Photo Credit: SHERBOCK / Shutterstock

After more than a year of high inflation across all parts of the economy, consumers have recently been seeing some signs of relief. The overall rate of growth in the Consumer Price Index has leveled out in recent months after a steep run-up in 2021 and early 2022. And categories that have grabbed headlines for fast-rising prices are cooling down as well. Gas prices dropped from $5.03 per gallon in June to $4.08 in August, real estate prices have fallen slightly from record highs this summer, and travel experts have calculated that domestic airfare prices are down 37% compared to prices from this summer.

The market for used vehicles is another area where consumers are hoping to see inflation ebb. The auto industry has been particularly hard-hit by supply chain disruptions arising from the COVID-19 pandemic over the last two and a half years. Many factories were shut down or operating at reduced capacity for stretches of 2020 and 2021 due to the pandemic, while shortages of parts like microchips have been a chronic problem for the industry. As a result, car manufacturers are producing millions fewer vehicles than before the pandemic, which has dramatically increased demand—and prices—for used cars.

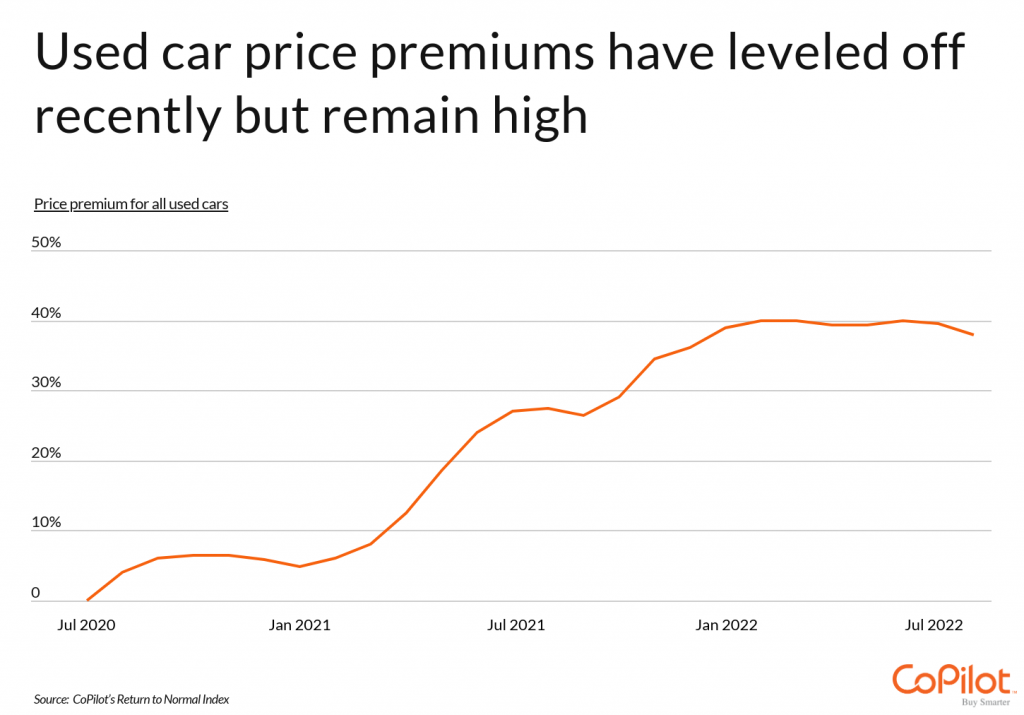

Fortunately, like in many other categories, price increases in the used car market may be turning a corner, according to CoPilot’s Return to Normal Index. The index compares current used vehicle values to what they would have been if not for the dynamics of the last two years. While CoPilot estimates that used cars carry an overall price premium of 39%, the explosive growth in car prices last year leveled off entering 2022. And recently, the Return to Normal Index saw its first three-month decline in the price premium on used cars.

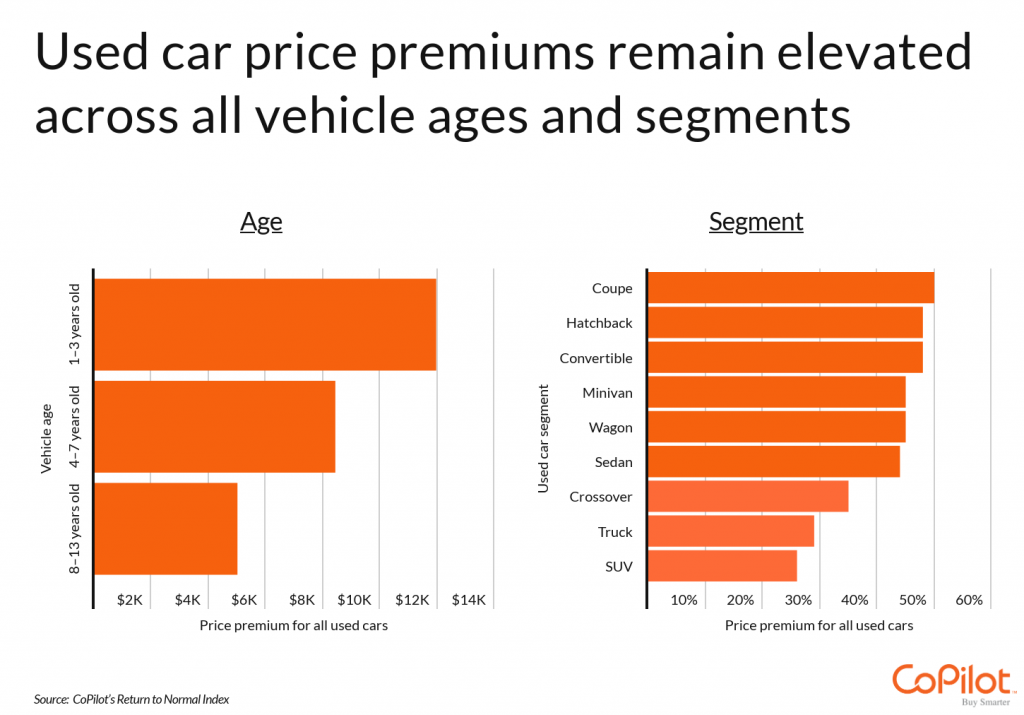

However, certain types of vehicles still have especially high price premiums. Given the lower supply of new vehicles, recent model years tend to have the greatest price premiums. Vehicles aged 1–3 years carry a typical premium of $11,964, more than one-third higher than the $8,431 premium for vehicles aged 4–7 years, and more than double the $5,002 premium for vehicles aged 8–13 years old.

Price premiums vary by segment as well. Many manufacturers have targeted more of their new vehicle production toward their best-selling vehicles, which has helped keep premiums lower for popular types like SUVs (26% price premium), trucks (29%), and crossovers (35%). Coupes (50% price premium), hatchbacks (48%), and convertibles (48%) hold the highest premiums of all vehicle types.

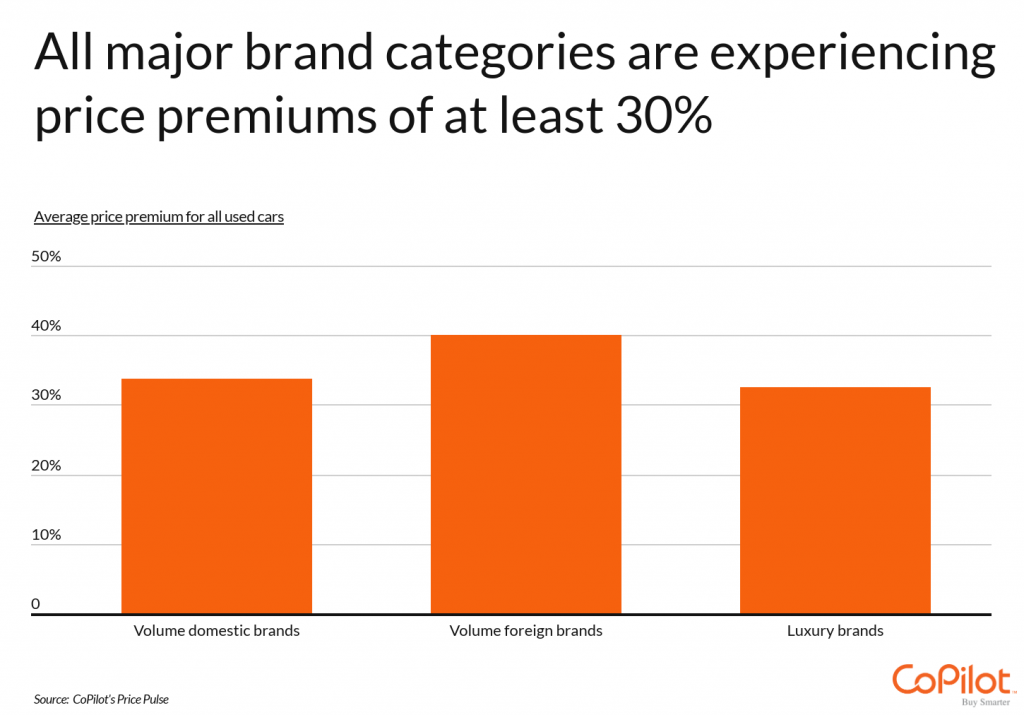

Along with age and vehicle type, brands also show variation in price premiums. Unfortunately for consumers, no major brand category has escaped price increases: volume domestic brands (such as Ford), volume foreign brands (such as Hyundai), and luxury brands (such as Tesla) all have average price premiums above 30%. But CoPilot’s Return to Normal Index shows that premiums are especially high for some manufacturers. Volume foreign brands offer the fewest deals for consumers. These makes have a nearly 40% price premium overall, and represent 10 of the top 15 brands with the highest price premiums—including each of the top four.

To find the brands with the largest used car price premiums, researchers at CoPilot analyzed the latest data from CoPilot’s Return to Normal Index. The researchers ranked used car brands by highest price premium percentage from July 2022. The price premium percentage is calculated using the differential between what any used car would typically be worth versus how much it is actually worth now, at retail.

Here are the brands with the largest used car price premiums.

Brands With the Largest Used Car Price Premiums

Photo Credit: chubis / Shutterstock

15. Chevrolet

- Price premium percentage: 41%

- Average listing price: $32,505

- Month-over-month change in price: $0

- Brand category: Volume Domestic Brands

Photo Credit: SHERBOCK / Shutterstock

14. Ford

- Price premium percentage: 42%

- Average listing price: $33,213

- Month-over-month change in price: $189

- Brand category: Volume Domestic Brands

Photo Credit: Art Konovalov / Shutterstock

13. Pontiac

- Price premium percentage: 43%

- Average listing price: $10,052

- Month-over-month change in price: $88

- Brand category: Volume Domestic Brands

Photo Credit: Devin Tolleson / Shutterstock

12. Scion

- Price premium percentage: 43%

- Average listing price: $13,625

- Month-over-month change in price: -$35

- Brand category: Volume Foreign Brands

Photo Credit: VinRart / Shutterstock

11. Honda

- Price premium percentage: 43%

- Average listing price: $26,257

- Month-over-month change in price: $289

- Brand category: Volume Foreign Brands

Photo Credit: ilikeyellow / Shutterstock

10. Mitsubishi

- Price premium percentage: 44%

- Average listing price: $20,281

- Month-over-month change in price: $104

- Brand category: Volume Foreign Brands

Photo Credit: TKalinowski / Shutterstock

9. Nissan

- Price premium percentage: 44%

- Average listing price: $24,390

- Month-over-month change in price: -$69

- Brand category: Volume Foreign Brands

Photo Credit: Anastasiia Gavriushina / Shutterstock

8. Mazda

- Price premium percentage: 44%

- Average listing price: $24,557

- Month-over-month change in price: $318

- Brand category: Volume Foreign Brands

Photo Credit: Hendrickson Photography / Shutterstock

7. Chrysler

- Price premium percentage: 45%

- Average listing price: $23,011

- Month-over-month change in price: -$231

- Brand category: Volume Domestic Brands

Photo Credit: Pavel L Photo and Video / Shutterstock

6. Smart

- Price premium percentage: 48%

- Average listing price: $12,701

- Month-over-month change in price: $301

- Brand category: Volume Foreign Brands

Photo Credit: Abu hasim.A / Shutterstock

5. Tesla

- Price premium percentage: 48%

- Average listing price: $70,374

- Month-over-month change in price: -$631

- Brand category: Luxury Brands

Photo Credit: katuka / Shutterstock

4. FIAT

- Price premium percentage: 51%

- Average listing price: $16,575

- Month-over-month change in price: $70

- Brand category: Volume Foreign Brands

Photo Credit: Roman Vyshnikov / Shutterstock

3. Hyundai

- Price premium percentage: 53%

- Average listing price: $22,849

- Month-over-month change in price: $167

- Brand category: Volume Foreign Brands

Photo Credit: Jonathan Weiss / Shutterstock

2. Kia

- Price premium percentage: 55%

- Average listing price: $24,353

- Month-over-month change in price: $258

- Brand category: Volume Foreign Brands

Photo Credit: Jonathan Jones

1. Volkswagen

- Price premium percentage: 58%

- Average listing price: $25,556

- Month-over-month change in price: $104

- Brand category: Volume Foreign Brands

Detailed Findings & Methodology

To find the brands with the largest used car price premiums, researchers at CoPilot analyzed the latest data from CoPilot’s Return to Normal Index. The researchers ranked used car brands by highest price premium percentage from July 2022. The price premium percentage is calculated using the differential between what any used car would typically be worth versus how much it is actually worth now, at retail. Additionally, the researchers also calculated the average listing price and the month-over-month change in price (June 2022 to July 2022) for each brand.