Image Credit: kitzcorner via Shutterstock

Access to credit is an important resource for managing personal finances, whether to pay for major purchases, serve as a bridge to cover regular expenses, or smooth out spending when something unexpected happens. But reliance on debt like credit cards can also mean racking up large balances that are hard to pay off. In the tumultuous economy of the last few years, consumers have experienced both highs and lows when it comes to credit.

Despite a spike in unemployment at the outset of COVID-19, many households fared well financially during the early phases of the pandemic. Government relief programs like stimulus checks, expanded unemployment benefits, and mortgage and student loan forbearance gave a boost to household finances, while consumers spent less due to lockdowns and concerns about the virus. This allowed debt holders to make progress toward becoming current on payments. Credit card balances in the U.S. declined by more than $120 billion in 2020 and another $28 billion from December 2020 to April 2021.

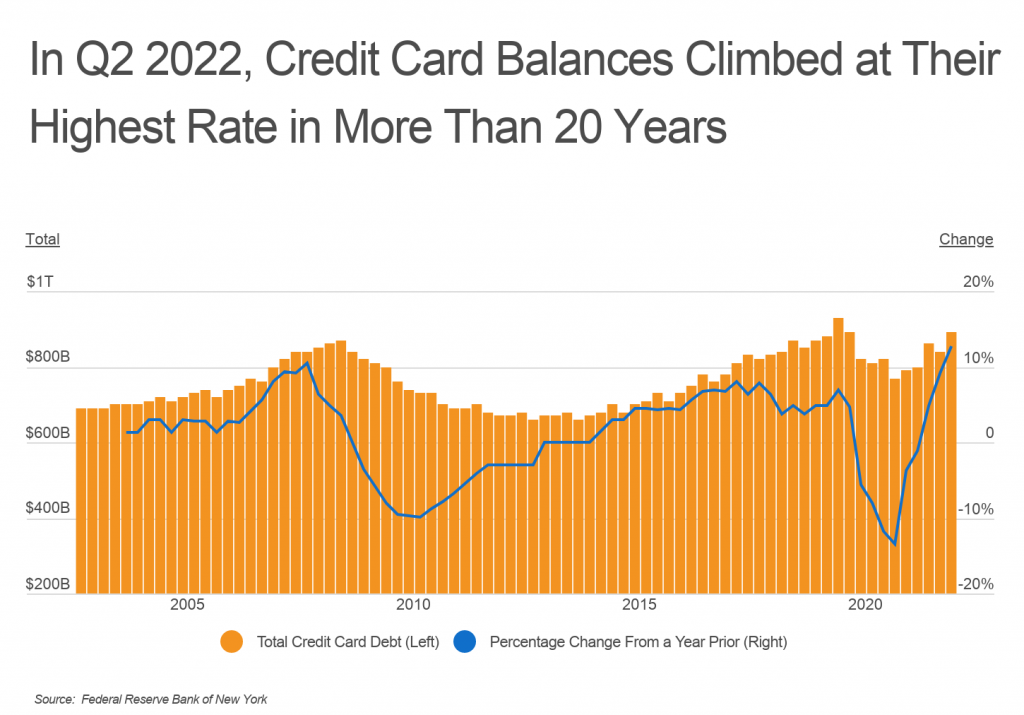

Inflation has reared its head over the last 18 months, however, putting new pressure on families. Prices for essentials like food, energy, and shelter have risen rapidly and remained at elevated levels. Savings rates, which had increased to historic heights earlier in the pandemic, are now on the decline, leaving households less in reserve to help weather the effects of inflation. As a result, consumers are turning to credit cards to help manage costs: aggregate limits on credit cards increased by $100 billion from Q1 to Q2 of 2022, while credit card balances increased by $46 billion over the same period.

Credit card debt in Q2 of 2022 totaled $890 billion, which still trailed a pre-pandemic peak of $930 billion in Q4 of 2019. But debt has surged over the last year. Credit card debt was 9.1% higher in Q1 of 2022 than the year before and 12.7% higher in Q2. The latter figure represents the fastest rate of growth for credit card balances in nearly 20 years.

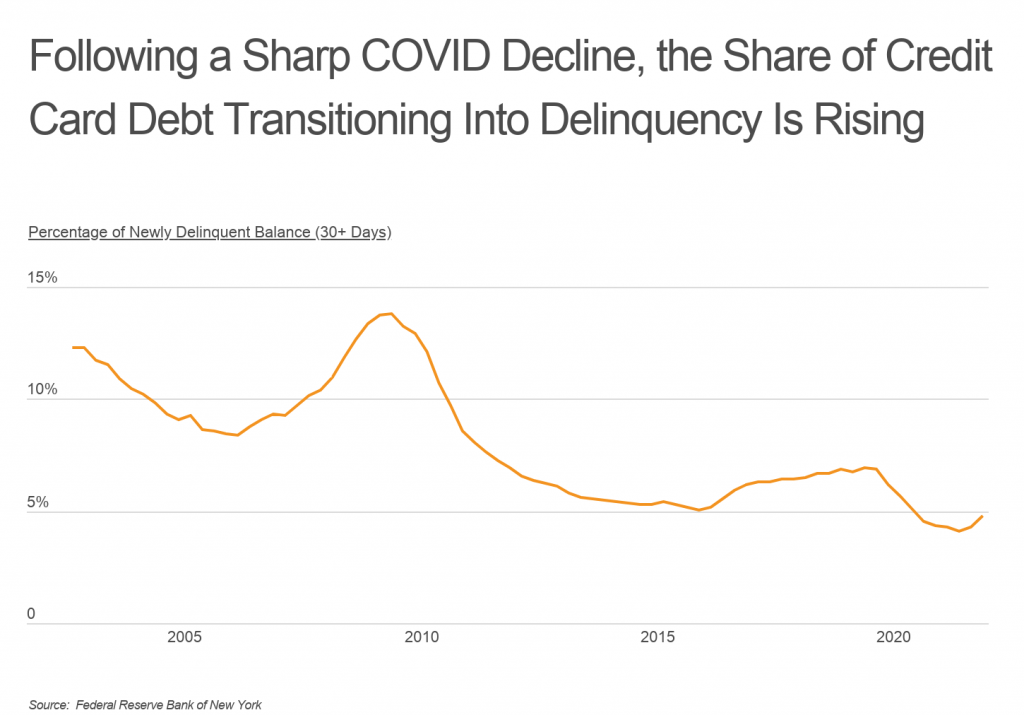

With the amount of credit card debt rising again, cardholders are also increasingly at risk of falling behind on payments. The share of credit card debt in serious delinquency remains at historically low levels after declining across 2020 and 2021. But after 2 straight years of decline, the percentage of newly delinquent credit card debt rose in the first 2 quarters of 2022, from 4.1% at the end of last year to 4.76%.

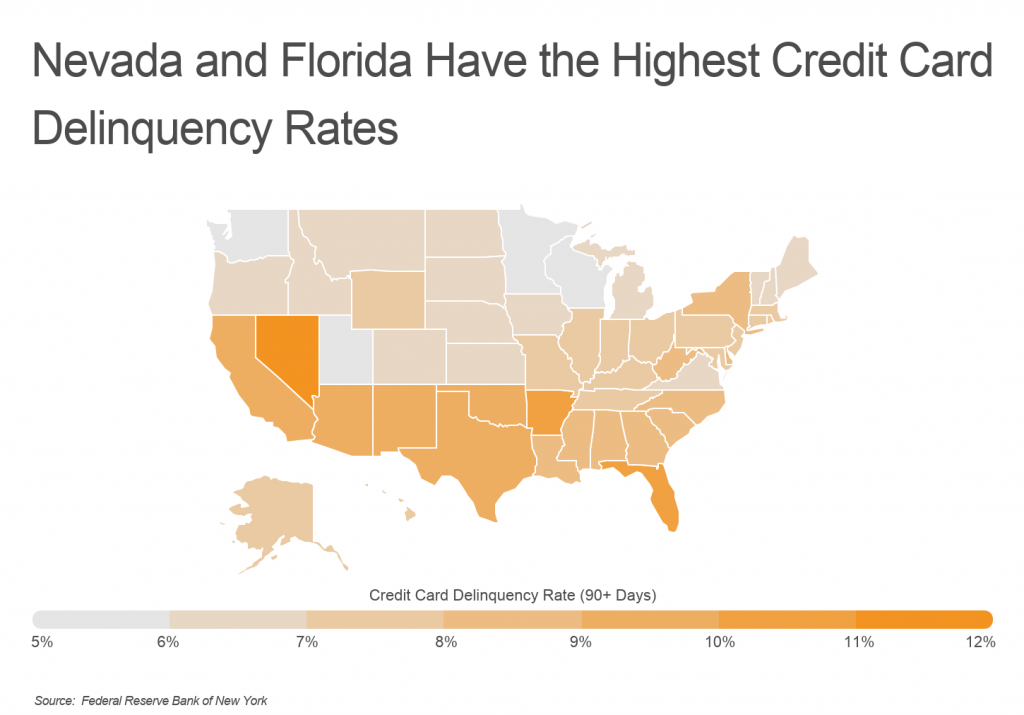

Credit card reliance and behavior vary across the country, meaning that rates of usage and delinquency can look different by geography. Many of the states with the highest credit card delinquency rates are found in the Southeast and Southwest, which have relatively low incomes compared to the rest of the U.S. While low-income residents in these areas are less likely to have a card and tend to have lower balances, they are also more likely to struggle with paying off credit card debts.

Notably, 3 states in the Southeast and Southwest regions — Nevada (12%), Florida (10.66%), and Arkansas (10.23%) — stand out as having more than 10% of credit card debt 90+ days delinquent, which are the 3 highest delinquency rates in the nation. In contrast, the Upper Midwest and New England tend to have the lowest rates of delinquency, highlighted by Wisconsin (5.34%), Minnesota (5.78%), and Vermont (6.03%).

The data used in this analysis is from the Federal Reserve Bank of New York’s Household Debt and Credit Report and Experian’s FICO Score by State. To determine the states with the highest delinquency rates, researchers at Upgraded Points calculated the share of credit card balances at least 90 days delinquent as of the fourth quarter of 2021. In the event of a tie, the state with the greater total credit card debt per capita was ranked higher. The percentage point change in the credit card delinquency rate was calculated by comparing Q4 2021 to Q4 of 2019.

States With the Highest Credit Card Delinquency Rates

Photo Credit: Mihai Andritoiu / Shutterstock

15. Delaware

- Credit card delinquency rate (90+ days): 8.38%

- Change since pre-pandemic (percentage points): -0.18

- Per capita credit card debt: $3,180

- Credit card debt as share of all non-mortgage debt: 18.3%

- Average credit score: 714

Photo Credit: Sean Pavone / Shutterstock

14. Alabama

- Credit card delinquency rate (90+ days): 8.53%

- Change since pre-pandemic (percentage points): +0.16

- Per capita credit card debt: $2,370

- Credit card debt as share of all non-mortgage debt: 14.4%

- Average credit score: 691

Photo Credit: f11photo / Shutterstock

13. Louisiana

- Credit card delinquency rate (90+ days): 8.60%

- Change since pre-pandemic (percentage points): -0.02

- Per capita credit card debt: $2,520

- Credit card debt as share of all non-mortgage debt: 14.2%

- Average credit score: 689

Photo Credit: Sean Pavone / Shutterstock

12. South Carolina

- Credit card delinquency rate (90+ days): 8.63%

- Change since pre-pandemic (percentage points): +0.47

- Per capita credit card debt: $2,810

- Credit card debt as share of all non-mortgage debt: 16.0%

- Average credit score: 693

Photo Credit: Sean Pavone / Shutterstock

11. Mississippi

- Credit card delinquency rate (90+ days): 8.77%

- Change since pre-pandemic (percentage points): -0.73

- Per capita credit card debt: $2,150

- Credit card debt as share of all non-mortgage debt: 12.3%

- Average credit score: 681

Photo Credit: ESB Professional / Shutterstock

10. Georgia

- Credit card delinquency rate (90+ days): 8.91%

- Change since pre-pandemic (percentage points): +0.58

- Per capita credit card debt: $3,210

- Credit card debt as share of all non-mortgage debt: 16.3%

- Average credit score: 693

Photo Credit: Mihai Simonia / Shutterstock

9. New York

- Credit card delinquency rate (90+ days): 8.94%

- Change since pre-pandemic (percentage points): -0.02

- Per capita credit card debt: $3,520

- Credit card debt as share of all non-mortgage debt: 21.3%

- Average credit score: 722

Photo Credit: Sean Pavone / Shutterstock

8. New Mexico

- Credit card delinquency rate (90+ days): 9.07%

- Change since pre-pandemic (percentage points): +0.07

- Per capita credit card debt: $2,540

- Credit card debt as share of all non-mortgage debt: 17.7%

- Average credit score: 699

Photo Credit: Dancestrokes / Shutterstock

7. California

- Credit card delinquency rate (90+ days): 9.07%

- Change since pre-pandemic (percentage points): +0.37

- Per capita credit card debt: $3,330

- Credit card debt as share of all non-mortgage debt: 21.5%

- Average credit score: 721

Photo Credit: Sean Pavone / Shutterstock

6. Oklahoma

- Credit card delinquency rate (90+ days): 9.16%

- Change since pre-pandemic (percentage points): +0.25

- Per capita credit card debt: $2,530

- Credit card debt as share of all non-mortgage debt: 16.4%

- Average credit score: 692

Photo Credit: Sean Pavone / Shutterstock

5. Arizona

- Credit card delinquency rate (90+ days): 9.40%

- Change since pre-pandemic (percentage points): -0.99

- Per capita credit card debt: $3,060

- Credit card debt as share of all non-mortgage debt: 18.5%

- Average credit score: 710

Photo Credit: Sean Pavone / Shutterstock

4. Texas

- Credit card delinquency rate (90+ days): 9.43%

- Change since pre-pandemic (percentage points): +0.23

- Per capita credit card debt: $3,190

- Credit card debt as share of all non-mortgage debt: 17.5%

- Average credit score: 692

Photo Credit: Sean Pavone / Shutterstock

3. Arkansas

- Credit card delinquency rate (90+ days): 10.23%

- Change since pre-pandemic (percentage points): +0.49

- Per capita credit card debt: $2,380

- Credit card debt as share of all non-mortgage debt: 15.3%

- Average credit score: 694

Photo Credit: Sean Pavone / Shutterstock

2. Florida

- Credit card delinquency rate (90+ days): 10.66%

- Change since pre-pandemic (percentage points): +0.12

- Per capita credit card debt: $3,450

- Credit card debt as share of all non-mortgage debt: 19.6%

- Average credit score: 706

Photo Credit: Sean Pavone / Shutterstock

1. Nevada

- Credit card delinquency rate (90+ days): 12.00%

- Delinquency rate change since pre-pandemic (percentage points): +0.49

- Per capita credit card debt: $3,350

- Credit card debt as share of all non-mortgage debt: 20.9%

- Average credit score: 701

Final Thoughts & Methodology

Credit can be important for making major purchases, or for covering regular and unexpected expenses. Some consumers struggle to pay off those large balances, however, especially throughout the rapidly-changing economy of the last few years.

Stimulus checks, unemployment benefits, and loan forbearance allowed people to pay down their debts early in the COVID-19 pandemic, despite the rise in unemployment. Inflation and increasing prices on essentials diminished savings rates, however, leaving many consumers to utilize credit again.

Despite a lower total amount today than its pre-pandemic peak, credit card debt experienced its fastest rate of growth in nearly 20 years when comparing the second quarter of 2022 to the year prior. And while the share of credit card debt in serious delinquency is still at historic lows after declining for two years, it began to rise again in the first half of 2022.

Southeastern and Southwestern states have higher rates of credit card delinquency. Although residents in these locations have fewer cards and lower balances, they also have less income on average, and may struggle to pay their debts. Nevada, Florida, and Arkansas stand out as having the highest delinquency rates in the U.S., each topping 10%. The lowest rates of delinquency are found in states with higher average incomes, such as Wisconsin, Minnesota, and Vermont.

The data used in this analysis is from the Federal Reserve Bank of New York’s Household Debt and Credit Report and Experian’s FICO Score by State. To determine the states with the highest delinquency rates, researchers at Upgraded Points calculated the share of credit card balances at least 90 days delinquent as of the fourth quarter of 2021. In the event of a tie, the state with the greater total credit card debt per capita was ranked higher. The percentage point change in the credit card delinquency rate was calculated by comparing Q4 2021 to Q4 of 2019.