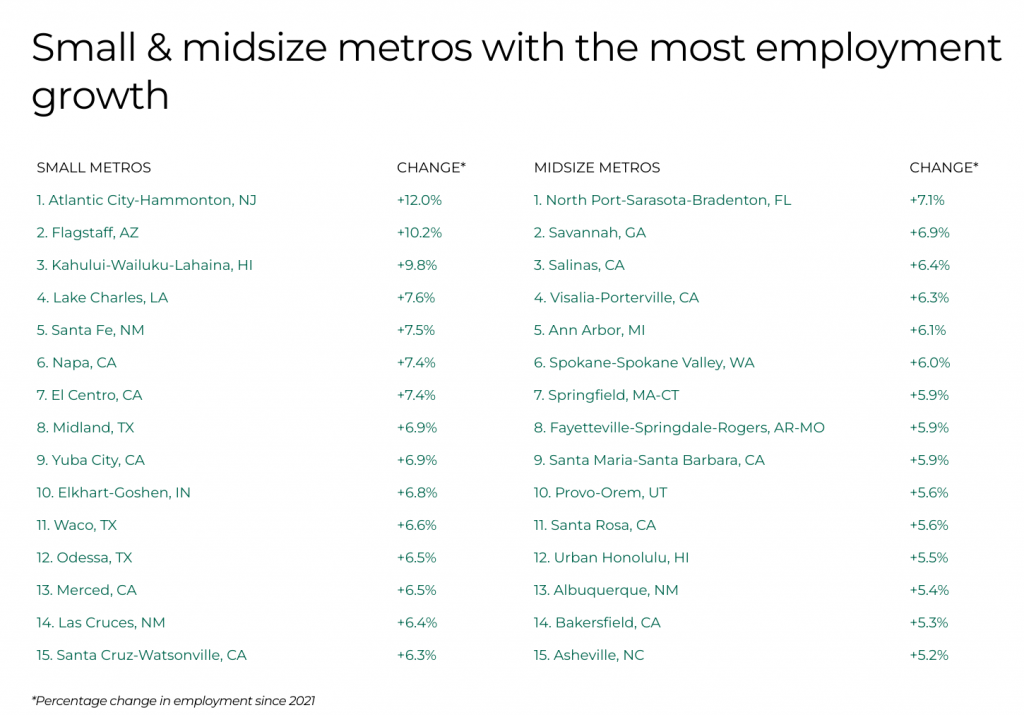

The data used in this analysis is from the U.S. Bureau of Labor Statistics Current Employment Statistics dataset. To determine the locations with the most employment growth, researchers at Filterbuy calculated the percentage change in employment between March 2021 and March 2022, considering only metropolitan areas with at least 100,000 residents. In the event of a tie, the location with the greater total change in employment since March of 2021 was ranked higher.

Here are the U.S. metropolitan areas with the most employment growth.

Large Metros With the Most Employment Growth

Photo Credit: John_T / Shutterstock

15. Raleigh, NC

- Percentage change in employment since 2021: +5.5%

- Total change in employment since 2021: +35,400

- Percentage change in employment since 2020: +4.5%

- Total change in employment since 2020: +29,200

- Current unemployment rate: 3.1%

Photo Credit: thetahoeguy / Shutterstock

14. San Jose-Sunnyvale-Santa Clara, CA

- Percentage change in employment since 2021: +5.5%

- Total change in employment since 2021: +59,200

- Percentage change in employment since 2020: -1.2%

- Total change in employment since 2020: -14,100

- Current unemployment rate: 3.0%

Photo Credit: CSNafzger / Shutterstock

13. Seattle-Tacoma-Bellevue, WA

- Percentage change in employment since 2021: +5.5%

- Total change in employment since 2021: +108,000

- Percentage change in employment since 2020: -1.3%

- Total change in employment since 2020: -28,400

- Current unemployment rate: 3.6%

Photo Credit: May_Lana / Shutterstock

12. Miami-Fort Lauderdale-West Palm Beach, FL

- Percentage change in employment since 2021: +5.6%

- Total change in employment since 2021: +147,000

- Percentage change in employment since 2020: +0.9%

- Total change in employment since 2020: +23,600

- Current unemployment rate: 3.2%

Photo Credit: Steve Heap / Shutterstock

11. Nashville-Davidson–Murfreesboro–Franklin, TN

- Percentage change in employment since 2021: +6.3%

- Total change in employment since 2021: +64,900

- Percentage change in employment since 2020: +4.1%

- Total change in employment since 2020: +42,900

- Current unemployment rate: 2.7%

Photo Credit: Steve Minkler / Shutterstock

10. Riverside-San Bernardino-Ontario, CA

- Percentage change in employment since 2021: +6.3%

- Total change in employment since 2021: +96,900

- Percentage change in employment since 2020: +3.7%

- Total change in employment since 2020: +58,000

- Current unemployment rate: 5.1%

Photo Credit: ESB Professional / Shutterstock

9. Atlanta-Sandy Springs-Roswell, GA

- Percentage change in employment since 2021: +6.3%

- Total change in employment since 2021: +175,100

- Percentage change in employment since 2020: +2.8%

- Total change in employment since 2020: +79,300

- Current unemployment rate: 3.2%

Photo Credit: Matt Gush / Shutterstock

8. Fresno, CA

- Percentage change in employment since 2021: +6.8%

- Total change in employment since 2021: +23,600

- Percentage change in employment since 2020: +1.3%

- Total change in employment since 2020: +4,700

- Current unemployment rate: 6.9%

Photo Credit: Pete Niesen / Shutterstock

7. San Francisco-Oakland-Hayward, CA

- Percentage change in employment since 2021: +6.8%

- Total change in employment since 2021: +155,500

- Percentage change in employment since 2020: -2.5%

- Total change in employment since 2020: -62,900

- Current unemployment rate: 3.5%

Photo Credit: CK Foto / Shutterstock

6. Dallas-Fort Worth-Arlington, TX

- Percentage change in employment since 2021: +6.8%

- Total change in employment since 2021: +256,700

- Percentage change in employment since 2020: +5.0%

- Total change in employment since 2020: +190,100

- Current unemployment rate: 3.9%

Photo Credit: Sean Pavone / Shutterstock

5. Los Angeles-Long Beach-Anaheim, CA

- Percentage change in employment since 2021: +7.0%

- Total change in employment since 2021: +402,900

- Percentage change in employment since 2020: -1.6%

- Total change in employment since 2020: -98,500

- Current unemployment rate: 5.3%

Photo Credit: kan khampanya / Shutterstock

4. San Diego-Carlsbad, CA

- Percentage change in employment since 2021: +7.3%

- Total change in employment since 2021: +102,900

- Percentage change in employment since 2020: +0.0%

- Total change in employment since 2020: +400

- Current unemployment rate: 4.2%

Photo Credit: Sean Pavone / Shutterstock

3. Austin-Round Rock, TX

- Percentage change in employment since 2021: +8.0%

- Total change in employment since 2021: +90,400

- Percentage change in employment since 2020: +7.0%

- Total change in employment since 2020: +80,300

- Current unemployment rate: 3.1%

Photo Credit: Songquan Deng / Shutterstock

2. Orlando-Kissimmee-Sanford, FL

- Percentage change in employment since 2021: +9.1%

- Total change in employment since 2021: +111,800

- Percentage change in employment since 2020: +0.5%

- Total change in employment since 2020: +6,500

- Current unemployment rate: 3.5%

Photo Credit: Sean Pavone / Shutterstock

1. Las Vegas-Henderson-Paradise, NV

- Percentage change in employment since 2021: +12.6%

- Total change in employment since 2021: +116,600

- Percentage change in employment since 2020: +0.1%

- Total change in employment since 2020: +1,100

- Current unemployment rate: 5.4%

Detailed Findings & Methodology

The data used in this analysis is from the U.S. Bureau of Labor Statistics Current Employment Statistics dataset. To determine the locations with the most employment growth, researchers calculated the percentage change in employment between March of 2021 and March of 2022. In the event of a tie, the location with the greater total change in employment since March of 2021 was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more). Note, all values for employment are seasonally adjusted.