Photo Credit: Zakhar Mar / Shutterstock

Despite inflation, rising interest rates, and recession fears, the outlook for the construction industry in the next few years appears positive.

A midyear report from the American Institute of Architects projected 9.1% growth in nonresidential construction for the remainder of 2022 and 6% growth in 2023. Residential construction has been experiencing declines in recent months as rising costs mount, but these declines come off of record-high activity in the past two years. And with the industry experiencing a boom, job growth in construction has been steady.

High demand for construction across the board has helped boost the industry over the past two years, and could help construction companies weather a potential recession. The dramatic run-up in home values and rents highlighted the need to add residential housing supply, while the COVID-19 pandemic spurred facility upgrades to many non-residential spaces. The federal government has also been investing heavily in construction and infrastructure over the past two years. A series of COVID-19 relief packages in 2020 and 2021 has sent billions of dollars flowing to the industry, but the centerpiece of federal investment was a $1.9 trillion infrastructure bill signed into law late last year. The bipartisan package will fund major new construction projects in transportation, telecommunication, energy, and more for years to come.

Heightened demand and investment has also aided the construction industry’s employment. Construction was not as hard-hit as other parts of the economy by mass layoffs at the outset of the COVID-19 pandemic, and the industry has also recovered jobs more quickly. Construction employment had a strong bounceback after lockdowns and other restrictions began to ease in the late spring of 2020, and has continued to grow since. As a result, job recovery in construction has consistently outpaced recovery in total private sector employment for more than two years. Employment in the industry passed pre-pandemic levels in January 2022, several months before the economy as a whole hit the same milestone.

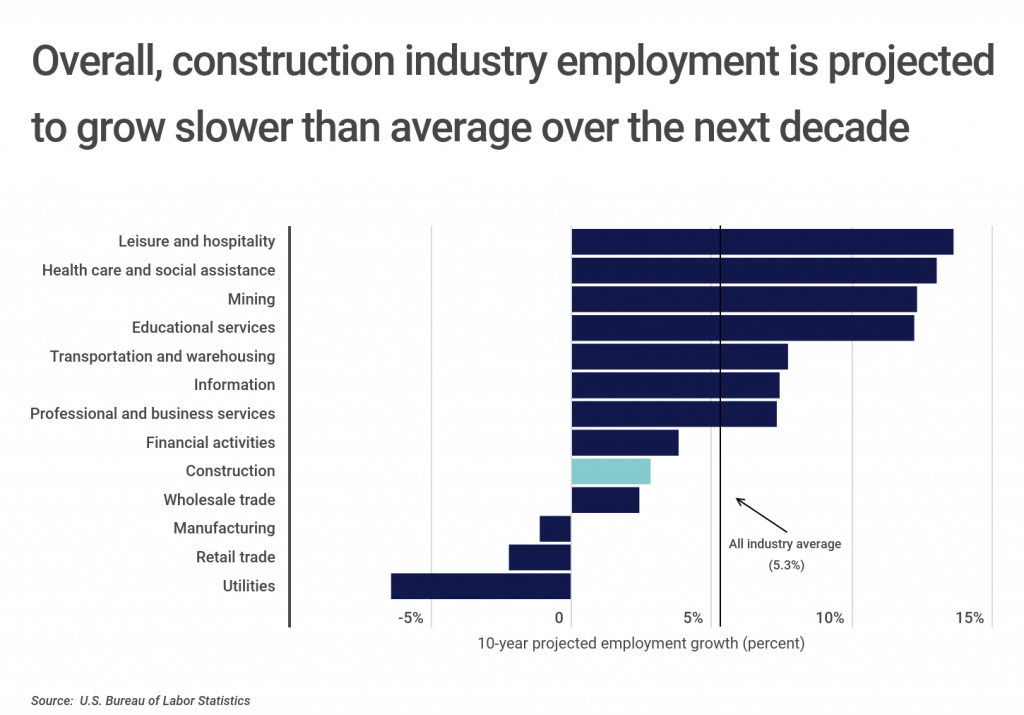

In part because of the construction industry’s faster COVID-19 recovery, the Bureau of Labor Statistics estimates that job growth in the construction industry will be slower than average over the next decade. Construction employment is projected to grow just 2.8% between now and 2031, compared to an average 5.3% rate of job growth across all industries—many of which are still recovering from the pandemic. Additionally, technological changes in the industry are poised to make many processes more efficient and less labor-intensive, while changing demand in industries that rely on construction projects, like energy, may create jobs in some areas while reducing employment in others.

Some roles in construction are set for increased employment in the years ahead, however, with projected employment outpacing both the estimates for the construction industry as a whole and the all-industry average. As the industry changes and modernizes, many of the professions set for the greatest rate of growth are in fact jobs not commonly associated with construction, like market research analysts, software developers, and lawyers. But it is transformations in energy and communications infrastructure that will provide the fastest employment growth in the industry.

The data used in this analysis is from the U.S. Bureau of Labor Statistics. To identify the fastest-growing jobs in construction, researchers at Construction Coverage calculated the projected change in employment between 2021 and 2031 for the most popular construction industry jobs.

Here are the fastest-growing jobs in the construction industry.

The Fastest-Growing Construction Industry Jobs

Photo Credit: mojo cp / Shutterstock

15. Computer and information systems managers

- 10-year projected employment growth (percent): +8.6%

- 10-year projected employment growth (total): +200

- Total employment (current): 2,400

- Median annual wage (current): $129,910

Photo Credit: Varavin88 / Shutterstock

14. Electricians

- 10-year projected employment growth (percent): +9.0%

- 10-year projected employment growth (total): +46,100

- Total employment (current): 512,900

- Median annual wage (current): $59,000

Photo Credit: David Gyung / Shutterstock

13. Market research analysts and marketing specialists

- 10-year projected employment growth (percent): +11.9%

- 10-year projected employment growth (total): +1,700

- Total employment (current): 14,000

- Median annual wage (current): $60,130

Photo Credit: wutzkohphoto / Shutterstock

12. Financial managers

- 10-year projected employment growth (percent): +12.4%

- 10-year projected employment growth (total): +2,000

- Total employment (current): 15,900

- Median annual wage (current): $126,230

Photo Credit: sirtravelalot / Shutterstock

11. Construction managers

- 10-year projected employment growth (percent): +12.4%

- 10-year projected employment growth (total): +28,900

- Total employment (current): 232,500

- Median annual wage (current): $98,500

Photo Credit: Elizaveta Galitckaia / Shutterstock

10. Floor layers, except carpet, wood, and hard tiles

- 10-year projected employment growth (percent): +12.6%

- 10-year projected employment growth (total): +1,800

- Total employment (current): 14,500

- Median annual wage (current): $48,270

Photo Credit: Martin Dworschak / Shutterstock

9. Tile and stone setters

- 10-year projected employment growth (percent): +12.7%

- 10-year projected employment growth (total): +4,300

- Total employment (current): 33,700

- Median annual wage (current): $48,090

Photo Credit: PongMoji / Shutterstock

8. Telecommunications line installers and repairers

- 10-year projected employment growth (percent): +13.2%

- 10-year projected employment growth (total): +4,100

- Total employment (current): 30,700

- Median annual wage (current): $47,710

Photo Credit: Andrey Popov / Shutterstock

7. Mechanical door repairers

- 10-year projected employment growth (percent): +14.5%

- 10-year projected employment growth (total): +2,400

- Total employment (current): 16,800

- Median annual wage (current): $45,250

Photo Credit: wutzkohphoto / Shutterstock

6. Software developers

- 10-year projected employment growth (percent): +15.1%

- 10-year projected employment growth (total): +300

- Total employment (current): 2,300

- Median annual wage (current): $89,400

Photo Credit: Flamingo Images / Shutterstock

5. Lawyers

- 10-year projected employment growth (percent): +16.1%

- 10-year projected employment growth (total): +300

- Total employment (current): 1,600

- Median annual wage (current): $152,650

Photo Credit: Zakhar Mar / Shutterstock

4. Radio, cellular, and tower equipment installers and repairers

- 10-year projected employment growth (percent): +21.6%

- 10-year projected employment growth (total): +400

- Total employment (current): 1,900

- Median annual wage (current): $51,690

Photo Credit: Kzenon / Shutterstock

3. Logisticians

- 10-year projected employment growth (percent): +27.8%

- 10-year projected employment growth (total): +400

- Total employment (current): 1,500

- Median annual wage (current): $64,000

Photo Credit: anatoliy gleb / Shutterstock

2. Solar photovoltaic installers

- 10-year projected employment growth (percent): +30.2%

- 10-year projected employment growth (total): +3,900

- Total employment (current): 12,900

- Median annual wage (current): $47,710

Photo Credit: Aunging / Shutterstock

1. Wind turbine service technicians

- 10-year projected employment growth (percent): +60.5%

- 10-year projected employment growth (total): +1,400

- Total employment (current): 2,400

- Median annual wage (current): $50,630

Methodology & Detailed Findings

The data used in this analysis is from the U.S. Bureau of Labor Statistics Employment Projections Survey. To identify the fastest-growing jobs in construction, researchers at Construction Coverage calculated the projected change in employment between 2021 and 2031 for all detailed occupations with at least 1,000 employees in the construction industry in 2021. All data reported at the occupation level—including projected employment, current employment, and median wages—are specific to the construction industry.