Photo Credit: Stokkete / Shutterstock

The COVID-19 pandemic altered American spending patterns dramatically. In the early days of the pandemic, social distancing and stay-at-home orders resulted in a shift away from transportation, restaurant, and entertainment expenditures. However, consumer spending has since rebounded, and now high inflation has raised the basic cost of living. In addition, rising interest rates are making the cost of borrowing more expensive. While many Americans use credit cards regularly for their rewards and benefits, more people are turning to credit cards for temporary relief as prices continue to rise.

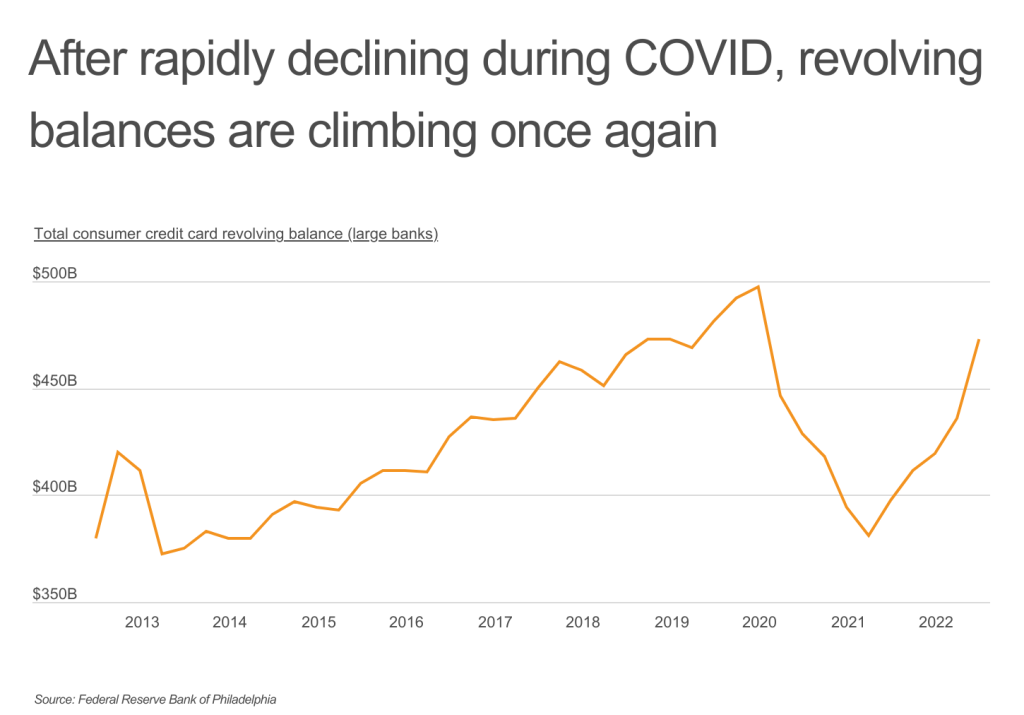

In 2020 and 2021, large decreases in consumer spending combined with stimulus checks and other financial relief helped reduce revolving credit card balances, which is the amount that accrues interest carried from one billing cycle to the next. And in the spring of 2022, total revolving credit card debt reached its lowest level since 2014. But as consumer spending started to recover and inflation swelled, revolving debt has been climbing steadily and is now nearing pre-pandemic levels.

Unfortunately, at the same time credit card balances rose, the cost of carrying credit card debt increased sharply. In a bid to rein in inflation, the Federal Reserve raised interest rates 10 times since March of 2022. Consequently, the average credit card interest rate for accounts assessed interest swelled from 16.17% in early 2022 to nearly 21% in Q1 2023.

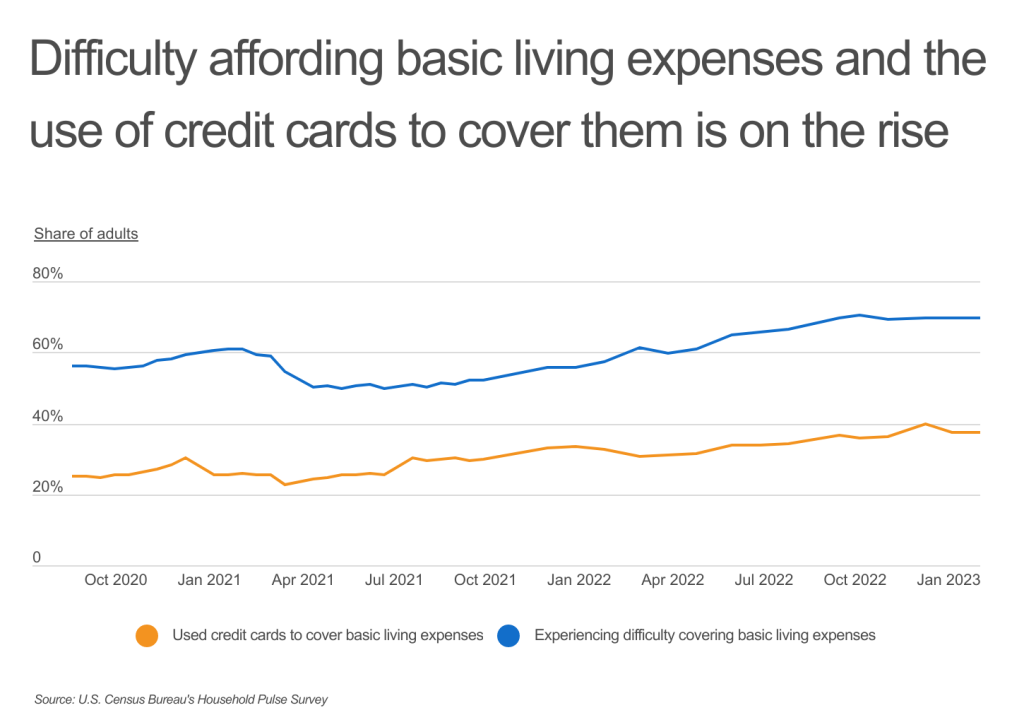

The combination of high interest rates and rising costs has put American households in a challenging position. Now, nearly 70% of people report they are finding it difficult to pay for basic living expenses—up from less than 50% in May 2021, according to the U.S. Census Bureau’s Household Pulse Survey. At the same time, more and more Americans have turned to their credit cards. As of February 2023, 37% of adults said they used credit cards to cover basic living expenses, up from 23% in March 2021.

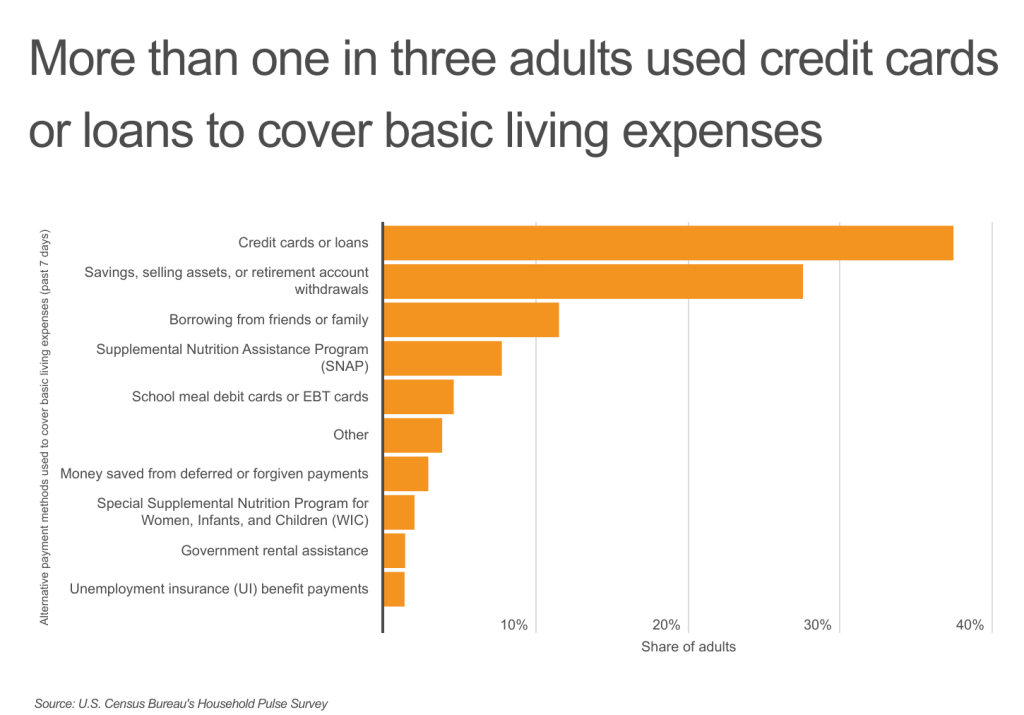

Aside from regular income sources, credit cards or loans are the most common payment method used to cover basic living expenses. The 37% of adults who reported using credit cards or loans to pay for living expenses is nearly 10 percentage points higher than the 28% of adults who used savings, sold assets/possessions, or made retirement account withdrawals. Less common methods for paying for living expenses include borrowing from friends or family, various government assistance programs, and money saved from deferred or forgiven payments.

To determine the states where people are using credit cards to cover basic living expenses, researchers at Upgraded Points analyzed the latest data from the U.S. Census Bureau. The researchers ranked states according to the share of adults who self-reported recently using credit cards to meet their spending needs. Adults were surveyed during the month of February 2023. Researchers also calculated the total adults using credit cards to cover expenses, the share of adults with difficulty covering expenses, and the total adults with difficulty covering expenses.

Here are the states where people are using credit cards to cover basic living expenses.

States With the Highest Share of Adults That Used Credit Cards to Cover Basic Living Expenses

Photo Credit: Charles Morra / Shutterstock

15. Florida

- Share of adults using credit cards to cover expenses: 38.3%

- Total adults using credit cards to cover expenses: 5,933,666

- Share of adults with difficulty covering expenses: 72.7%

- Total adults with difficulty covering expenses: 11,518,683

Photo Credit: f11photo / Shutterstock

14. Nevada

- Share of adults using credit cards to cover expenses: 38.9%

- Total adults using credit cards to cover expenses: 856,412

- Share of adults with difficulty covering expenses: 75.4%

- Total adults with difficulty covering expenses: 1,694,172

Photo Credit: f11photo / Shutterstock

13. Wisconsin

- Share of adults using credit cards to cover expenses: 39.0%

- Total adults using credit cards to cover expenses: 1,623,222

- Share of adults with difficulty covering expenses: 61.8%

- Total adults with difficulty covering expenses: 2,607,624

Photo Credit: LittleKitty / Shutterstock

12. Pennsylvania

- Share of adults using credit cards to cover expenses: 39.0%

- Total adults using credit cards to cover expenses: 3,416,585

- Share of adults with difficulty covering expenses: 68.8%

- Total adults with difficulty covering expenses: 6,198,417

Photo Credit: f11photo / Shutterstock

11. Maryland

- Share of adults using credit cards to cover expenses: 39.1%

- Total adults using credit cards to cover expenses: 1,673,871

- Share of adults with difficulty covering expenses: 62.5%

- Total adults with difficulty covering expenses: 2,723,161

Photo Credit: Andrew Zarivny / Shutterstock

10. Colorado

- Share of adults using credit cards to cover expenses: 39.5%

- Total adults using credit cards to cover expenses: 1,598,071

- Share of adults with difficulty covering expenses: 65.0%

- Total adults with difficulty covering expenses: 2,677,301

Photo Credit: Sean Pavone / Shutterstock

9. New Jersey

- Share of adults using credit cards to cover expenses: 39.7%

- Total adults using credit cards to cover expenses: 2,422,101

- Share of adults with difficulty covering expenses: 69.2%

- Total adults with difficulty covering expenses: 4,331,596

Photo Credit: ja-images / Shutterstock

8. Hawaii

- Share of adults using credit cards to cover expenses: 39.7%

- Total adults using credit cards to cover expenses: 403,568

- Share of adults with difficulty covering expenses: 63.6%

- Total adults with difficulty covering expenses: 652,663

Photo Credit: Francisco Sandoval Guate / Shutterstock

7. Texas

- Share of adults using credit cards to cover expenses: 40.2%

- Total adults using credit cards to cover expenses: 7,575,103

- Share of adults with difficulty covering expenses: 75.1%

- Total adults with difficulty covering expenses: 14,510,810

Photo Credit: Ingus Kruklitis / Shutterstock

6. California

- Share of adults using credit cards to cover expenses: 40.3%

- Total adults using credit cards to cover expenses: 10,683,020

- Share of adults with difficulty covering expenses: 70.9%

- Total adults with difficulty covering expenses: 19,333,920

Photo Credit: Felix Mizioznikov / Shutterstock

5. Delaware

- Share of adults using credit cards to cover expenses: 40.4%

- Total adults using credit cards to cover expenses: 287,896

- Share of adults with difficulty covering expenses: 64.8%

- Total adults with difficulty covering expenses: 471,643

Photo Credit: Jon Bilous / Shutterstock

4. New Hampshire

- Share of adults using credit cards to cover expenses: 40.9%

- Total adults using credit cards to cover expenses: 414,589

- Share of adults with difficulty covering expenses: 65.8%

- Total adults with difficulty covering expenses: 678,271

Photo Credit: Ingus Kruklitis / Shutterstock

3. New York

- Share of adults using credit cards to cover expenses: 41.1%

- Total adults using credit cards to cover expenses: 5,413,583

- Share of adults with difficulty covering expenses: 70.9%

- Total adults with difficulty covering expenses: 9,529,943

Photo Credit: Travellaggio / Shutterstock

2. Massachusetts

- Share of adults using credit cards to cover expenses: 41.4%

- Total adults using credit cards to cover expenses: 1,993,177

- Share of adults with difficulty covering expenses: 64.3%

- Total adults with difficulty covering expenses: 3,186,312

Photo Credit: f11photo / Shutterstock

1. Connecticut

- Share of adults using credit cards to cover expenses: 42.5%

- Total adults using credit cards to cover expenses: 1,051,156

- Share of adults with difficulty covering expenses: 74.6%

- Total adults with difficulty covering expenses: 1,886,738

Detailed Findings & Methodology

To determine the states where people are using credit cards to cover basic living expenses, researchers at Upgraded Points analyzed the latest data from the U.S. Census Bureau’s Household Pulse Survey. The researchers ranked states according to the share of adults who self-reported recently using credit cards to meet their spending needs. Adults were surveyed during the month of February 2023. In the event of a tie, the state with the larger total number of adults that used credit cards to cover basic living expenses was ranked higher. Researchers also calculated the total adults using credit cards to cover expenses, the share of adults with difficulty covering expenses, and the total adults with difficulty covering expenses.