After nearly three years of stubbornly high inflation, the rate of price increases in the U.S. finally appears to be slowing down. U.S. Consumer Price Index data for October 2023 showed an overall 3.2% increase in prices year-over-year and no increase from September 2023. Two major spending categories—energy (-4.5%) and used vehicles (-7.1%)—have even declined since last October.

While the rate of price increases is falling closer to historical norms and the Federal Reserve’s target inflation rate of 2%, prices are still rising. And consumers are still feeling the cumulative effects of rapid inflation that dates back to early 2021. According to BLS data, $1 today has the same purchasing power as just $0.85 in January of 2021.

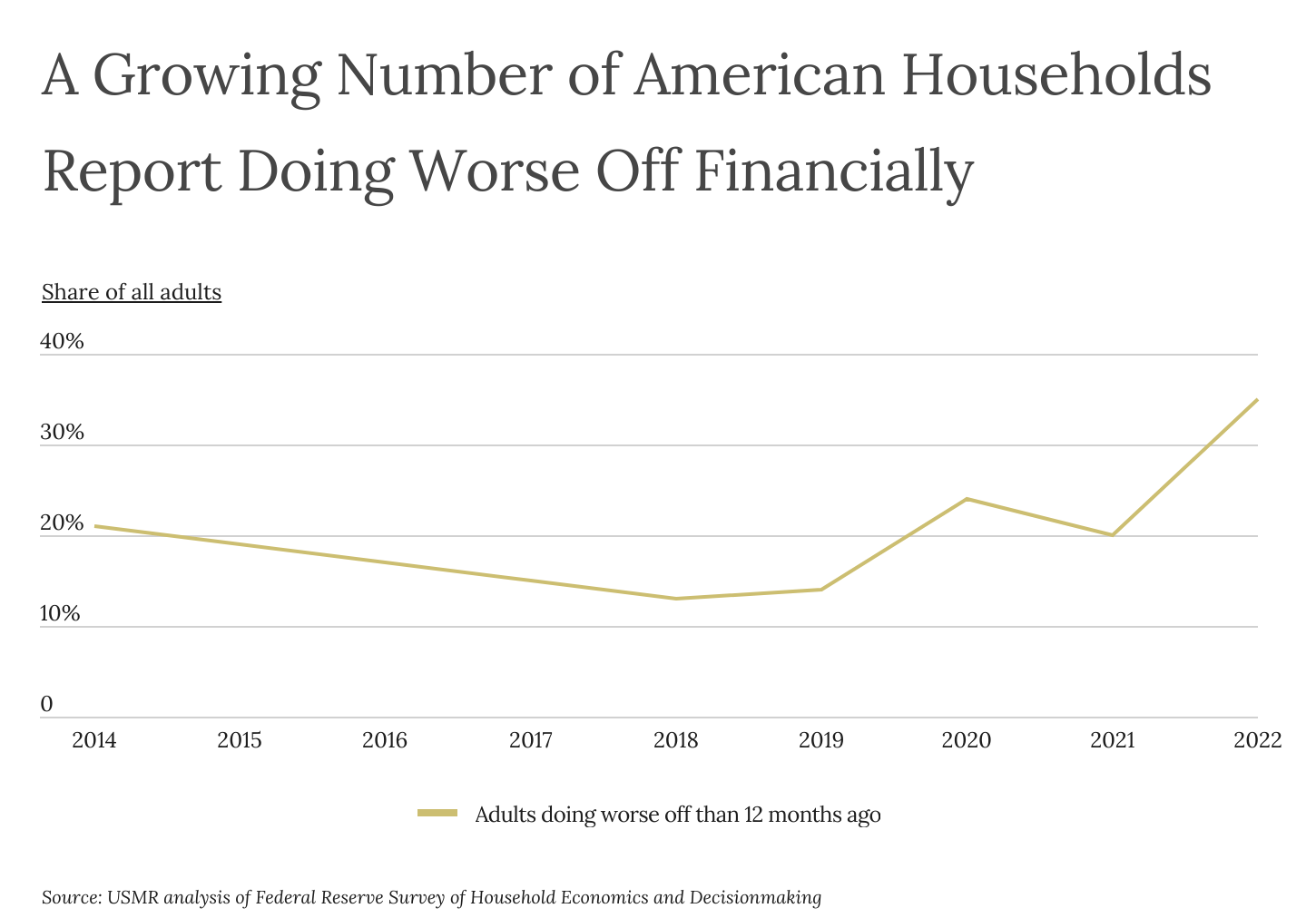

How Americans Have Felt Financially Over the Past Decade

Inflation weighs heavily on the public’s mind when judging the current state of the economy. Though the U.S. continues to add jobs and experience wage growth, these encouraging trends have not shaken U.S. adults’ feelings of financial difficulty. According to surveys conducted by the Federal Reserve, 35% of U.S. adults in 2022 reported that they were doing worse off financially than 12 months prior. That figure was up from 20% in 2021 and 14% in 2019, the last year before the COVID-19 pandemic.

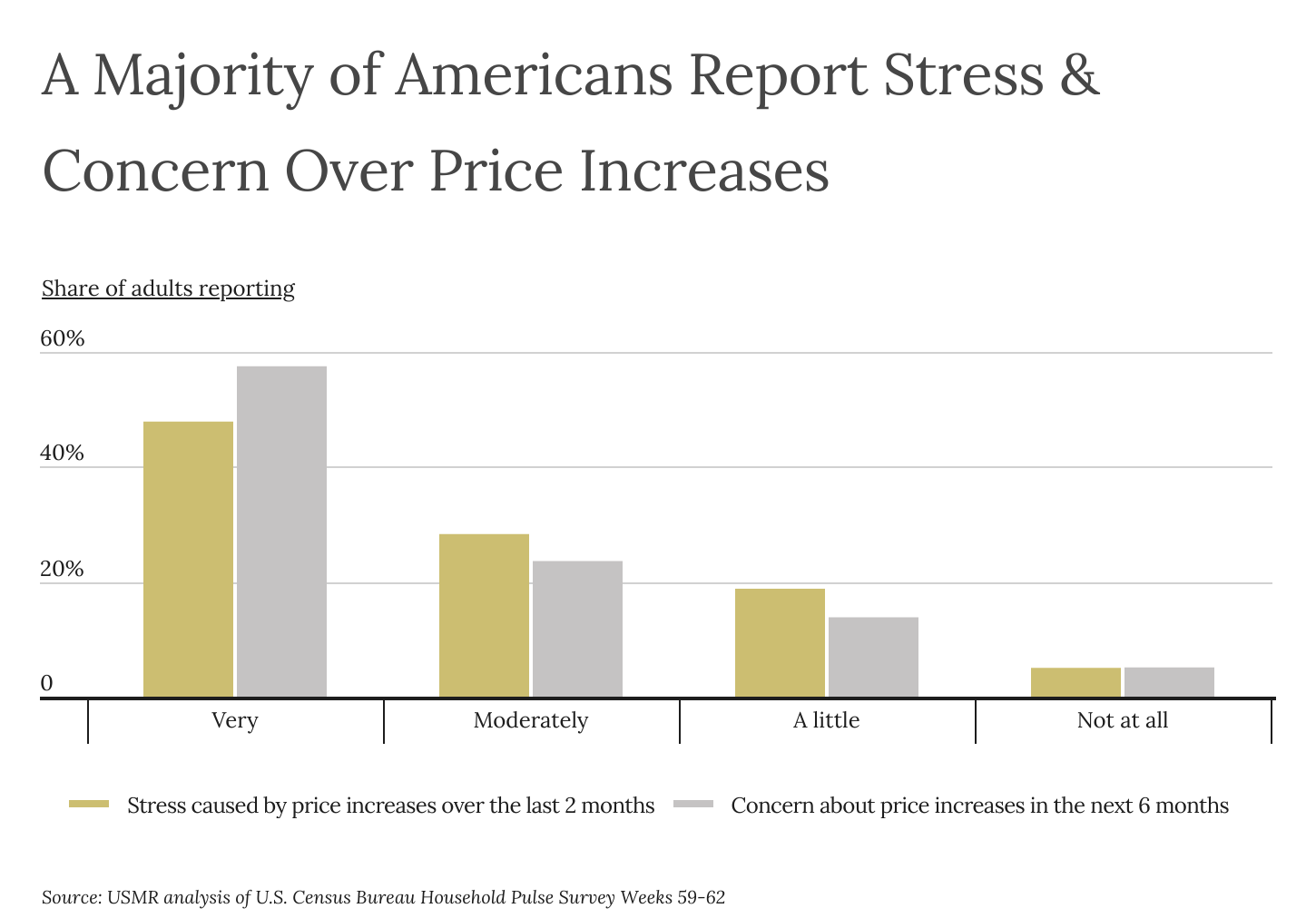

How Americans Feel Financially Now

Other recent data confirms Americans’ gloomy view of the economy. In surveys from the third quarter of 2023, nearly half of Americans (47.9%) stated that they were very stressed about price increases within the past two months, while another 47.1% reported being moderately or a little stressed. Expectations for the near future are similarly pessimistic: 57.5% of Americans say they are very concerned about price increases in the next 6 months, and just 5.1% say they are not at all concerned.

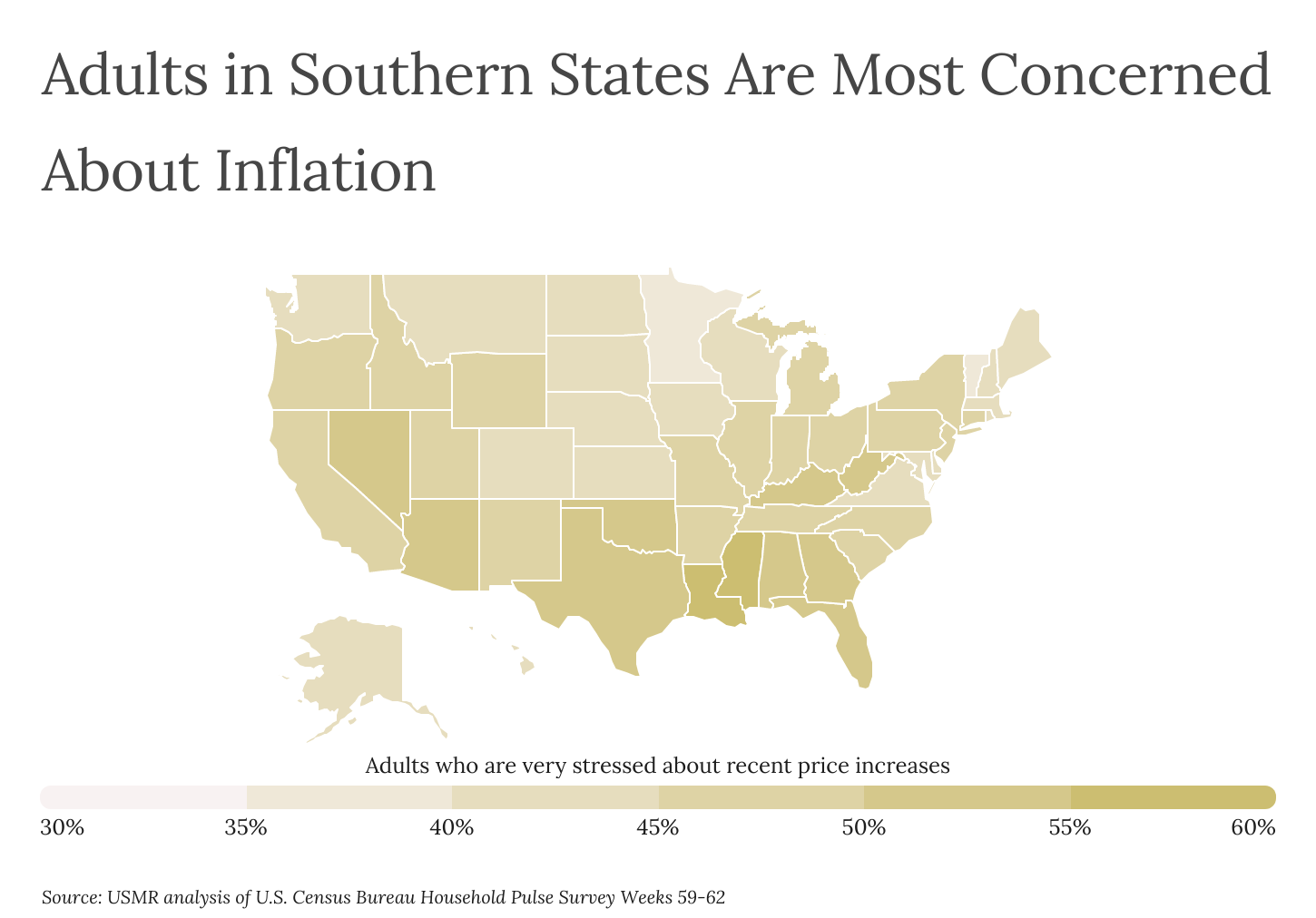

Financial Stress Levels by Location

While concerns about inflation are shared across the country, adults in the southern U.S. report much higher levels of stress. Mississippi leads all states with 56.7% of adults reporting that they are very stressed about recent price increases, and neighboring Louisiana ranks second at 55.2%. In contrast, northern states report comparatively low stress levels. In Vermont, just 35.5% of adults are very stressed about price increases, with Minnesota, South Dakota, and Washington not far behind.

Below is a complete breakdown of all 50 states. The research was conducted by U.S. Money Reserve using Q3 2023 data from the Census Bureau. For more details on how the analysis was conducted, refer to the methodology below.

Photo Credit: Ingus Kruklitis / Shutterstock

15. New York

- Adults who are very stressed about recent price increases: 48.6%

- Adults who are very concerned about future price increases: 56.2%

- Adults who find it very difficult to cover usual expenses: 17.9%

- Adults who used savings to meet spending needs: 27.9%

Photo Credit: yhelfman / Shutterstock

14. California

- Adults who are very stressed about recent price increases: 48.7%

- Adults who are very concerned about future price increases: 57.3%

- Adults who find it very difficult to cover usual expenses: 19.0%

- Adults who used savings to meet spending needs: 28.8%

Photo Credit: turtix / Shutterstock

13. New Mexico

- Adults who are very stressed about recent price increases: 48.9%

- Adults who are very concerned about future price increases: 59.8%

- Adults who find it very difficult to cover usual expenses: 19.6%

- Adults who used savings to meet spending needs: 31.4%

Photo Credit: Sean Pavone / Shutterstock

12. Arkansas

- Adults who are very stressed about recent price increases: 49.8%

- Adults who are very concerned about future price increases: 63.1%

- Adults who find it very difficult to cover usual expenses: 18.1%

- Adults who used savings to meet spending needs: 27.2%

Photo Credit: Gregory E. Clifford / Shutterstock

11. Arizona

- Adults who are very stressed about recent price increases: 50.7%

- Adults who are very concerned about future price increases: 60.2%

- Adults who find it very difficult to cover usual expenses: 18.8%

- Adults who used savings to meet spending needs: 31.0%

Photo Credit: Andrey Bayda / Shutterstock

10. Nevada

- Adults who are very stressed about recent price increases: 51.0%

- Adults who are very concerned about future price increases: 63.3%

- Adults who find it very difficult to cover usual expenses: 20.3%

- Adults who used savings to meet spending needs: 30.1%

Photo Credit: Rob Hainer / Shutterstock

9. Alabama

- Adults who are very stressed about recent price increases: 51.5%

- Adults who are very concerned about future price increases: 64.4%

- Adults who find it very difficult to cover usual expenses: 19.6%

- Adults who used savings to meet spending needs: 26.4%

Photo Credit: Sean Pavone / Shutterstock

8. West Virginia

- Adults who are very stressed about recent price increases: 51.6%

- Adults who are very concerned about future price increases: 62.5%

- Adults who find it very difficult to cover usual expenses: 17.6%

- Adults who used savings to meet spending needs: 27.8%

Photo Credit: ESB Professional / Shutterstock

7. Georgia

- Adults who are very stressed about recent price increases: 52.2%

- Adults who are very concerned about future price increases: 62.3%

- Adults who find it very difficult to cover usual expenses: 20.9%

- Adults who used savings to meet spending needs: 29.9%

Photo Credit: Harold Stiver / Shutterstock

6. Kentucky

- Adults who are very stressed about recent price increases: 52.3%

- Adults who are very concerned about future price increases: 63.4%

- Adults who find it very difficult to cover usual expenses: 18.6%

- Adults who used savings to meet spending needs: 27.4%

Photo Credit: Sean Pavone / Shutterstock

5. Oklahoma

- Adults who are very stressed about recent price increases: 52.6%

- Adults who are very concerned about future price increases: 62.5%

- Adults who find it very difficult to cover usual expenses: 22.2%

- Adults who used savings to meet spending needs: 27.8%

Photo Credit: Roschetzky Photography / Shutterstock

4. Texas

- Adults who are very stressed about recent price increases: 53.0%

- Adults who are very concerned about future price increases: 59.6%

- Adults who find it very difficult to cover usual expenses: 20.0%

- Adults who used savings to meet spending needs: 29.6%

Photo Credit: Songquan Deng / Shutterstock

3. Florida

- Adults who are very stressed about recent price increases: 53.6%

- Adults who are very concerned about future price increases: 64.2%

- Adults who find it very difficult to cover usual expenses: 20.6%

- Adults who used savings to meet spending needs: 31.6%

Photo Credit: Sean Pavone / Shutterstock

2. Louisiana

- Adults who are very stressed about recent price increases: 55.2%

- Adults who are very concerned about future price increases: 66.5%

- Adults who find it very difficult to cover usual expenses: 24.2%

- Adults who used savings to meet spending needs: 28.0%

Photo Credit: Sean Pavone / Shutterstock

1. Mississippi

- Adults who are very stressed about recent price increases: 56.7%

- Adults who are very concerned about future price increases: 66.5%

- Adults who find it very difficult to cover usual expenses: 24.5%

- Adults who used savings to meet spending needs: 26.3%

Methodology

Photo Credit: wutzkohphoto / Shutterstock

The data used in this analysis is from Weeks 59–62 of the U.S. Census Bureau’s Household Pulse Survey. This period closely aligns with the most recent quarter: Q3 2023. To identify the states most impacted by inflation, researchers at U.S. Money Reserve calculated the percentage of adults who reported being “very stressed” about recent price increases. Available choices for survey respondents included: very stressed, moderately stressed, a little stressed, or not at all stressed. Researchers also calculated the percentage of adults who felt “very concerned” about future price increases and the percentage of adults who found it “very difficult” to cover usual household expenses (both using a similar rating scale). The percentage of adults who reported needing to use savings to meet their spending needs was also included. All data was averaged across the four surveys covering the study period.

For complete results, see U.S. States Most Impacted by Inflation on US Money Reserve.