Photo Credit: Nicola Katie / Shutterstock

Recent data suggests that efforts to tame inflation are starting to have an effect. After nearly a year of steady interest rate increases by the Federal Reserve, year-over-year growth in the Consumer Price Index slowed to 6.0% in February 2023. This figure was the lowest since September 2021.

While inflation might have finally reached its peak, many Americans continue to struggle with high prices. Nominal wages have grown since the start of the COVID-19 pandemic amid the Great Resignation and ongoing labor market tightness, but this rate of growth has trailed the rate of price increases for most workers. This cuts into household budgets and makes it more difficult for consumers to maintain their standard of living.

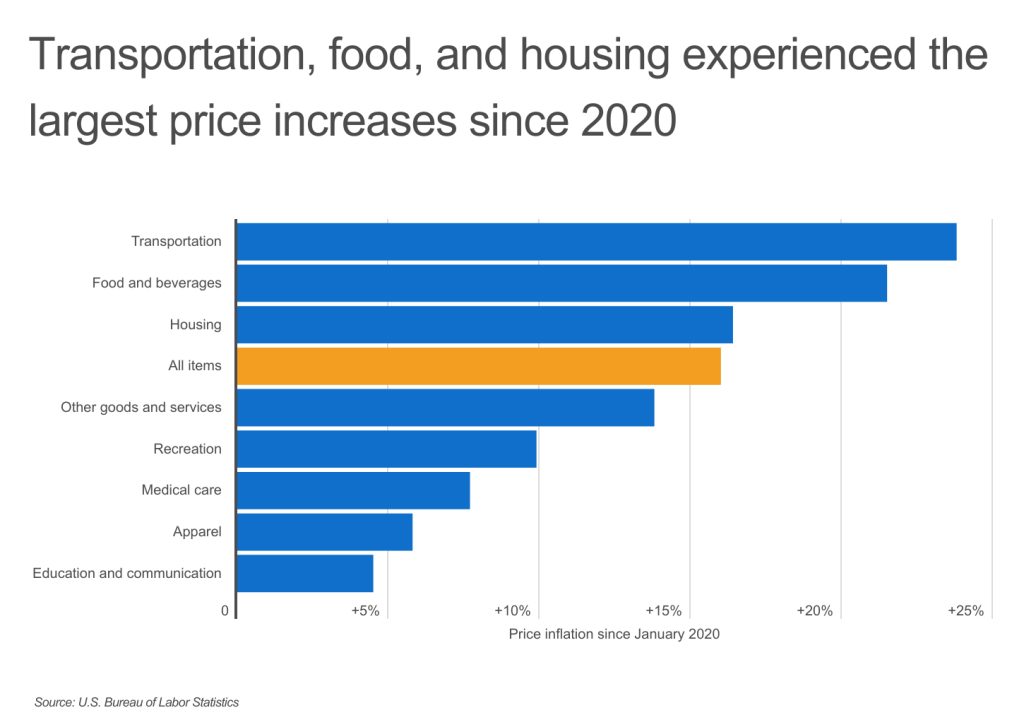

One of the factors that has made the recent run of inflation especially challenging is the fact that the spending categories with the greatest price increases are necessities. Inflation has taken place throughout the economy, but over the last three years, the biggest spikes have occurred in the categories of transportation (+23.8%), food and beverages (+21.5%), and housing (+16.4%). These categories are difficult for households to cut back on, and the rate of inflation for each has exceeded the average 16% price increase across all items.

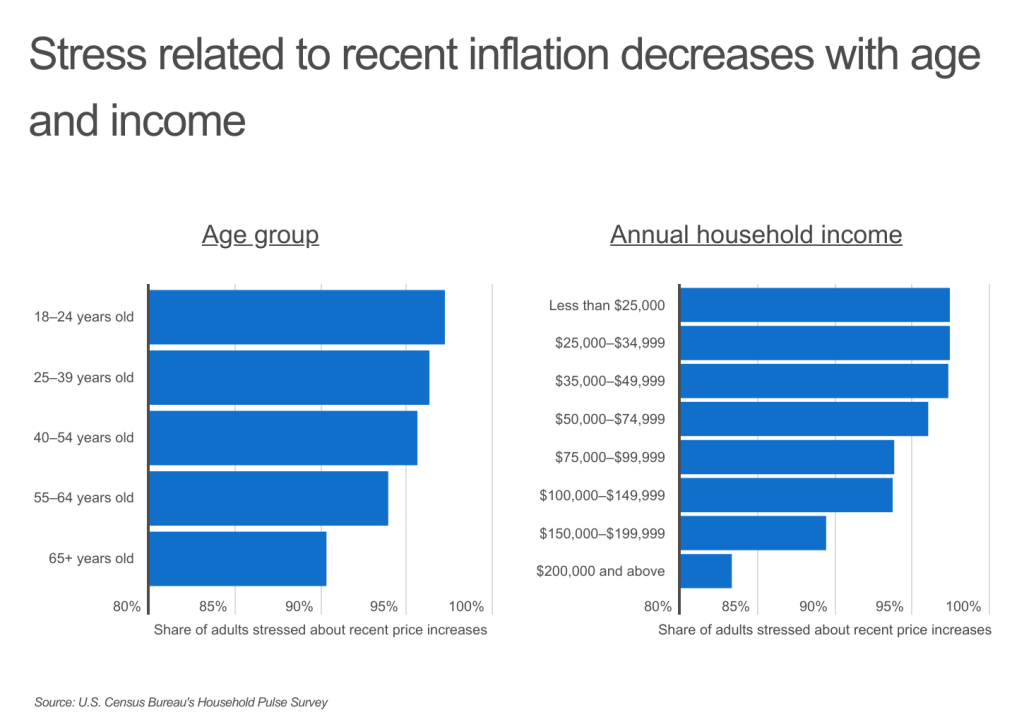

Faced with these circumstances, U.S. households are feeling the pressure of inflation. More than 90% of adults in every age group express that they feel stressed about recent price increases. The most stressed age group is people aged 18 to 24, who are early in their careers and may not have savings, investments, or credit to fall back on. Inflation-related stress is also a widespread concern across income levels. In every income bracket below $75,000, more than 95% of people report feeling stressed about inflation. Even among the highest earners making above $200,000, more than 80% feel stress about recent price increases.

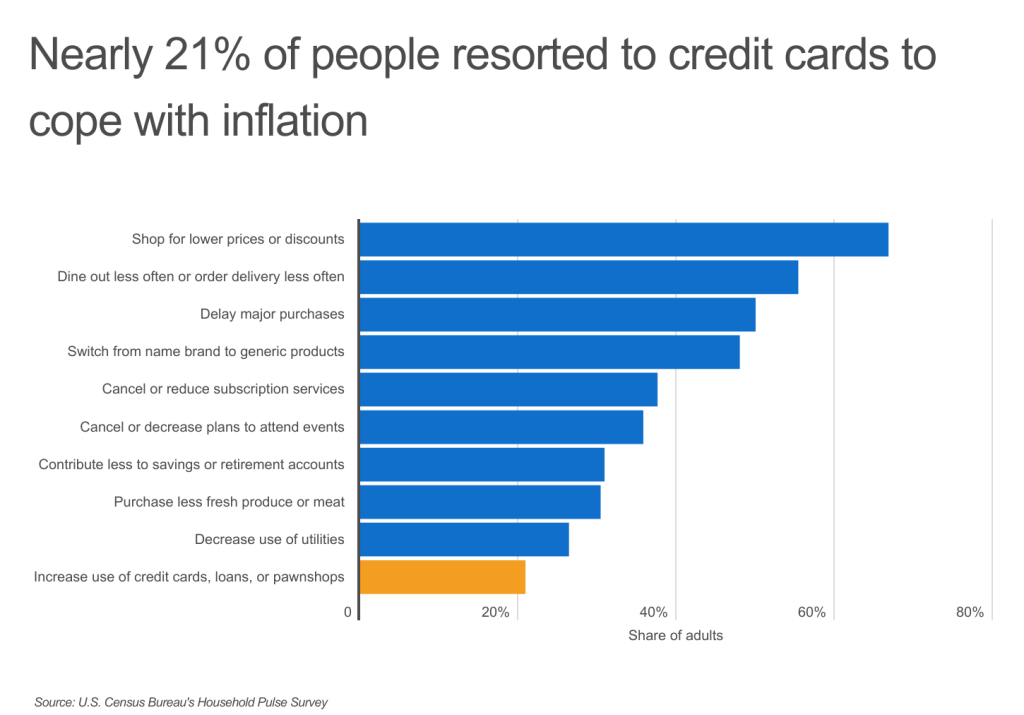

Consumers are adopting a variety of strategies to cope with the effects of inflation. Most commonly, shoppers look to cut costs: more than two-thirds of adults say they look for lower prices or discounts when making a purchase, more than half are eating out less and delaying major purchases, and nearly half are switching from name brand to generic products.

Inflation has also pushed 21% of adults to use credit cards, loans, or pawnshops to help pay their increased costs. Reliance on credit can be a quick way to help make ends meet in the short term, but doing so can be a risky move financially. People who carry balances on their credit cards or pay off loans slowly will ultimately pay more in interest—a risk exacerbated by the fact that interest rates have risen dramatically.

U.S. households are not turning to credit cards in equal measure, however, as there are geographic differences in where adults have started using cards more frequently. States in the Midwest, like Wisconsin and South Dakota, and in the South, like Georgia and Mississippi, have the fewest adults reporting an increased reliance on credit cards to cope with inflation. In contrast, Western states like Utah, Arizona, Nevada, and California have all seen nearly one in four adults using their cards more often. But one New England state—Maine—sits at the top of the list, with 24.6% of adults reporting an increased reliance on credit cards due to rising prices.

To find the states where inflation is driving increased reliance on credit cards, researchers at Upgraded Points analyzed data collected in early January 2023 from the U.S. Census Bureau’s Census Household Pulse Survey. Researchers ranked states according to each state’s share of adults that increased their use of credit cards, loans, or pawn shops to cope with price increases.

Here are the states where inflation is driving increased reliance on credit cards.

States Where Inflation Is Driving Increased Reliance on Credit Cards

Photo Credit: Jacob Boomsma / Shutterstock

15. Alaska

- Share of adults that increased their use of credit cards due to prices: 21.8%

- Share of adults that relied on credit cards to meet spending needs: 35.0%

- Share of adults stressed about recent price increases: 92.4%

- Share of adults concerned about future price increases: 94.2%

Photo Credit: Tupungato / Shutterstock

14. Missouri

- Share of adults that increased their use of credit cards due to prices: 21.9%

- Share of adults that relied on credit cards to meet spending needs: 34.7%

- Share of adults stressed about recent price increases: 95.6%

- Share of adults concerned about future price increases: 96.7%

Photo Credit: Jacob Boomsma / Shutterstock

13. North Dakota

- Share of adults that increased their use of credit cards due to prices: 22.0%

- Share of adults that relied on credit cards to meet spending needs: 34.4%

- Share of adults stressed about recent price increases: 94.5%

- Share of adults concerned about future price increases: 95.9%

Photo Credit: Ryan Conine / Shutterstock

12. Texas

- Share of adults that increased their use of credit cards due to prices: 22.0%

- Share of adults that relied on credit cards to meet spending needs: 36.7%

- Share of adults stressed about recent price increases: 95.2%

- Share of adults concerned about future price increases: 97.0%

Photo Credit: Sean Pavone / Shutterstock

11. South Carolina

- Share of adults that increased their use of credit cards due to prices: 22.6%

- Share of adults that relied on credit cards to meet spending needs: 32.9%

- Share of adults stressed about recent price increases: 94.2%

- Share of adults concerned about future price increases: 96.8%

Photo Credit: FotosForTheFuture / Shutterstock

10. New Jersey

- Share of adults that increased their use of credit cards due to prices: 22.6%

- Share of adults that relied on credit cards to meet spending needs: 43.4%

- Share of adults stressed about recent price increases: 95.3%

- Share of adults concerned about future price increases: 94.9%

Photo Credit: turtix / Shutterstock

9. New Mexico

- Share of adults that increased their use of credit cards due to prices: 22.7%

- Share of adults that relied on credit cards to meet spending needs: 39.0%

- Share of adults stressed about recent price increases: 93.6%

- Share of adults concerned about future price increases: 95.2%

Photo Credit: Andrew Zarivny / Shutterstock

8. Oregon

- Share of adults that increased their use of credit cards due to prices: 23.0%

- Share of adults that relied on credit cards to meet spending needs: 34.0%

- Share of adults stressed about recent price increases: 92.9%

- Share of adults concerned about future price increases: 95.1%

Photo Credit: Jon Bilous / Shutterstock

7. Connecticut

- Share of adults that increased their use of credit cards due to prices: 23.2%

- Share of adults that relied on credit cards to meet spending needs: 41.3%

- Share of adults stressed about recent price increases: 92.0%

- Share of adults concerned about future price increases: 96.3%

Photo Credit: Jacob Boomsma / Shutterstock

6. Colorado

- Share of adults that increased their use of credit cards due to prices: 23.4%

- Share of adults that relied on credit cards to meet spending needs: 40.8%

- Share of adults stressed about recent price increases: 93.3%

- Share of adults concerned about future price increases: 94.9%

Photo Credit: Matt Gush / Shutterstock

5. California

- Share of adults that increased their use of credit cards due to prices: 24.0%

- Share of adults that relied on credit cards to meet spending needs: 37.8%

- Share of adults stressed about recent price increases: 94.4%

- Share of adults concerned about future price increases: 95.4%

Photo Credit: Kit Leong / Shutterstock

4. Nevada

- Share of adults that increased their use of credit cards due to prices: 24.4%

- Share of adults that relied on credit cards to meet spending needs: 38.2%

- Share of adults stressed about recent price increases: 95.6%

- Share of adults concerned about future price increases: 94.6%

Photo Credit: Sean Pavone / Shutterstock

3. Arizona

- Share of adults that increased their use of credit cards due to prices: 24.4%

- Share of adults that relied on credit cards to meet spending needs: 38.8%

- Share of adults stressed about recent price increases: 93.4%

- Share of adults concerned about future price increases: 95.7%

Photo Credit: JCA Images / Shutterstock

2. Utah

- Share of adults that increased their use of credit cards due to prices: 24.4%

- Share of adults that relied on credit cards to meet spending needs: 45.2%

- Share of adults stressed about recent price increases: 97.2%

- Share of adults concerned about future price increases: 98.0%

Photo Credit: Sean Pavone / Shutterstock

1. Maine

- Share of adults that increased their use of credit cards due to prices: 24.6%

- Share of adults that relied on credit cards to meet spending needs: 37.3%

- Share of adults stressed about recent price increases: 94.4%

- Share of adults concerned about future price increases: 94.5%

Detailed Findings & Methodology

To find the states where inflation is driving increased reliance on credit cards, researchers at Upgraded Points analyzed data from the U.S. Census Bureau’s Census Household Pulse Survey for Week 53, spanning January 4, 2023 through January 16, 2023. Researchers ranked states according to each state’s share of adults that increased their use of credit cards, loans, or pawn shops to cope with price increases. Researchers also calculated the share of adults that relied on credit cards or loans to meet spending needs, the share of adults stressed about price increases in the last two months, and the share of adults concerned about price increases in the next six months.