GLP-1 receptor agonists, originally developed for managing type 2 diabetes, have rapidly emerged as highly effective treatment options for obesity. Medications such as semaglutide (branded as Ozempic and Wegovy) and tirzepatide (branded as Mounjaro and Zepbound) work by mimicking a natural hormone that regulates both appetite and blood sugar. By reducing hunger and promoting a feeling of fullness, these drugs have been shown to facilitate significant weight loss, with many patients shedding 15% or more of their body weight.

The efficacy of GLP-1s has made them a breakthrough not only in managing obesity and diabetes, but also in their potential to treat several related conditions. According to IRIS—a proprietary market intelligence platform developed by Real Chemistry—GLP-1s could show efficacy and safety in as many as 20 therapeutic areas in the next 10 years. This could lead to FDA approvals for treatment in obstructive sleep apnea, kidney disease, Alzheimer’s disease, liver disease, PCOS, and more.

Despite their benefits, access to GLP-1 medications remains inequitable. Perceived high costs, inconsistent insurance coverage, and drug shortages have created barriers, limiting who is currently benefiting from these treatments. While obesity affects more than 40% of U.S. adults—up from roughly 30% in 2000—access to GLP-1 therapies is inconsistent across demographic and socioeconomic groups. For instance, lower-income and minority populations, who are disproportionately affected by obesity, are also the least likely to access these medications.

Using data from Real Chemistry’s IRIS platform—which consists of medical, hospital, and pharmacy claims as a primary data source, covering more than 300 million U.S. patients over 10 years—this study examines the rising demand for GLP-1 drugs, along with the demographic and geographic disparities in access.

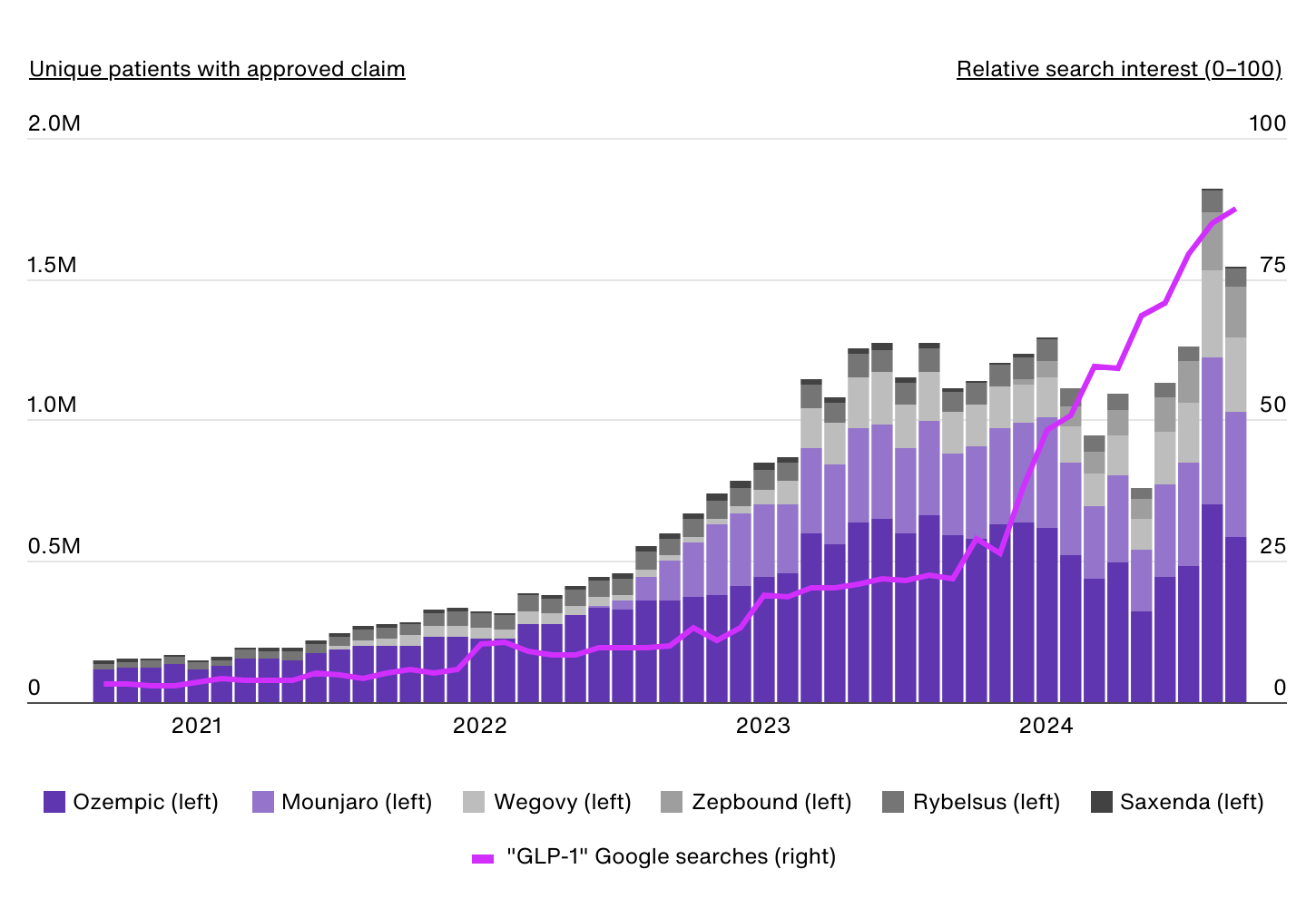

Approved GLP-1 Claims by Product

Data Source: IRIS by Real Chemistry & Google Trends | Image Credit: Real Chemistry

The first GLP-1 receptor agonist approved for obesity was liraglutide, marketed in the U.S. as Saxenda, in 2014. However, the market remained relatively small until semaglutide, initially approved for type 2 diabetes under the brand name Ozempic, gained widespread attention for its significant weight loss effects. In 2021, semaglutide was approved by the FDA for chronic weight management in adults with obesity (body mass index of 30 kilograms per square meter (kg/m2) or greater) or overweight (body mass index of 27 kg/m2 or greater) under the brand name Wegovy. Compared to liraglutide, which requires daily injections and typically results in more modest weight loss, semaglutide offers a more convenient weekly dosing schedule and greater reductions in body weight.

As demand for Wegovy quickly outpaced supply, other industry competitors began to jump into the obesity market. This trend accelerated with tirzepatide gaining FDA approval for type 2 diabetes under the name Mounjaro in 2022, and subsequent approval of Zepbound for chronic weight management in adults with obesity or overweight in 2023.

Prior to Wegovy’s FDA approval for obesity, there were approximately 190,000 approved claims for GLP-1 medications to treat obesity each month. By August 2024, that number had risen nearly tenfold to more than 1.8 million monthly approved claims. This data currently includes diabetes-indicated GLP-1s like Ozempic and Mounjaro, given that patients may have dual diagnoses of obesity/type 2 diabetes or some prior obesity diagnosis (during the 10-year analysis period).

Over the same period, public interest in these drugs exploded as well, with Google searches for “GLP-1” increasing twentyfold.

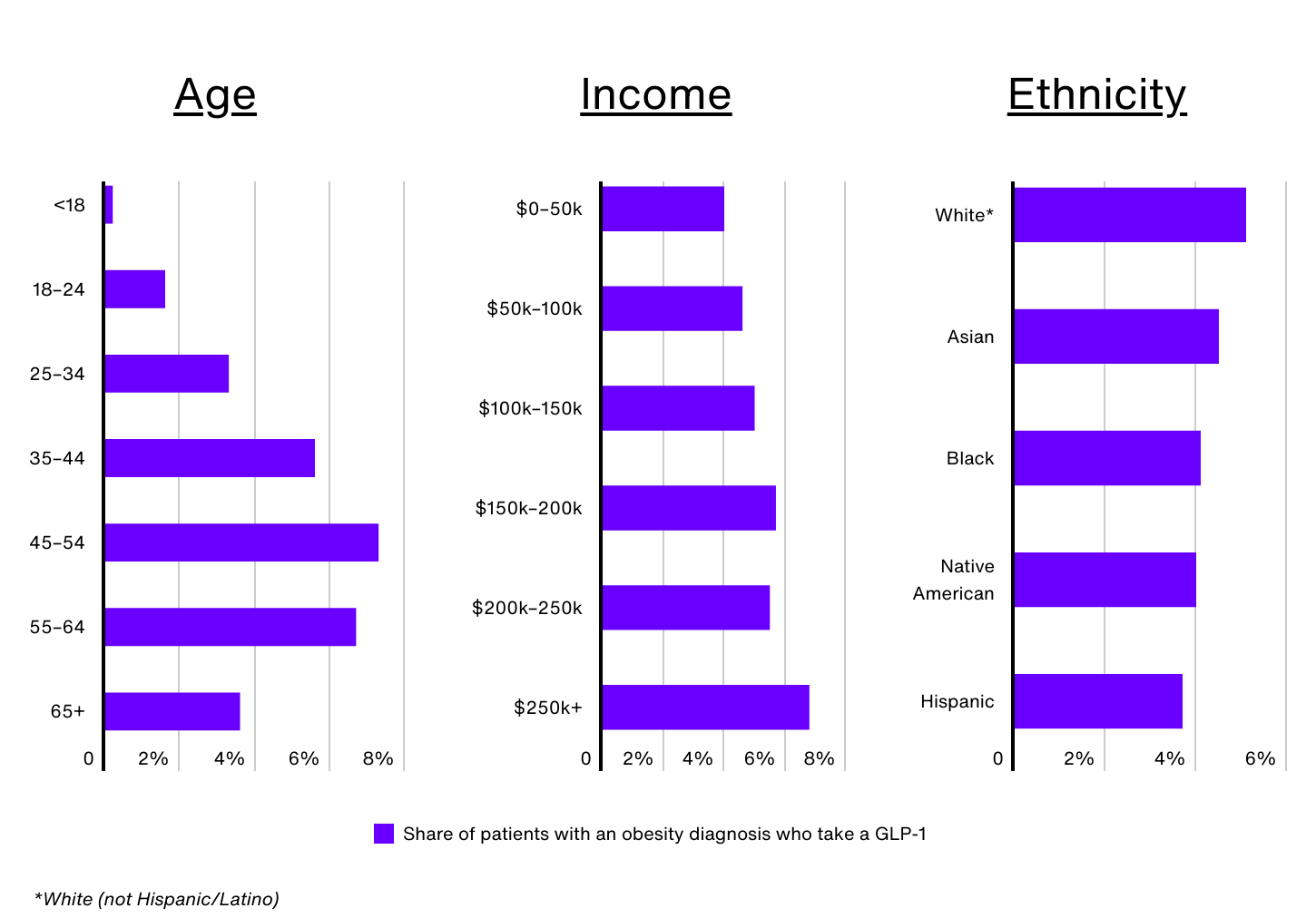

Demographic Breakdown of GLP-1 Use

Data Source: IRIS by Real Chemistry | Image Credit: Real Chemistry

Despite the surge in demand for GLP-1 medications, significant disparities exist when it comes to who is using them. Nationally, just 1.0% of all patients and 4.8% of patients with an obesity diagnosis have taken a GLP-1 in the past 12 months, but these rates vary widely by demographic group.

Age is a key factor. Despite Wegovy receiving FDA approval for children ages 12 and up, only 0.2% of Americans under 18 with obesity are prescribed a GLP-1. Older adults, especially those 65 and over, also face barriers, as Medicare does not currently cover GLP-1 medications for obesity. This lack of coverage significantly limits access for seniors with obesity, contributing to the relatively low rate of usage (3.6%) among this group. In contrast, adults aged 45 to 54 make up just 16.1% of the obesity population, but comprise 24.3% of GLP-1 users.

GLP-1 use also increases with income. Obesity patients earning over $250,000 annually are 72% more likely to take a GLP-1 than those earning $50,000 or less (6.8% vs. 4.0%). Perceptions around the high costs of these medications, even with insurance approval, have created barriers for many, especially low-income individuals. Additionally, Medicaid coverage of GLP-1 medications for obesity varies across states, leaving many patients ineligible for coverage depending on where they live. Low-income individuals may also face other barriers, such as difficulty taking time off work for regular medical visits or not having a regular healthcare provider, which limits their access to these drugs.

According to CDC data, non-Hispanic Black and Hispanic adults have the highest prevalence of obesity in the U.S. (49.9% and 45.6%, respectively). However, the use of GLP-1 medications for weight management does not align with these trends. In the U.S., an estimated 5.1% of non-Hispanic White patients with obesity use GLP-1s, compared to 4.5% of Asian patients, 4.1% of non-Hispanic Black patients, 4.0% of Native American patients, and 3.7% of Hispanic patients.

Sex is another factor. Female patients make up nearly 65% of GLP-1 users nationwide, and around 5.2% of women with obesity are prescribed a GLP-1 medication (compared to 4.2% of men). Women have historically faced greater social pressure to maintain lower body weight—and a recent Pew Research study found that women are more likely to believe willpower alone is insufficient for long-term weight loss, making them potentially more open to medical interventions.

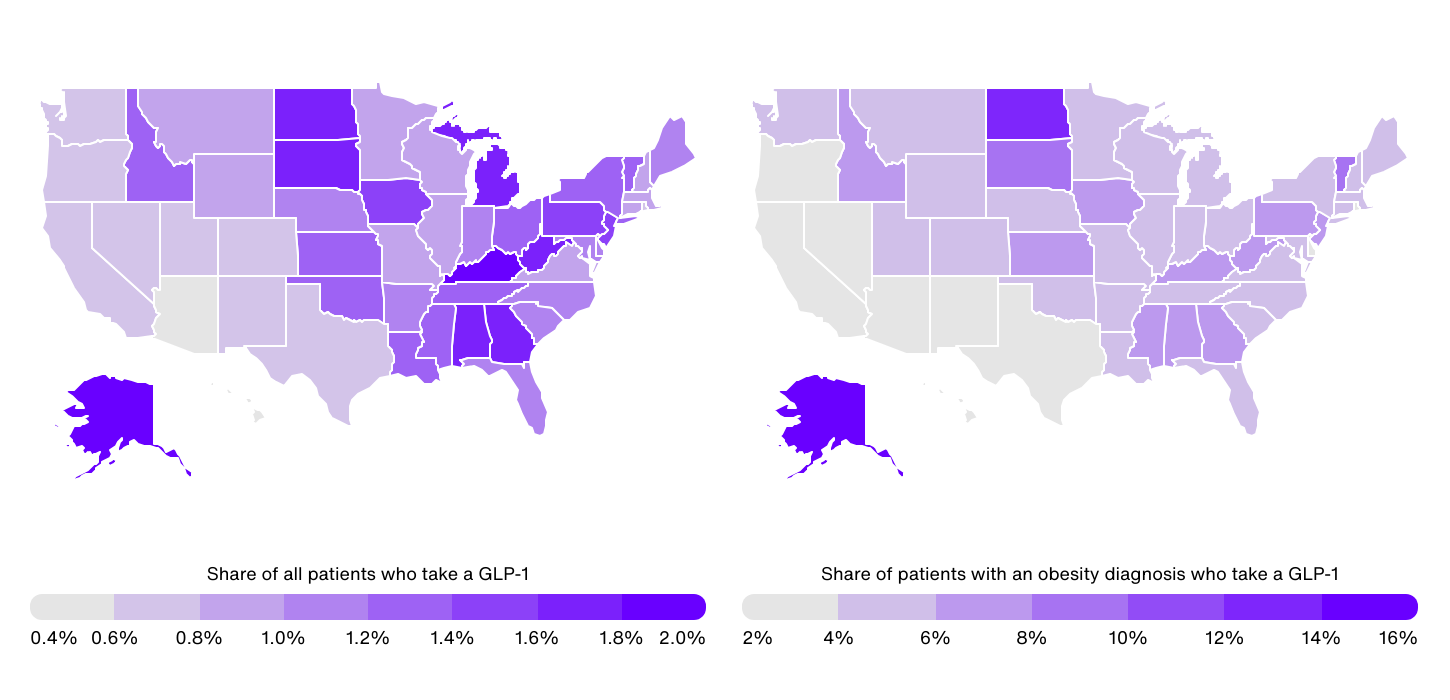

GLP-1 Use for Obesity by State

Data Source: IRIS by Real Chemistry | Image Credit: Real Chemistry

At the state level, GLP-1 use among all patients (not just obesity patients) ranges from a high of 1.9% in Kentucky to a low of 0.4% in Hawaii. Generally, GLP-1 usage is concentrated in the Southeast and parts of the Midwest, where self-reported obesity rates also tend to be higher. Besides Kentucky, other Southeastern states with high rates of GLP-1 use include Alabama (1.7%), West Virginia (1.7%), and Georgia (1.6%). In the Midwest, Michigan, South Dakota, North Dakota, and Iowa all report rates of 1.5% or more.

In contrast, eight of the 10 states with the lowest share of patients on GLP-1s are located in the Western U.S., where obesity prevalence tends to be lower. These states include Hawaii (0.4%), Arizona (0.5%), Colorado (0.6%), Nevada (0.6%), New Mexico (0.6%), Oregon (0.6%), Washington (0.7%), and Utah (0.7%).

When focusing specifically on GLP-1 use among patients with an obesity diagnosis, there is an even larger disparity between states, with rates ranging from 14.8% in Alaska to just 2.3% in Arizona. This is a result of differences in obesity diagnosis rates across states. For instance, while Alaska has an above-average obesity rate based on self-reported data, the state has significantly below-average rates of obesity diagnosis.

However, these wide differences also highlight the complex mix of demographic, socioeconomic, and cultural factors that drive access to and adoption of GLP-1 treatments. Factors such as Medicaid coverage, income levels, age, and healthcare infrastructure play a crucial role in determining who can currently benefit from these medications, and addressing these disparities will be key to maximizing access to GLP-1 therapies in the years ahead.

U.S. Obesity Market Analysis Methodology

Photo Credit: PeopleImages.com – Yuri A / Shutterstock

The data used in this study comes from IRIS by Real Chemistry—a proprietary market intelligence platform fueled by billions of data points, including medical, hospital, and pharmacy claims covering more than 300 million U.S. patients over 10 years. This report also consists of IRIS analysis using numerous other datasets such as social media conversations, paid media spend, earned media coverage, clinical trials, and peer-reviewed publication monitoring.

For this analysis, the population with obesity is defined as those patients with one or more obesity-related diagnostic claims, including BMI-related codes. The cohort excludes any person with no diagnosis, procedure, or pharmacy claims of any kind in the prior 12 months for stability. It does not exclude people who have a diabetes comorbidity due to significant overlap in populations.

GLP-1 users are defined as patients with an approved claim for at least one of the following GLP-1 medications in the prior 12 months: Mounjaro, Ozempic, Rybelsus, Saxenda, Wegovy, and Zepbound. Although Mounjaro, Ozempic, and Rybelsus are not FDA-approved for obesity treatment, they are included in the analysis due to the high number of patients with an obesity diagnosis using these products compared to other FDA-approved diabetes GLP-1 agonists. Patients on Mounjaro, Ozempic, or Rybelsus are only included when they also have an obesity-related diagnosis as described above. Saxenda, Wegovy, and Zepbound patients are included regardless of obesity diagnostic claims.

States were ranked based on the percentage of total patients who have an approved claim for a GLP-1 in the 12 months prior to September 30, 2024. In the event of a tie, the state with the higher percentage of patients with obesity taking a GLP-1 was ranked higher.

For complete results, see U.S. Obesity Market Analysis: Exploring Demographic & Geographic Disparities in GLP-1 Use on Real Chemistry.