Photo Credit: randy andy / Shutterstock

During the pandemic, remote workers across the country took advantage of the ability to live nearly anywhere. However, many companies are now requiring employees to return to the office. While the job market has cooled slightly in recent months, it is still hot, and abundant job openings mean that workers have plenty of job options to consider. At the same time, home prices have risen dramatically, potentially eroding increases in pay that jobs in some locales may provide.

After crashing in spring 2020, the job market has made an astounding comeback. Unemployment is at a relatively low rate (3.5%), and there are currently 1.7 job openings per unemployed worker. In mid-2022, this ratio reached a peak of 2.0, the highest it’s been in over two decades. This tight labor market is a boon to workers looking for new job opportunities; not only are there plenty of available jobs, but it means more bargaining power for workers and higher earnings potential.

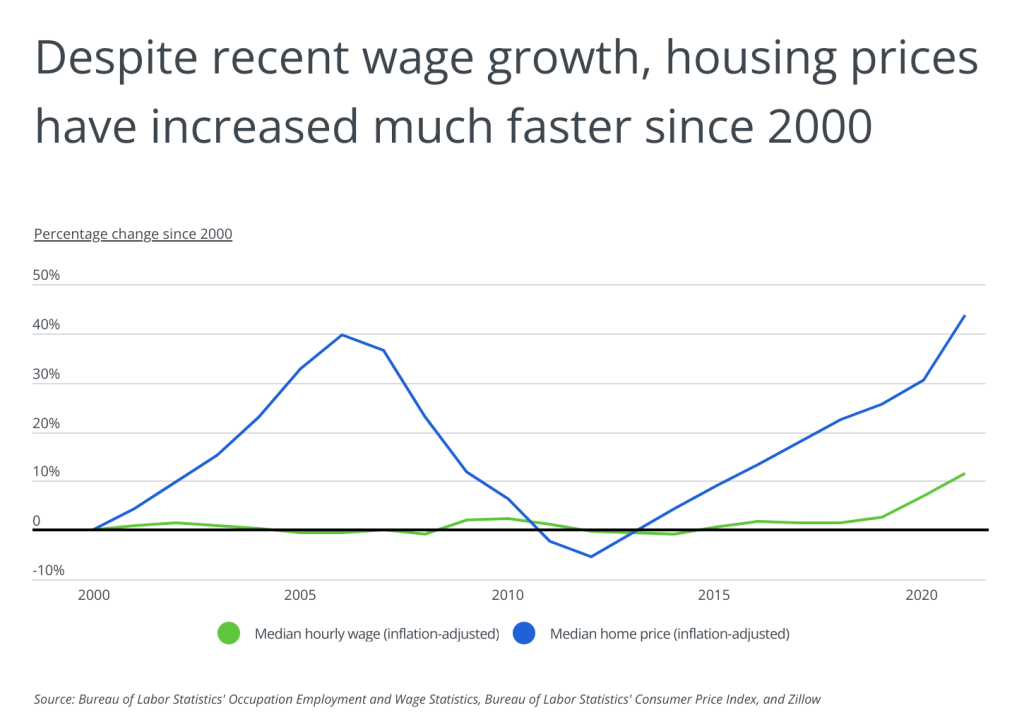

Indeed, this very tight labor market has led to an increase in overall wages. Real median hourly wages have grown by 11.4% since 2000. However, home prices have risen even faster; the real median home price has grown by nearly 44% over the same period. While workers’ wages are rising, home prices—and price levels overall—are eating away at these earnings gains. As workers consider moving to take advantage of better-paying jobs, regional differences in home prices remain top of mind.

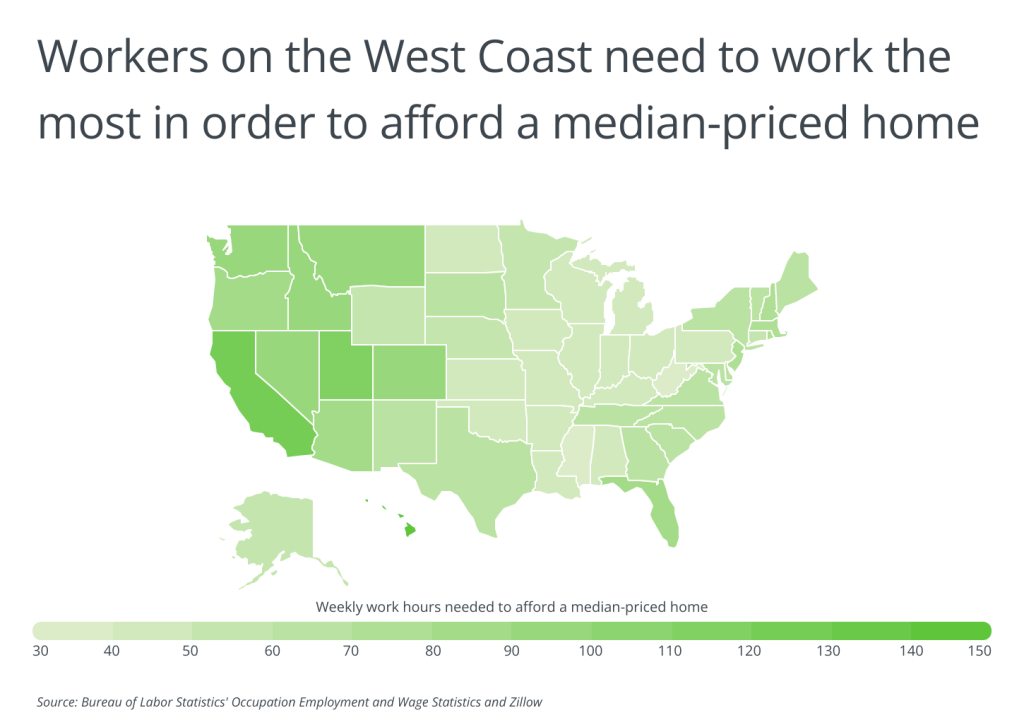

Despite having higher paying jobs, high home prices mean that it is still difficult to afford a home in some parts of the country. On a regional level, workers tend to earn more on the West Coast, but disproportionately high home prices mean that they must work more hours to afford a home. At the state level, the typical worker in Hawaii, California, and Utah must work over 100 hours per week to afford a median-priced home without being considered cost-burdened. This means the worker allocates no more than 30% of their monthly income to mortgage payments. In contrast, a typical worker in Mississippi or West Virginia doesn’t even need to work a full 40-hour week to comfortably afford a median-priced home.

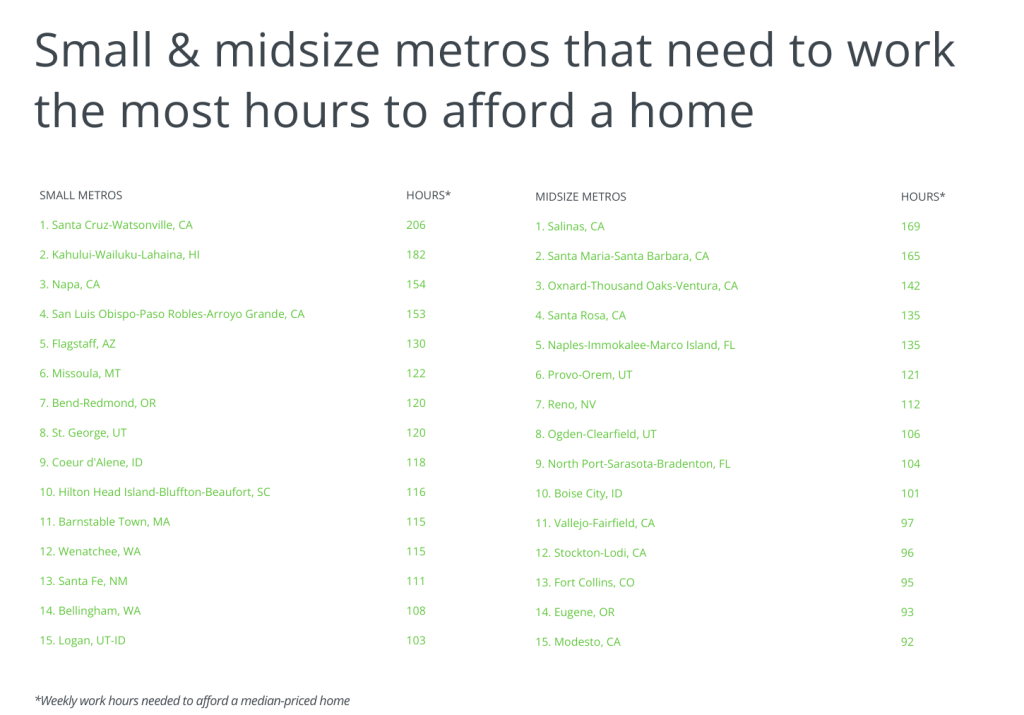

To determine the locations where people need to work the most hours to afford a home, researchers at HireAHelper analyzed the latest data from the Bureau of Labor Statistics and Zillow. The researchers ranked metros according to the weekly work hours needed to afford a median-priced home. The analysis assumes the worker is earning a median wage, makes a 20% down payment on the mortgage, and allocates less than 30% of their monthly wage to mortgage payments. Researchers also calculated the monthly mortgage payment for a median-priced home, the median home price, the median hourly wage, and the median annual wage.

Here are the U.S. metropolitan areas where people need to work the most hours to afford a home.

Large Metros That Need to Work the Most Hours to Afford a Home

Photo Credit: trekandshoot / Shutterstock

15. Las Vegas-Henderson-Paradise, NV

- Weekly work hours needed to afford a median-priced home: 89

- Monthly mortgage payment for a median-priced home: $2,077

- Median home price: $418,187

- Median hourly wage: $18.05

- Median annual wage: $37,550

Photo Credit: Steve Heap / Shutterstock

14. Nashville-Davidson–Murfreesboro–Franklin, TN

- Weekly work hours needed to afford a median-priced home: 91

- Monthly mortgage payment for a median-priced home: $2,228

- Median home price: $448,498

- Median hourly wage: $18.88

- Median annual wage: $39,260

Photo Credit: ShengYing Lin / Shutterstock

13. Austin-Round Rock, TX

- Weekly work hours needed to afford a median-priced home: 91

- Monthly mortgage payment for a median-priced home: $2,669

- Median home price: $537,243

- Median hourly wage: $22.55

- Median annual wage: $46,910

Photo Credit: Andrew Zarivny / Shutterstock

12. Portland-Vancouver-Hillsboro, OR-WA

- Weekly work hours needed to afford a median-priced home: 92

- Monthly mortgage payment for a median-priced home: $2,784

- Median home price: $560,474

- Median hourly wage: $23.26

- Median annual wage: $48,380

Photo Credit: Andriy Blokhin / Shutterstock

11. Sacramento–Roseville–Arden-Arcade, CA

- Weekly work hours needed to afford a median-priced home: 96

- Monthly mortgage payment for a median-priced home: $2,917

- Median home price: $587,164

- Median hourly wage: $23.35

- Median annual wage: $48,570

Photo Credit: Galina Savina / Shutterstock

10. Miami-Fort Lauderdale-West Palm Beach, FL

- Weekly work hours needed to afford a median-priced home: 98

- Monthly mortgage payment for a median-priced home: $2,364

- Median home price: $475,854

- Median hourly wage: $18.59

- Median annual wage: $38,670

Photo Credit: photo.ua / Shutterstock

9. Salt Lake City, UT

- Weekly work hours needed to afford a median-priced home: 98

- Monthly mortgage payment for a median-priced home: $2,867

- Median home price: $577,249

- Median hourly wage: $22.55

- Median annual wage: $46,900

Photo Credit: Checubus / Shutterstock

8. Seattle-Tacoma-Bellevue, WA

- Weekly work hours needed to afford a median-priced home: 99

- Monthly mortgage payment for a median-priced home: $3,718

- Median home price: $748,399

- Median hourly wage: $28.96

- Median annual wage: $60,230

Photo Credit: Andrew Zarivny / Shutterstock

7. Denver-Aurora-Lakewood, CO

- Weekly work hours needed to afford a median-priced home: 100

- Monthly mortgage payment for a median-priced home: $3,072

- Median home price: $618,385

- Median hourly wage: $23.66

- Median annual wage: $49,210

Photo Credit: Jon Bilous / Shutterstock

6. Riverside-San Bernardino-Ontario, CA

- Weekly work hours needed to afford a median-priced home: 117

- Monthly mortgage payment for a median-priced home: $2,855

- Median home price: $574,659

- Median hourly wage: $18.76

- Median annual wage: $39,020

Photo Credit: Sean Pavone / Shutterstock

5. San Diego-Carlsbad, CA

- Weekly work hours needed to afford a median-priced home: 145

- Monthly mortgage payment for a median-priced home: $4,342

- Median home price: $874,095

- Median hourly wage: $23.10

- Median annual wage: $48,050

Photo Credit: Sean Pavone / Shutterstock

4. Los Angeles-Long Beach-Anaheim, CA

- Weekly work hours needed to afford a median-priced home: 150

- Monthly mortgage payment for a median-priced home: $4,460

- Median home price: $897,894

- Median hourly wage: $22.87

- Median annual wage: $47,580

Photo Credit: Izabela23 / Shutterstock

3. Urban Honolulu, HI

- Weekly work hours needed to afford a median-priced home: 151

- Monthly mortgage payment for a median-priced home: $4,557

- Median home price: $917,354

- Median hourly wage: $23.17

- Median annual wage: $48,200

Photo Credit: Uladzik Kryhin / Shutterstock

2. San Jose-Sunnyvale-Santa Clara, CA

- Weekly work hours needed to afford a median-priced home: 162

- Monthly mortgage payment for a median-priced home: $7,636

- Median home price: $1,537,192

- Median hourly wage: $36.31

- Median annual wage: $75,510

Photo Credit: Bogdan Vacarciuc / Shutterstock

1. San Francisco-Oakland-Hayward, CA

- Weekly work hours needed to afford a median-priced home: 174

- Monthly mortgage payment for a median-priced home: $6,754

- Median home price: $1,359,655

- Median hourly wage: $29.81

- Median annual wage: $62,000

Detailed Findings & Methodology

To determine the locations where people need to work the most hours to afford a home, researchers at HireAHelper analyzed the latest data from the Bureau of Labor Statistics 2021 Occupational and Employment and Wage Statistics and Zillow’s Zillow Home Value Index (ZHVI), a measure of typical home value. The researchers ranked metros according to the weekly work hours needed to afford a median-priced home. In the event of a tie, the metro with the larger median hourly wage was ranked higher. Researchers also calculated the monthly mortgage payment for a median-priced home, the median home price, and the median annual wage. Median home price was calculated from Zillow’s ZHVI, and the monthly mortgage payment for a median-priced home was calculated by assuming a 30-year fixed rate mortgage with a 20% down payment. Weekly work hours needed to afford a median-price home were calculated assuming that no more than 30% of wage income goes towards mortgage payments.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000–349,999

- Midsize metros: 350,000–999,999

- Large metros: more than 1,000,000