As the U.S. economy has wrestled with the impacts of inflation over the last few years, construction has been one of the industries most impacted by rising costs.

Construction materials were strongly impacted by supply chain breakdowns during the pandemic, which created shortages for key goods during a period of high demand. Hopes that price increases would level out as supply chain issues were resolved eventually gave way to the reality of broad-based inflation. Rising costs for inputs like materials, equipment, labor, and transportation have increased the price tag for many construction projects. And with tremendous needs for new housing stock in the U.S. and a slew of infrastructure projects on the horizon from federal legislation like the Bipartisan Infrastructure Law and the Inflation Reduction Act, rising costs will impact how quickly and how affordably the country can meet its construction needs in the years ahead.

Increasing Construction Costs

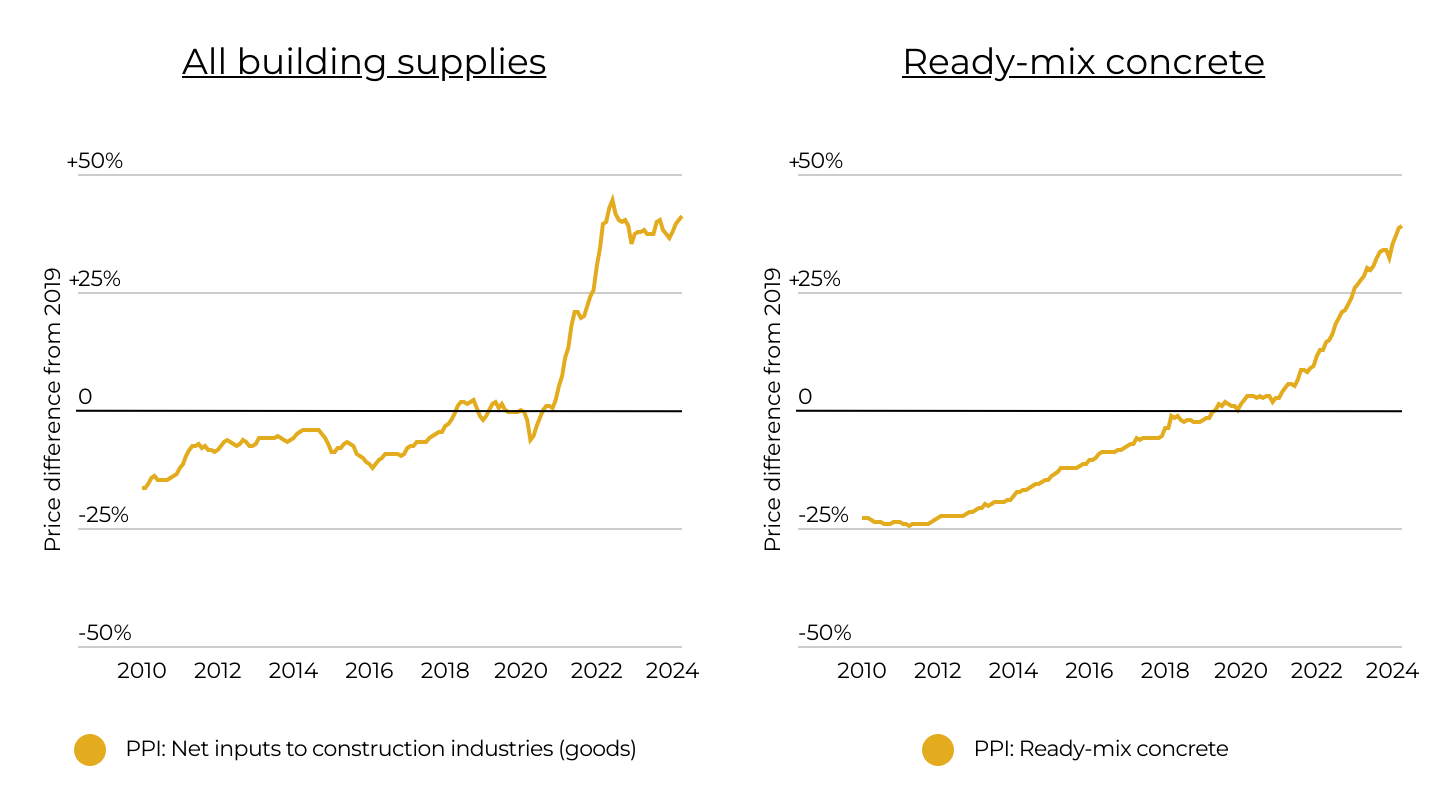

Source: Twisted Nail analysis of U.S. Bureau of Labor Statistics data | Image Credit: Twisted Nail

Many common building supplies have seen prices rise significantly since 2019. On average, all building supplies have seen prices increase by 41.2% since the start of the pandemic, reaching a peak of 44.5% in June 2022 before falling slightly in the subsequent two years. The most commonly used building material, concrete, has been on a steady but rapid upward trajectory for price over this span. Concrete prices are up 38.9% since 2019, and the rate of price growth has fallen during only two months since the start of 2022.

Critical to the cost of supplies like concrete are construction aggregates. Construction aggregates include sand, gravel, crushed stone, and other materials, all of which are used for applications like drainage, foundations, and as an ingredient in composite materials such as asphalt and concrete. These important uses give aggregates a critical role in the construction industry and the larger economy: a total of $35 billion of crushed stone and sand and gravel was produced in the U.S. last year.

Aggregate Production by State

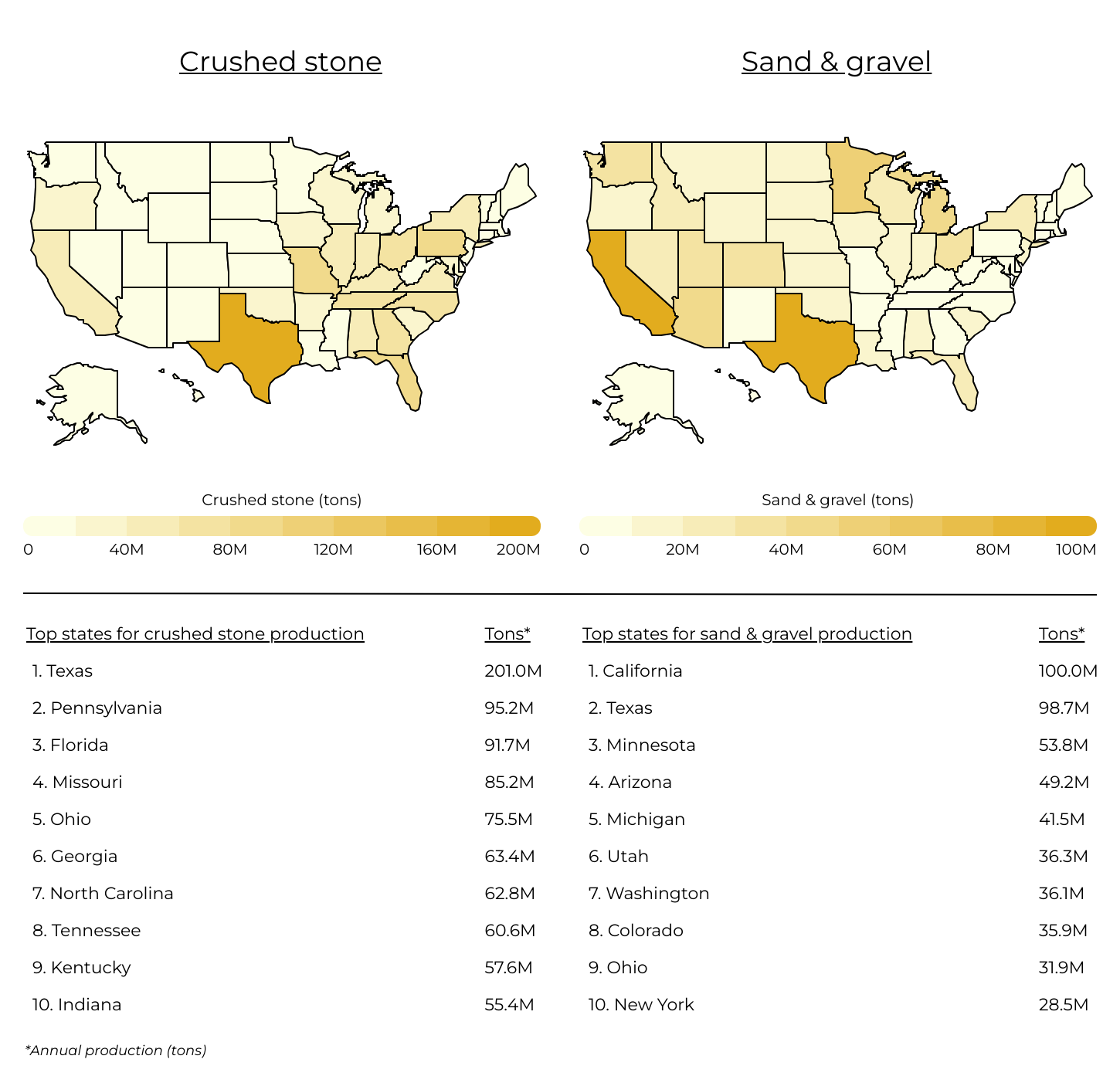

Source: Twisted Nail analysis of U.S. Geological Survey data | Image Credit: Twisted Nail

Texas leads the nation in construction aggregate production, processing approximately 200 million tons of crushed stone and nearly 100 million tons of sand and gravel annually. This accounts for about 12% of the total national supply, while Texas represents approximately 9% of the U.S. population. California, the second-largest producer, processes around 40 million tons of crushed stone and 100 million tons of sand and gravel. However, California’s production constitutes just 5.6% of the national supply, despite the state making up nearly 12% of the U.S. population.

Increasing equipment and labor costs influence construction aggregate prices, but local availability and transportation are also critical drivers. “While the input costs to produce these aggregates has increased nationwide, an often overlooked driver of cost is the delivery fees associated with bringing these aggregates to their end-use location. These expenses can be as much as 30–70% of the contractor’s final cost of material,” explained Hunter Kosar, owner of the Texas aggregate supplier Twisted Nail.

Due to their weight and the large volumes required for projects, aggregates are most cost-effective when sourced close to their point of use through a local aggregate supplier. While all 50 states produce sand and gravel, and all but two produce crushed stone, variations in permitting regulations and community appetite for new quarry projects can complicate sourcing aggregates in certain areas. These shortages can increase costs through greater competition for supply or higher shipping expenses.

Increases in Aggregate Prices by State

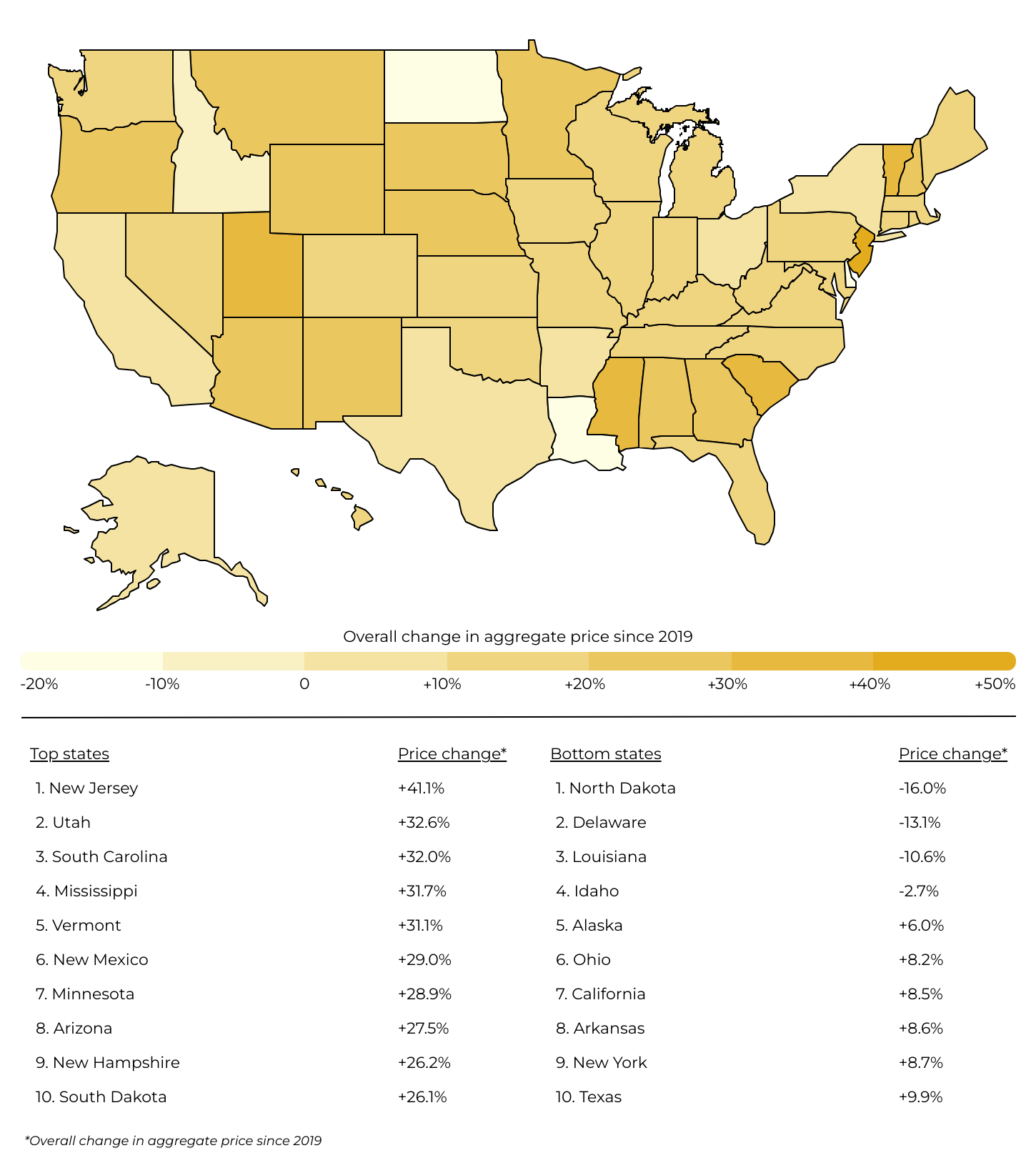

Source: Twisted Nail analysis of U.S. Geological Survey data | Image Credit: Twisted Nail

The vast majority of states have seen large increases in the price of construction aggregates in recent years. New Jersey has fared worst, with aggregate price increases of 41.1% over that span—nearly 10 percentage points higher than the next-fastest increasing state of Utah (32.6%). Notably, overall aggregate prices among top production states such as Texas, California, and Ohio have grown less than 10% since 2019—below the national average of 15.8%. According to Kosar, Texas has been able to avoid some of the increases seen nationwide because of the state’s extremely diverse and abundant network of quarry locations. Just four states—Idaho, Delaware, Louisiana, and North Dakota—have experienced declines since 2019.

This analysis was performed by Twisted Nail, a construction aggregate supply company based in Texas, using the latest data from the U.S. Geological Survey. Refer to the original post, Rapidly Rising Crushed Stone & Gravel Prices Are Pushing Up Building Costs in These States, for a complete breakdown of construction aggregate production and price increases for all 50 states.

Methodology

Photo Credit: Juan Enrique del Barrio / Shutterstock

The data used in this study comes from the U.S. Geological Survey’s Mineral Commodity Summaries. To determine the states where construction aggregate pricing has increased the most, researchers calculated the percentage change in the average price of 1) crushed stone and 2) sand and gravel (weighted by production quantity) between 2022 and 2019, the latest three year period available. Data on crushed stone and sand and gravel production, as well as the price increases for each, were also included.

For complete results, see Rapidly Rising Crushed Stone & Gravel Prices Are Pushing Up Building Costs in These States on Twisted Nail.