America’s homebuyers have had an extraordinarily difficult few years. A combination of surging demand and scarce inventory has led to fierce competition among buyers, driving home prices to record levels. On top of this, high interest rates have increased borrowing costs, creating another major hurdle for aspiring homeowners.

While existing homeowners have largely benefited from high prices in the form of equity gains, they also face their own set of challenges. For one, many are effectively “locked in” to their homes, having secured low-interest mortgages before rates began climbing. For these homeowners, relocating often means choosing between downsizing to a less expensive property or absorbing significantly higher monthly payments on a new loan.

Another factor is property taxes. Typically calculated as a percentage of a home’s assessed value, property taxes have become an increasing burden as property values continue to outpace inflation. Rising home prices since 2020 have pushed assessments—and in turn, property tax bills—markedly higher in many areas. In these markets, homeowners face higher housing costs even if they have a fixed-rate mortgage or own their property outright.

To address this issue, certain states have implemented mechanisms to protect homeowners from runaway tax increases. As of 2024, 19 states, including California, Florida, and New York, have assessment limits that cap how much a property’s assessed value can increase annually. While these limits help shield homeowners from the full impact of rising home prices, they also deter long-time owners from moving and contribute to significant disparities in property tax burdens across the U.S.

The Importance of Property Taxes

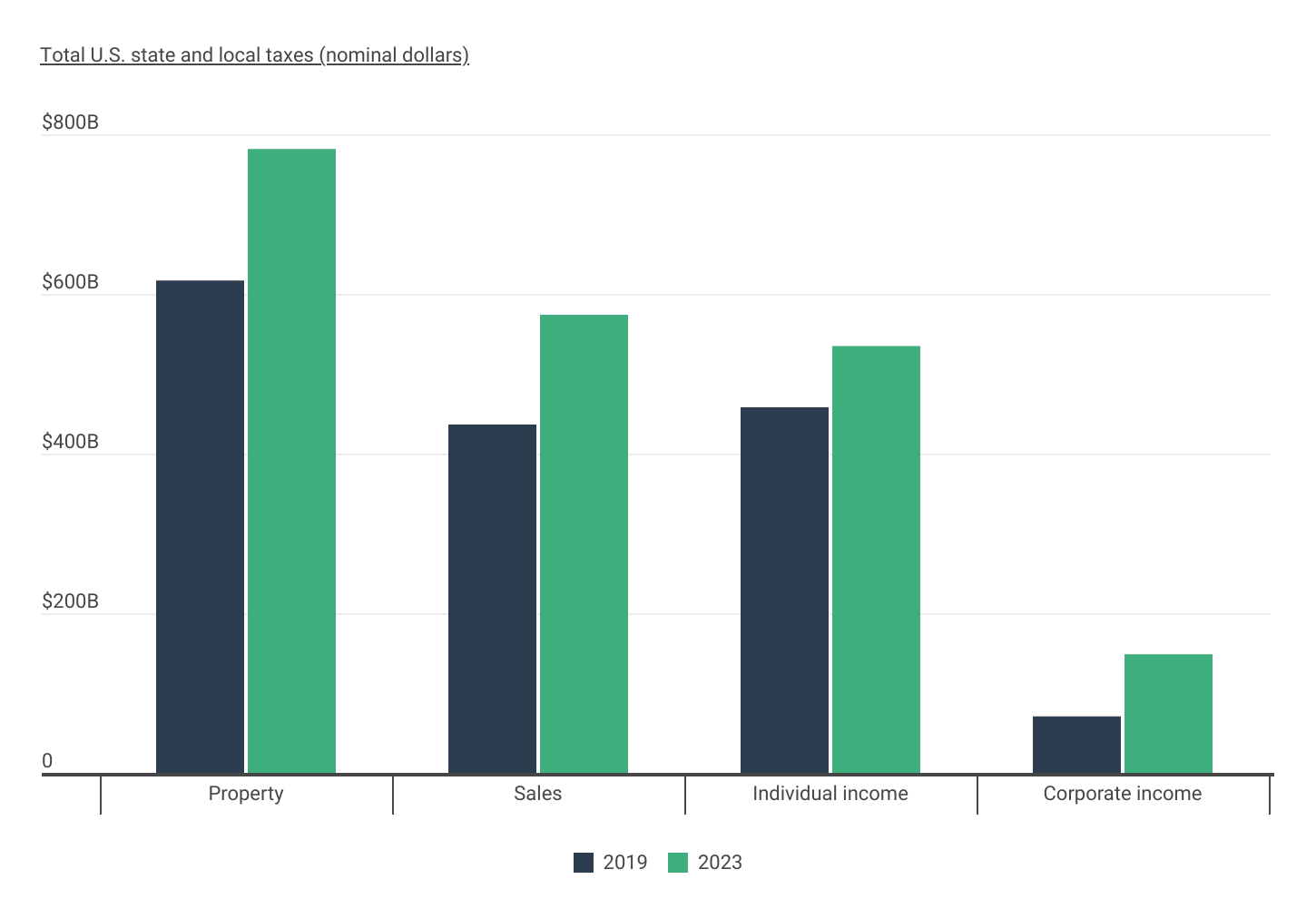

Property taxes account for the largest share of state and local taxes

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

Higher property taxes can be daunting for homeowners, but they are a boon for state and local governments that rely heavily on property tax revenue. Property taxes are a cornerstone of state and local government finances, providing the largest share of tax revenue to fund essential services such as education, public safety, and infrastructure. Unlike other tax types, property taxes offer a relatively stable revenue stream, as they are less directly affected by economic fluctuations.

From 2019 to 2023, property taxes saw the largest total increase in revenue among major tax categories, rising by $165 billion (27%) from $617 billion to $782 billion. This outpaced the growth in sales tax revenue, which increased by $138 billion, and individual income tax revenue, which grew by $77 billion. Corporate income taxes, while experiencing the largest percentage change, saw a smaller absolute increase of $78 billion.

How Property Tax Rates Have Changed

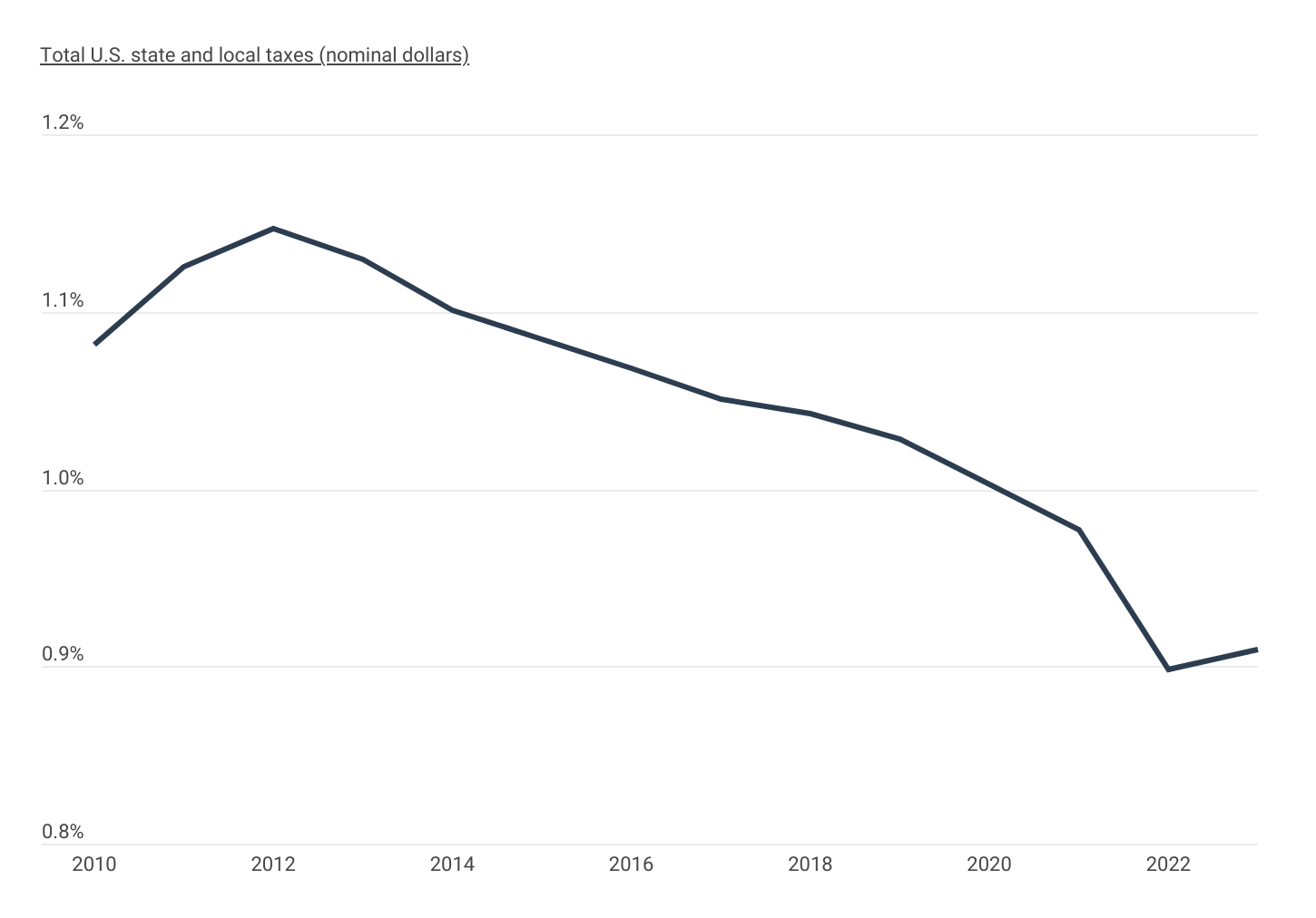

Property tax revenues have yet to catch up with rapid home price growth

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

While homeowners might expect recent surges in home values to directly translate to higher property tax bills, the reality is more complex. Nationwide, the effective property tax rate—the total taxes paid as a percentage of the aggregate value of owner-occupied housing—has steadily declined over the past decade. After peaking at 1.147% in 2012, the effective rate fell to 0.898% in 2022, its lowest level in over a decade. While preliminary data suggests a slight rebound to 0.909% in 2023, the effective rate remains well below its peak, highlighting the disconnect between rising home values and tax assessments.

This trend reflects the inherent lag in property tax systems, where assessments are typically updated periodically or when homes change ownership. The mismatch between rising property values and effective tax rates creates disparities in how tax burdens are distributed. Long-term homeowners often benefit from lower effective rates, while new buyers purchasing homes at higher market values may face disproportionately larger tax bills.

Regional Differences in Property Taxes

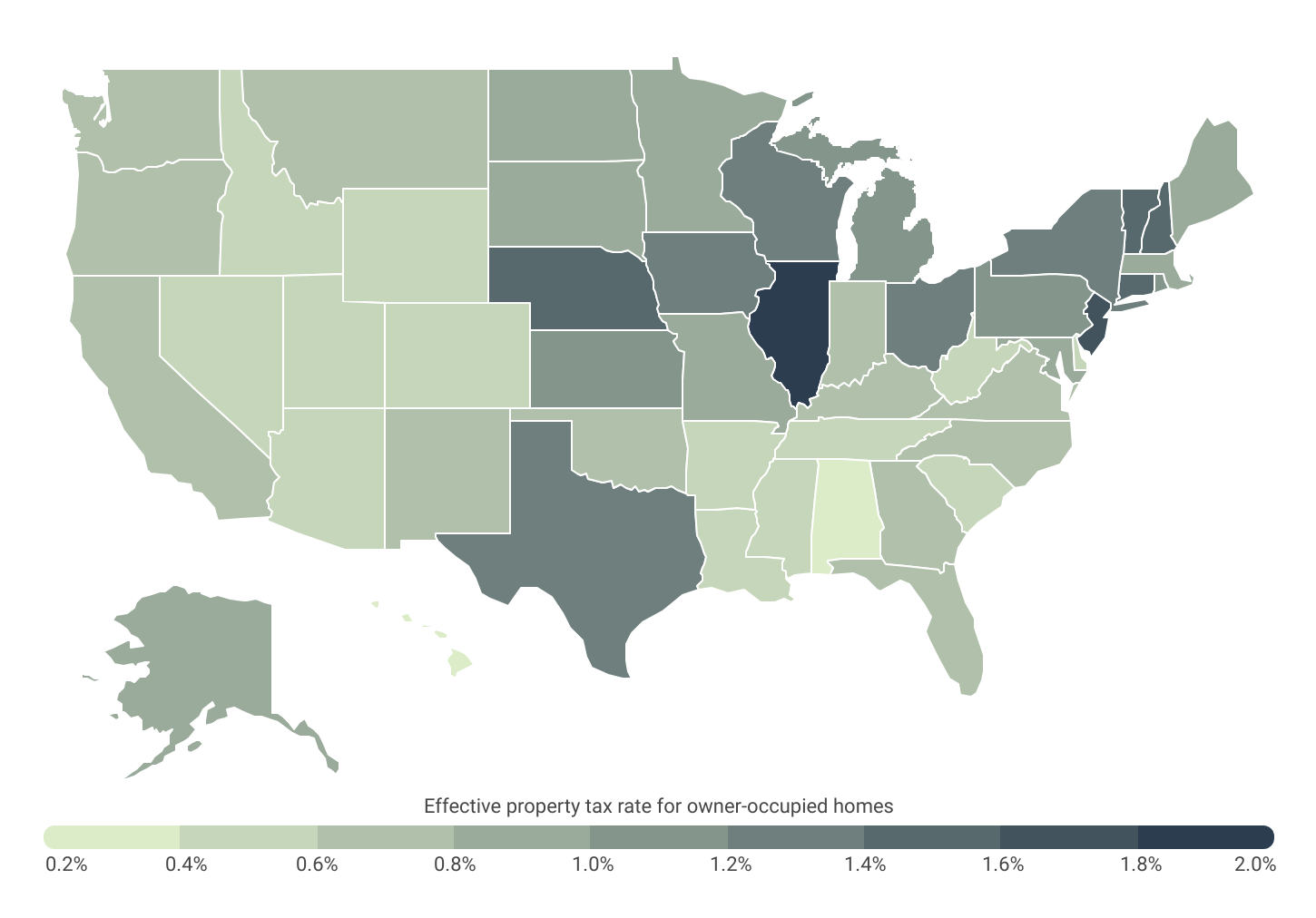

Illinois and New Jersey have the highest effective property tax rates for owner-occupied homes

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

Property tax burdens in the United States vary significantly depending on state, county, and city, reflecting a patchwork of overlapping state and local tax policies. This mosaic of property tax regimes creates wide disparities in effective tax rates across the country, with some regions experiencing markedly higher rates than others.

At the state level, the Northeast and Midwest lead with the highest effective property tax rates for owner-occupied homes. Illinois tops the list at 1.825%, followed closely by New Jersey at 1.773%. States like Connecticut (1.485%), Nebraska (1.435%), and Vermont (1.417%) also rank highly, reflecting a trend where densely populated or older, established states often require more revenue to support infrastructure and services. In contrast, the South and Mountain West regions generally have the lowest effective rates, with Hawaii (0.318%) and Alabama (0.359%) at the bottom, followed by Arizona (0.442%) and South Carolina (0.471%). A notable exception is Texas, which ranks seventh overall, with an effective property tax rate of 1.356%.

Drilling down to the county level, disparities are even more pronounced. Salem County, NJ has the highest effective tax rate in the country at 2.382%, followed by Monroe County, NY, at 2.314%. Other counties in Illinois and New Jersey dominate the top of the list. Conversely, DeKalb County, AL, boasts the lowest rate at 0.157%, with other counties in Alabama and Hawaii rounding out the bottom tier.

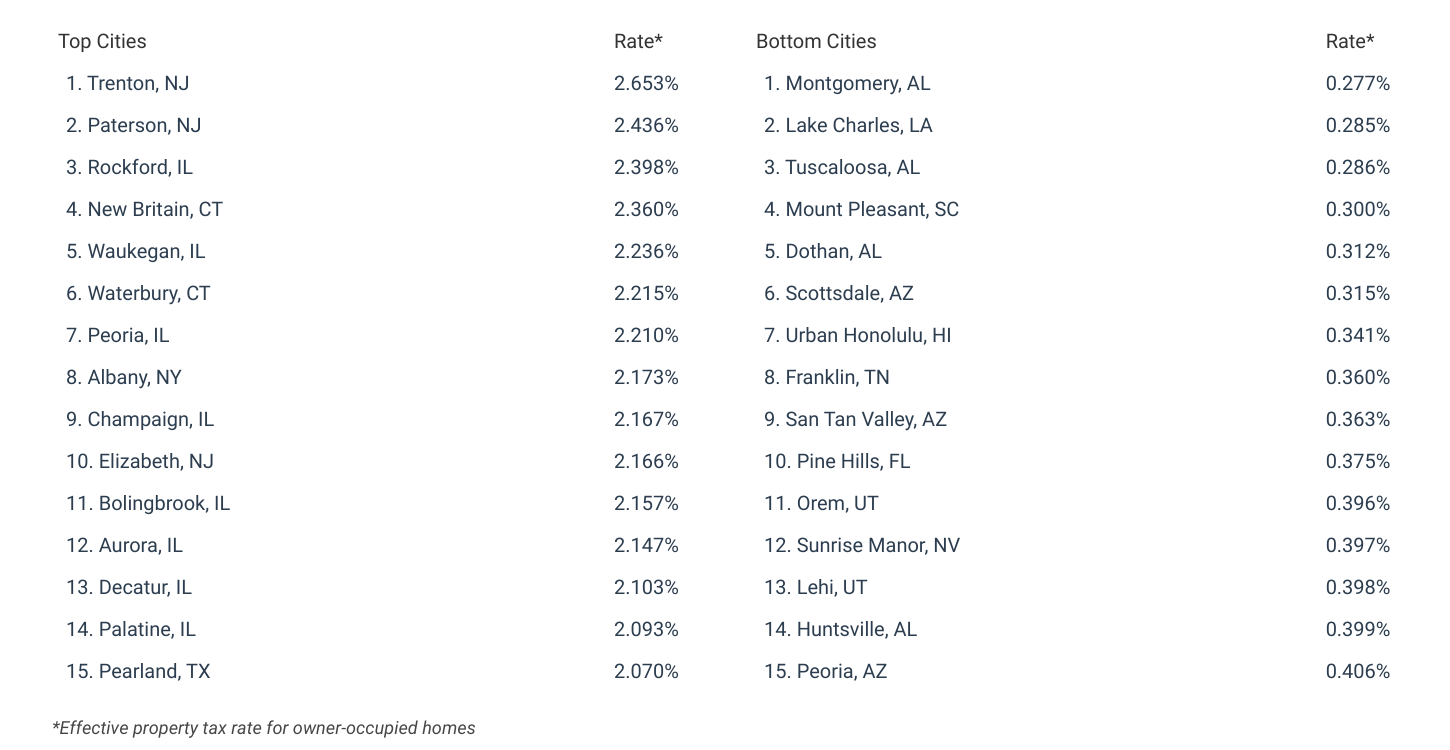

City-level differences also mirror these trends. Trenton, NJ, has the highest effective property tax rate of any U.S. city at 2.653%, while Montgomery, AL, has the lowest at 0.277%. Cities in Illinois, New Jersey, and Connecticut dominate the top ranks, while cities in Alabama, Louisiana, and Hawaii are among those with the smallest property tax burdens.

The analysis was conducted by Construction Coverage, a website that provides construction software and insurance reviews, using data from the U.S. Census Bureau. For more information and complete results, see Where Are U.S. Property Taxes Highest and Lowest? A State, County, and City Analysis on Construction Coverage.

States With the Highest Property Taxes

Counties With the Highest Property Taxes

Cities With the Highest Property Tax Rates

Methodology

Photo Credit: Robert Crum / Shutterstock

The data used in this analysis is from the U.S. Census Bureau’s 2023 American Community Survey. To determine the locations with the highest property taxes, researchers at Construction Coverage calculated the effective property tax rate for owner-occupied homes by dividing the aggregate annual real estate taxes paid by the aggregate value of housing units. In the event of a tie, the location with the greater median property taxes paid for owner-occupied homes was ranked higher. Additionally, due to top-coding limitations in the survey data, median home values over $2,000,000 were presented as >$2,000,000, median household incomes over $250,000 were presented as >$250,000, and median property taxes paid over $10,000 were replaced with the average property taxes paid.

For complete results, see Where Are U.S. Property Taxes Highest and Lowest? A State, County, and City Analysis on Construction Coverage.