Photo Credit: chayanuphol / Shutterstock

The COVID-19 pandemic created unprecedented hardship for large segments of the U.S. economy. However, one unexpected bright spot was the expansion of state stabilization funds—also known as rainy day funds—driven largely by increases in tax revenue.

At the beginning of the pandemic, the economy halted, and a short-lived but steep recession ensued. Stay-at-home orders and social distancing changed the way Americans lived, and as a result, their spending habits dramatically shifted. These changes caused many small businesses to be temporarily or permanently closed, and state balance sheets declined.

But this pandemic-induced recession was fleeting. The economic downturn quickly reversed in large part due to bipartisan legislation that swiftly provided fiscal support directly to individual taxpayers, businesses, and state governments. The combination of broad fiscal stimulus and higher-than-expected tax revenue pushed state rainy day funds to a record high. During 2021, states grew their budget surpluses by more than 60%.

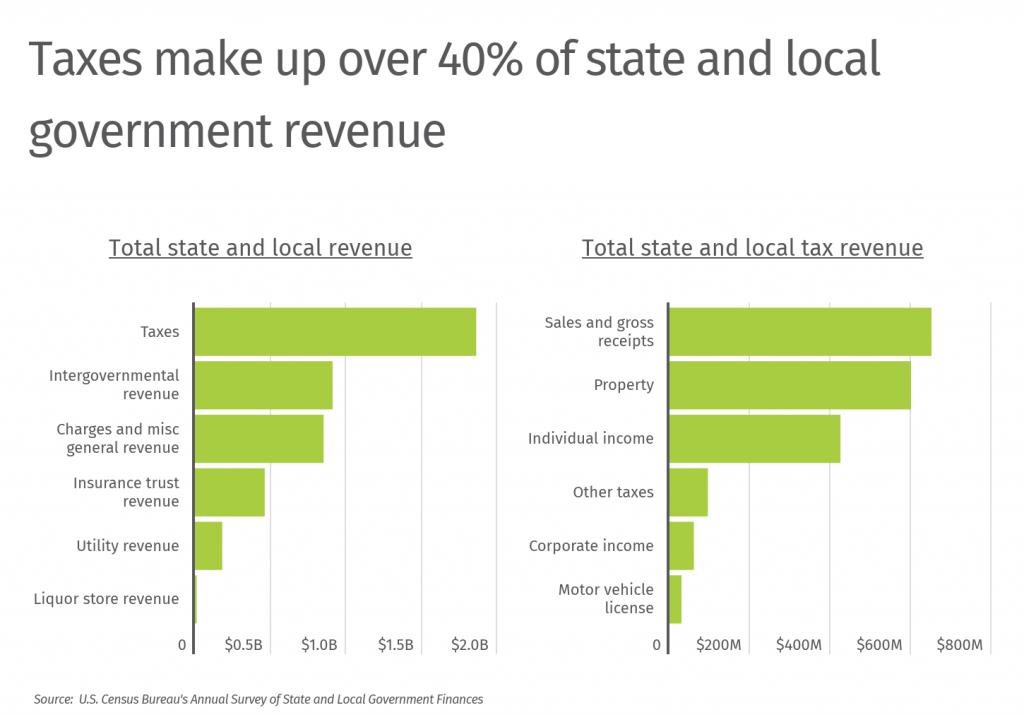

While states received direct financial support from the federal government, tax revenue was the primary contributor to state budget surpluses. State and local governments rely heavily on taxes to finance their operations. According to the Census Bureau, in 2020, total state and local government tax revenue amounted to nearly $1.9 billion—twice as much as intergovernmental revenue, which is the next largest revenue source. State and local taxes comprise several different types of taxes, but the largest sources come from sales and gross receipts, property, and individual income.

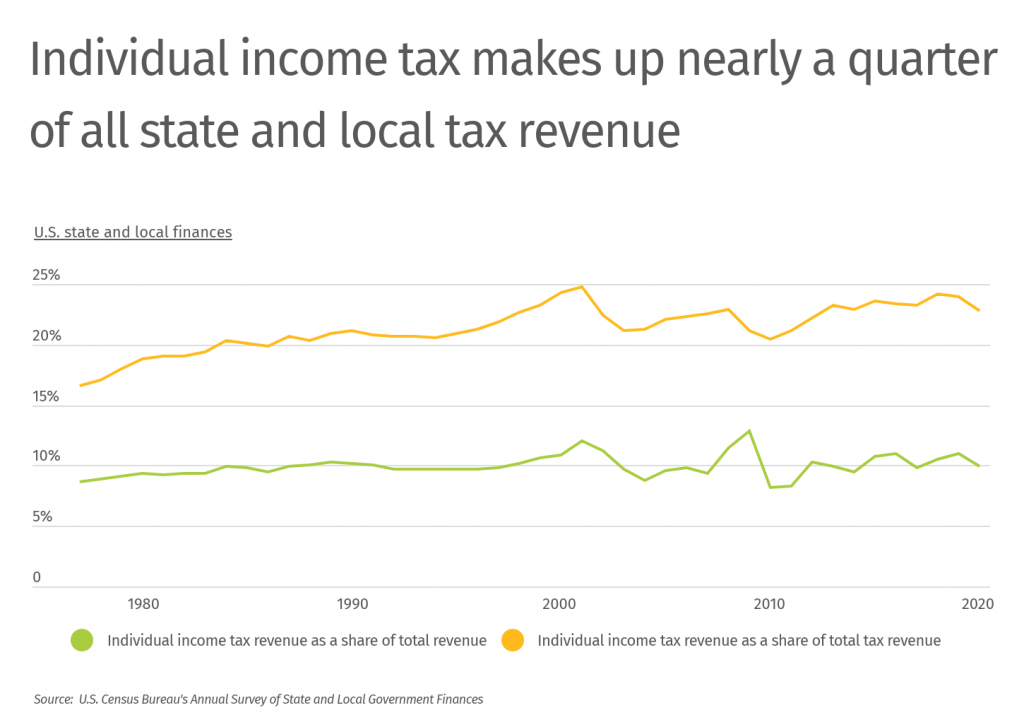

All but seven states tax some form of individual income, and all but nine states tax wage income. In total, individual income tax accounted for 9.9% of total state and local revenue and 22.8% of total state and local tax revenue in 2020, the most recent full year available. Today, individual income tax makes up a much larger proportion of total tax revenue than it did several decades ago in 1977, when it accounted for less than 17% of total tax revenue. While both individual income tax as a share of total revenue and as a share of total tax revenue dipped from 2019 to 2020, individual income taxes continue to be a significant revenue source for most states.

Looking ahead, many of the temporary factors that helped push state rainy day funds to record highs are projected to subside. Another issue for certain locations is that increases in remote work opportunities have encouraged residents to leave high-tax states, especially those states with high income taxes. According to the Tax Foundation, states with double-digit income taxes (such as California, New Jersey, and New York) were among the states that lost the most residents in 2021. Meanwhile, states that forgo individual income taxes altogether (such as Florida, Texas, and Nevada) reported some of the largest population increases.

To find the states that collect the most individual income tax, researchers at HowtoHome.com analyzed data from the U.S. Census Bureau. The researchers ranked states according to each state’s individual income tax revenue as a share of total revenue. Researchers also calculated individual income tax revenue as a share of total tax revenue, total individual income tax revenue, total tax revenue, and total revenue.

Here are the states that collect the most individual income tax.

States That Collect the Most Individual Income Tax

Photo Credit: Izabela23 / Shutterstock

15. Hawaii

- Individual income tax revenue as a share of total revenue: 11.1%

- Individual income tax revenue as a share of total tax revenue: 21.7%

- Total individual income tax revenue: $2,359,093,000

- Total tax revenue: $10,860,932,000

- Total revenue: $21,256,402,000

Photo Credit: Sean Pavone / Shutterstock

14. North Carolina

- Individual income tax revenue as a share of total revenue: 11.3%

- Individual income tax revenue as a share of total tax revenue: 28.4%

- Total individual income tax revenue: $12,505,906,000

- Total tax revenue: $44,011,586,000

- Total revenue: $110,400,823,000

Photo Credit: Sean Pavone / Shutterstock

13. Georgia

- Individual income tax revenue as a share of total revenue: 11.3%

- Individual income tax revenue as a share of total tax revenue: 26.8%

- Total individual income tax revenue: $11,704,328,000

- Total tax revenue: $43,708,584,000

- Total revenue: $103,264,080,000

Photo Credit: Mihai Andritoiu / Shutterstock

12. Delaware

- Individual income tax revenue as a share of total revenue: 11.8%

- Individual income tax revenue as a share of total tax revenue: 30.0%

- Total individual income tax revenue: $1,744,674,000

- Total tax revenue: $5,810,994,000

- Total revenue: $14,835,230,000

Photo Credit: Sean Pavone / Shutterstock

11. Indiana

- Individual income tax revenue as a share of total revenue: 12.8%

- Individual income tax revenue as a share of total tax revenue: 30.0%

- Total individual income tax revenue: $9,590,894,000

- Total tax revenue: $31,940,021,000

- Total revenue: $75,170,061,000

Photo Credit: Sean Pavone / Shutterstock

10. Kentucky

- Individual income tax revenue as a share of total revenue: 12.9%

- Individual income tax revenue as a share of total tax revenue: 33.0%

- Total individual income tax revenue: $6,434,162,000

- Total tax revenue: $19,495,610,000

- Total revenue: $50,023,462,000

Photo Credit: Mihai Andritoiu / Shutterstock

9. New Jersey

- Individual income tax revenue as a share of total revenue: 12.9%

- Individual income tax revenue as a share of total tax revenue: 21.9%

- Total individual income tax revenue: $15,412,766,000

- Total tax revenue: $70,318,773,000

- Total revenue: $119,261,406,000

Photo Credit: Sean Pavone / Shutterstock

8. California

- Individual income tax revenue as a share of total revenue: 12.9%

- Individual income tax revenue as a share of total tax revenue: 30.5%

- Total individual income tax revenue: $84,412,243,000

- Total tax revenue: $276,549,753,000

- Total revenue: $651,904,381,000

Photo Credit: IVY PHOTOS / Shutterstock

7. Minnesota

- Individual income tax revenue as a share of total revenue: 13.8%

- Individual income tax revenue as a share of total tax revenue: 29.4%

- Total individual income tax revenue: $10,923,158,000

- Total tax revenue: $37,137,398,000

- Total revenue: $79,427,041,000

Photo Credit: Jon Bilous / Shutterstock

6. Oregon

- Individual income tax revenue as a share of total revenue: 14.2%

- Individual income tax revenue as a share of total tax revenue: 39.1%

- Total individual income tax revenue: $8,635,691,000

- Total tax revenue: $22,065,012,000

- Total revenue: $60,946,595,000

Photo Credit: Jon Bilous / Shutterstock

5. Virginia

- Individual income tax revenue as a share of total revenue: 14.9%

- Individual income tax revenue as a share of total tax revenue: 31.0%

- Total individual income tax revenue: $14,996,649,000

- Total tax revenue: $48,311,690,000

- Total revenue: $100,686,538,000

Photo Credit: Sean Pavone / Shutterstock

4. Connecticut

- Individual income tax revenue as a share of total revenue: 15.8%

- Individual income tax revenue as a share of total tax revenue: 26.9%

- Total individual income tax revenue: $8,177,456,000

- Total tax revenue: $30,416,426,000

- Total revenue: $51,910,360,000

Photo Credit: ESB Professional / Shutterstock

3. Massachusetts

- Individual income tax revenue as a share of total revenue: 16.5%

- Individual income tax revenue as a share of total tax revenue: 34.1%

- Total individual income tax revenue: $17,414,713,000

- Total tax revenue: $51,013,885,000

- Total revenue: $105,809,443,000

Photo Credit: Sean Pavone / Shutterstock

2. New York

- Individual income tax revenue as a share of total revenue: 18.1%

- Individual income tax revenue as a share of total tax revenue: 33.9%

- Total individual income tax revenue: $67,963,993,000

- Total tax revenue: $200,443,056,000

- Total revenue: $376,214,893,000

Photo Credit: Sean Pavone / Shutterstock

1. Maryland

- Individual income tax revenue as a share of total revenue: 21.7%

- Individual income tax revenue as a share of total tax revenue: 40.5%

- Total individual income tax revenue: $17,030,628,000

- Total tax revenue: $42,033,738,000

- Total revenue: $78,310,759,000

Detailed Findings & Methodology

To find the states that collect the most individual income tax, researchers at HowtoHome.com analyzed data from the U.S. Census Bureau’s 2020 Annual Survey of State and Local Government Finances. Researchers ranked states according to each state’s individual income tax revenue as a share of total revenue. Researchers also calculated individual income tax revenue as a share of total tax revenue, total individual income tax revenue, total tax revenue, and total revenue.