Photo Credit: oneinchpunch / Shutterstock

The U.S. political landscape has become more polarized than ever before. In fact, a study of developed democracies around the world found that the political polarization trend in the U.S. is more dramatic than in any other country in the study. In the months prior to the 2020 election, the overwhelming majority of both Biden and Trump supporters responded that they would “be very concerned about the country’s direction” and believed that it would cause lasting harm to the U.S. if their opponent won. This amount of turmoil surrounding presidential elections not only influences Americans’ everyday decisions, but the volatility can be seen in the U.S. stock market as well.

As recent presidential elections have become increasingly contentious, certain issues facing Americans are coming into focus. The economy has always been a hot-button issue for American voters, but recent inflation and stock market volatility have made it an increasingly important concern. This is especially true for Republicans, who consider the economy the most important issue facing our country.

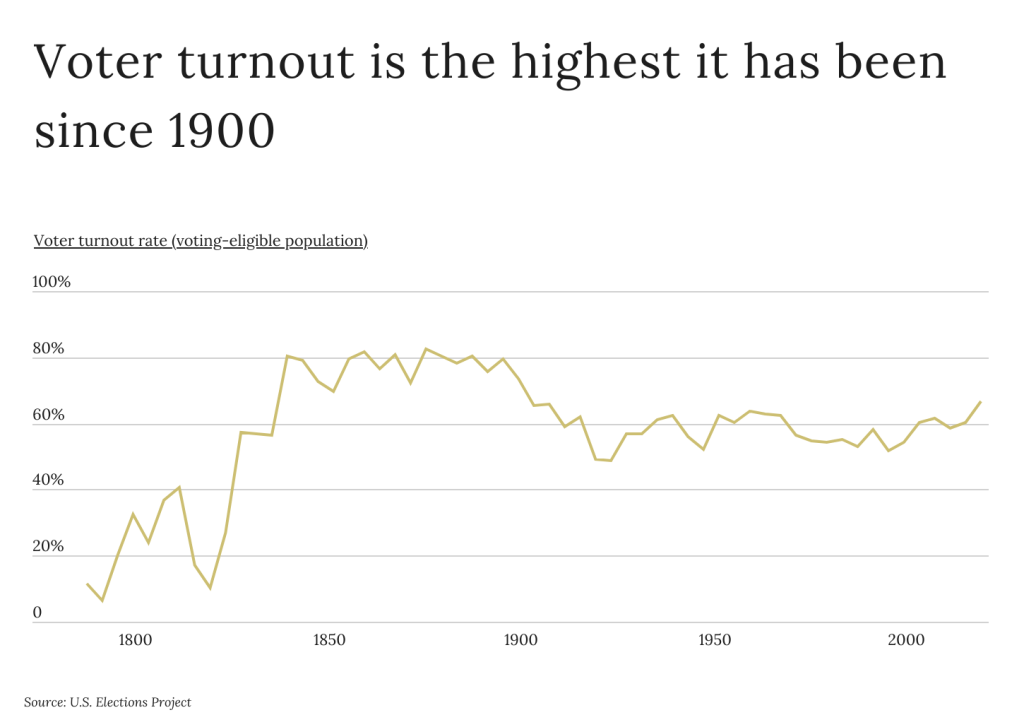

The combination of increased political polarization alongside a rocky economy has likely contributed to the record levels of voter turnout observed in recent years. Since bottoming out at just under 52% in 1996, voter turnout has steadily risen to nearly 67% during the 2020 election cycle. This level of civic engagement has not been seen since 1900—a sign of heightened voter focus.

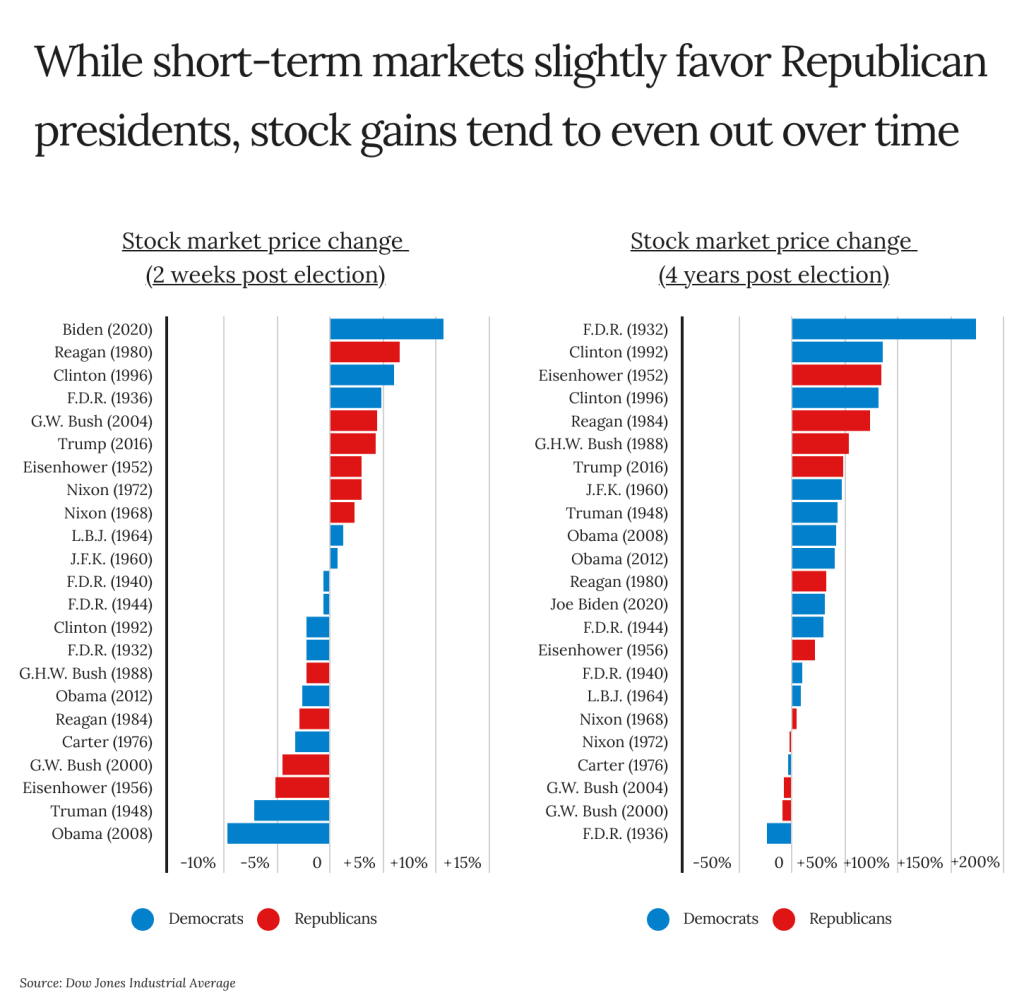

Despite increasing polarization around elections, one political party does not appear to have a significantly greater impact on the stock market than another. In the short term, the post-election stock market appears to slightly favor Republicans, with six out of the nine since 1932 producing positive two-week returns. This may be due to the fact that Republicans tend to favor less government regulation in business, and are often perceived to prioritize business and economic interests.

Over time, however, there is not a clear difference in the stock market when one political party is elected over another. In fact, there have only been five out of the 23 election cycles since 1932 that produced negative returns in the four years after election day. And of the five elections with the largest market price increases during the four years after election day, three were Democratic presidents—Franklin D. Roosevelt in 1932 and Bill Clinton in 1992 and 1996. Republican presidents Dwight D. Eisenhower (1952) and Ronald Reagan (1984) round out the top five.

To determine the strongest post-election stock markets in history, researchers at U.S. Money Reserve ranked post-presidential election stock markets from 1896 to 2020 according to the percentage change in the Dow Jones Industrial Average® stock market index two weeks after each election. In the event of a tie, the presidential election with the larger percentage change from election day to inauguration day was ranked higher.

Here are the strongest post-election stock markets in history.

The Strongest Post-Election Stock Markets in History

Photo Credit: U.S. Money Reserve

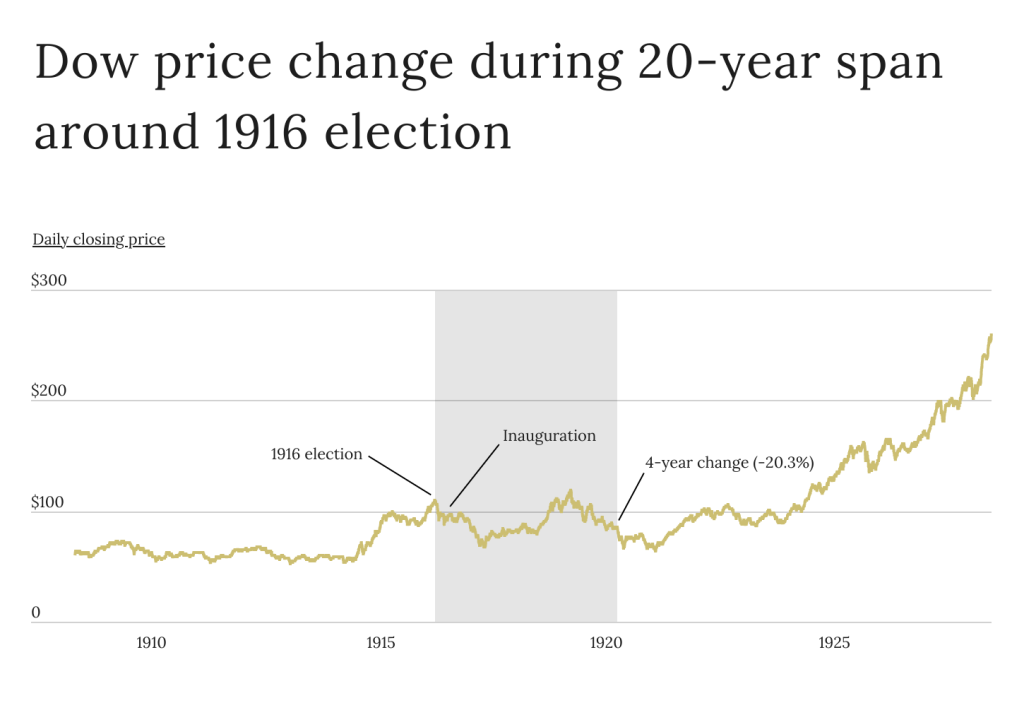

15. 1916 presidential election

- Stock market price change (2 weeks post-election): +2.7%

- Stock market price change (inauguration day): -11.4%

- Stock market price change (4 years post-election): -20.3%

- Elected president: Woodrow Wilson (Democratic)

- Runner-up: Charles Evans Hughes (Republican)

Photo Credit: U.S. Money Reserve

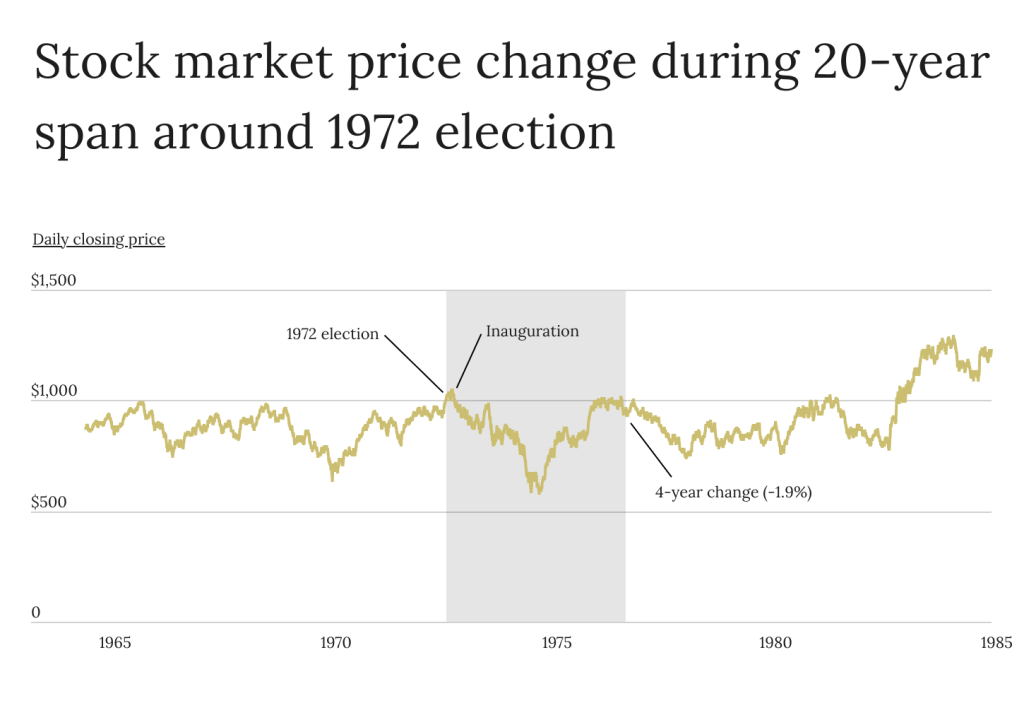

14. 1972 presidential election

- Stock market price change (2 weeks post-election): +2.9%

- Stock market price change (inauguration day): +4.2%

- Stock market price change (4 years post-election): -1.9%

- Elected president: Richard Nixon (Republican)

- Runner-up: George McGovern (Democratic)

Photo Credit: U.S. Money Reserve

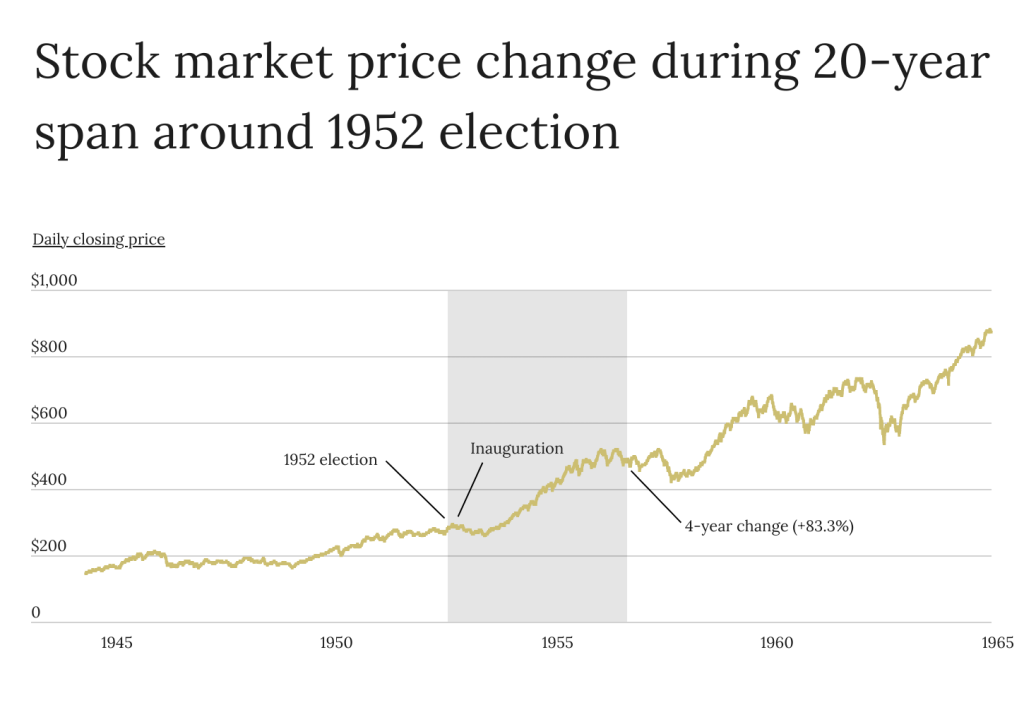

13. 1952 presidential election

- Stock market price change (2 weeks post-election): +2.9%

- Stock market price change (inauguration day): +6.6%

- Stock market price change (4 years post-election): +83.3%

- Elected president: Dwight D. Eisenhower (Republican)

- Runner-up: Adlai Stevenson II (Democratic)

Photo Credit: U.S. Money Reserve

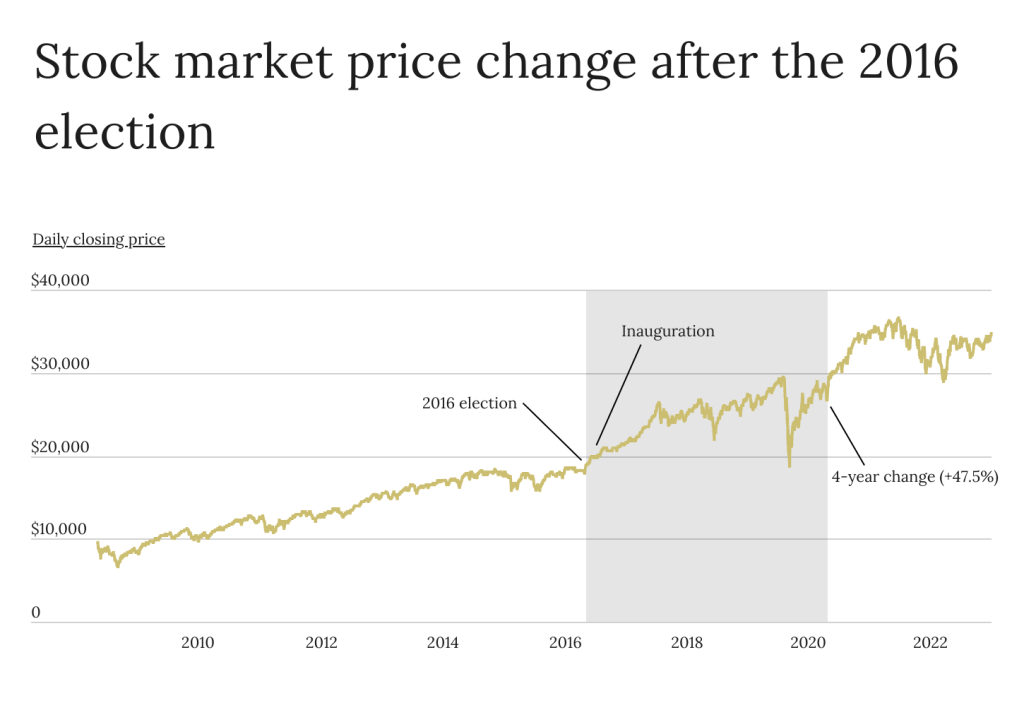

12. 2016 presidential election

- Stock market price change (2 weeks post-election): +4.2%

- Stock market price change (inauguration day): +8.6%

- Stock market price change (4 years post-election): +47.5%

- Elected president: Donald Trump (Republican)

- Runner-up: Hillary Clinton (Democratic)

Photo Credit: U.S. Money Reserve

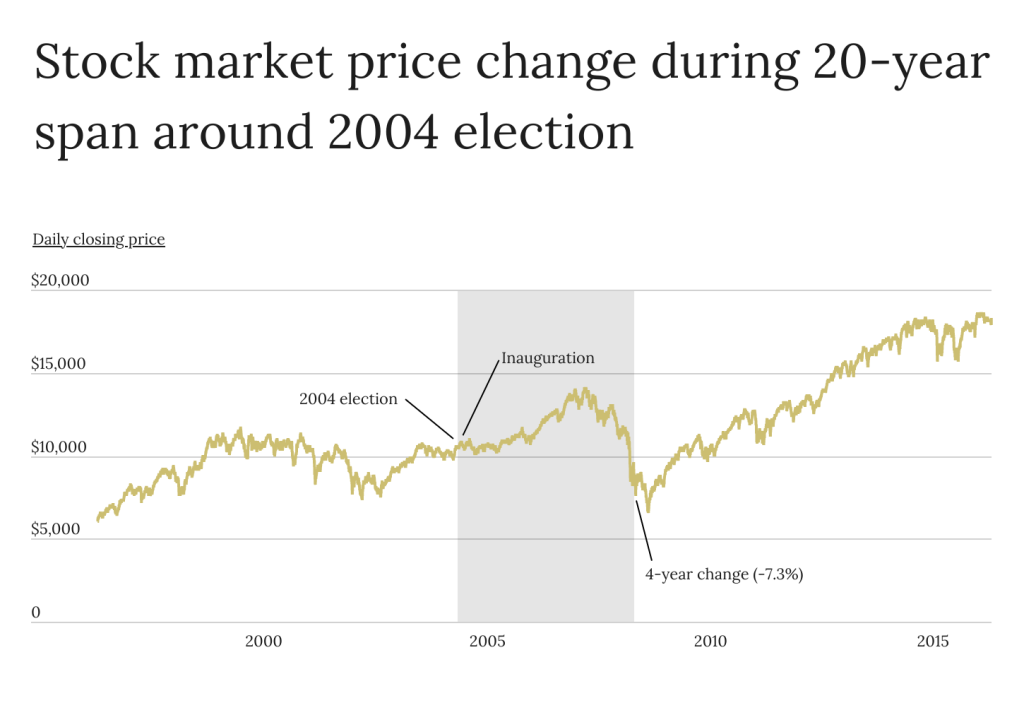

11. 2004 presidential election

- Stock market price change (2 weeks post-election): +4.3%

- Stock market price change (inauguration day): +4.1%

- Stock market price change (4 years post-election): -7.3%

- Elected president: George W. Bush (Republican)

- Runner-up: John Kerry (Democratic)

Photo Credit: U.S. Money Reserve

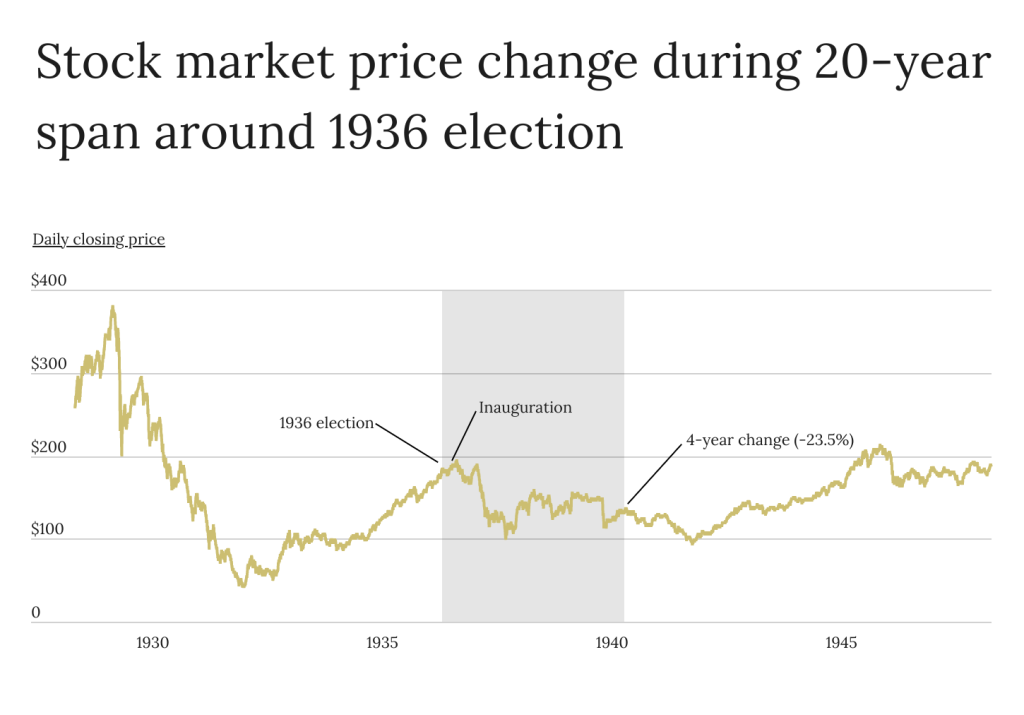

10. 1936 presidential election

- Stock market price change (2 weeks post-election): +4.7%

- Stock market price change (inauguration day): +5.3%

- Stock market price change (4 years post-election): -23.5%

- Elected president: Franklin D. Roosevelt (Democratic)

- Runner-up: Alf Landon (Republican)

Photo Credit: U.S. Money Reserve

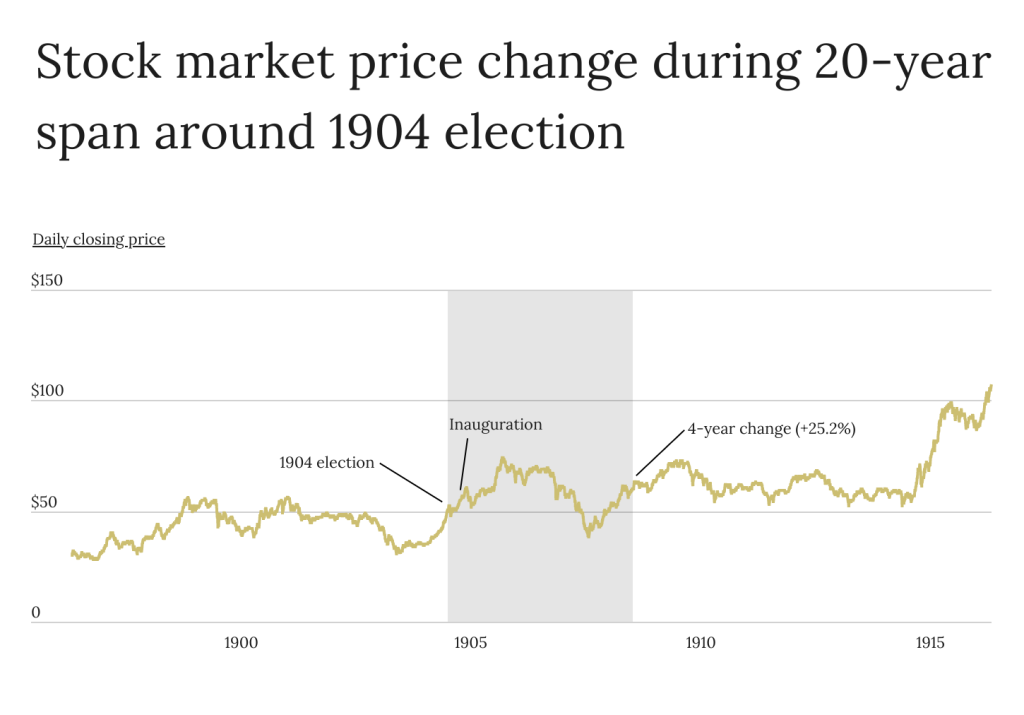

9. 1904 presidential election

- Stock market price change (2 weeks post-election): +5.4%

- Stock market price change (inauguration day): +14.7%

- Stock market price change (4 years post-election): +25.2%

- Elected president: Theodore Roosevelt (Republican)

- Runner-up: Alton B. Parker (Democratic)

Photo Credit: U.S. Money Reserve

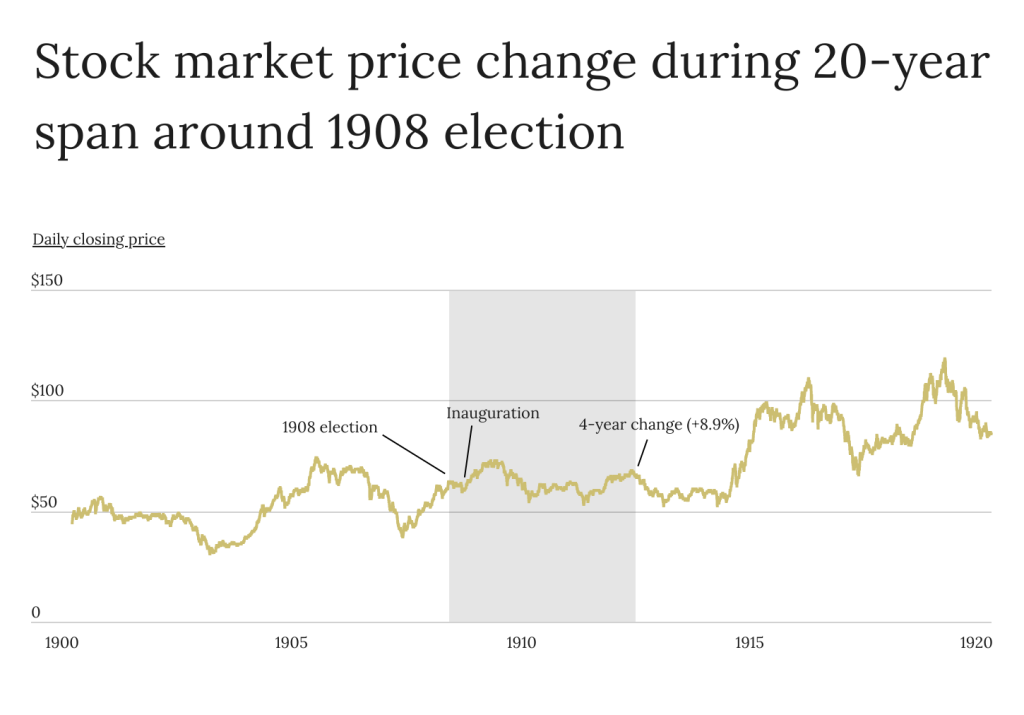

8. 1908 presidential election

- Stock market price change (2 weeks post-election): +5.8%

- Stock market price change (inauguration day): -1.3%

- Stock market price change (4 years post-election): +8.9%

- Elected president: William Howard Taft (Republican)

- Runner-up: William Jennings Bryan (Democratic)

Photo Credit: U.S. Money Reserve

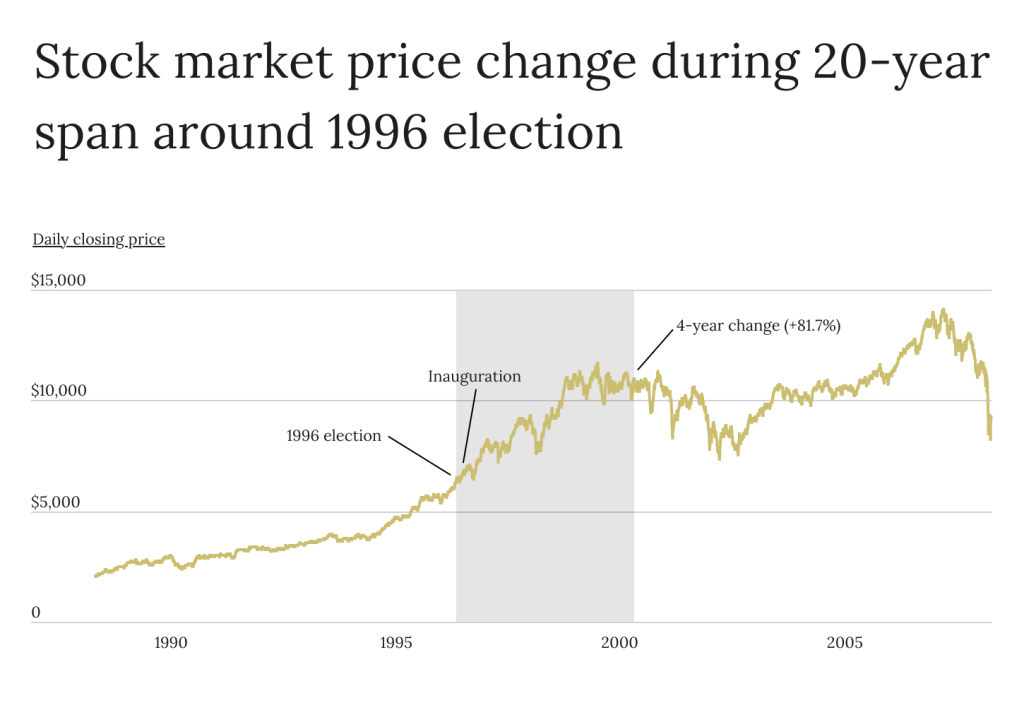

7. 1996 presidential election

- Stock market price change (2 weeks post-election): +5.9%

- Stock market price change (inauguration day): +13.3%

- Stock market price change (4 years post-election): +81.7%

- Elected president: Bill Clinton (Democratic)

- Runner-up: Bob Dole (Republican)

Photo Credit: U.S. Money Reserve

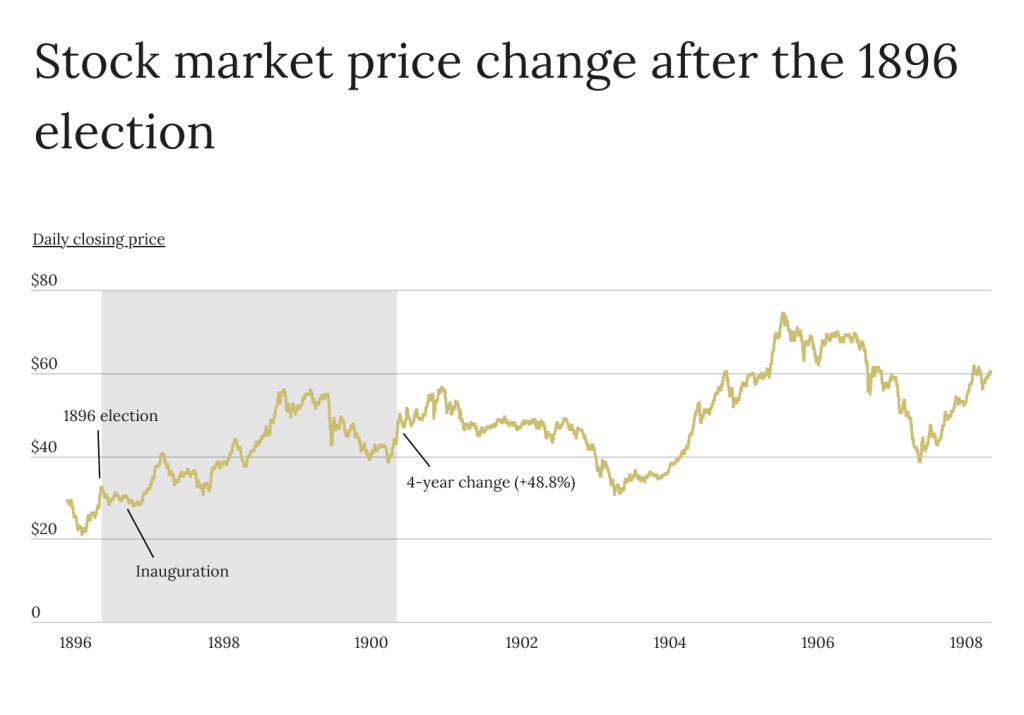

6. 1896 presidential election

- Stock market price change (2 weeks post-election): +6.5%

- Stock market price change (inauguration day): +1.0%

- Stock market price change (4 years post-election): +48.8%

- Elected president: William McKinley (Republican)

- Runner-up: William Jennings Bryan (Democratic)

Photo Credit: U.S. Money Reserve

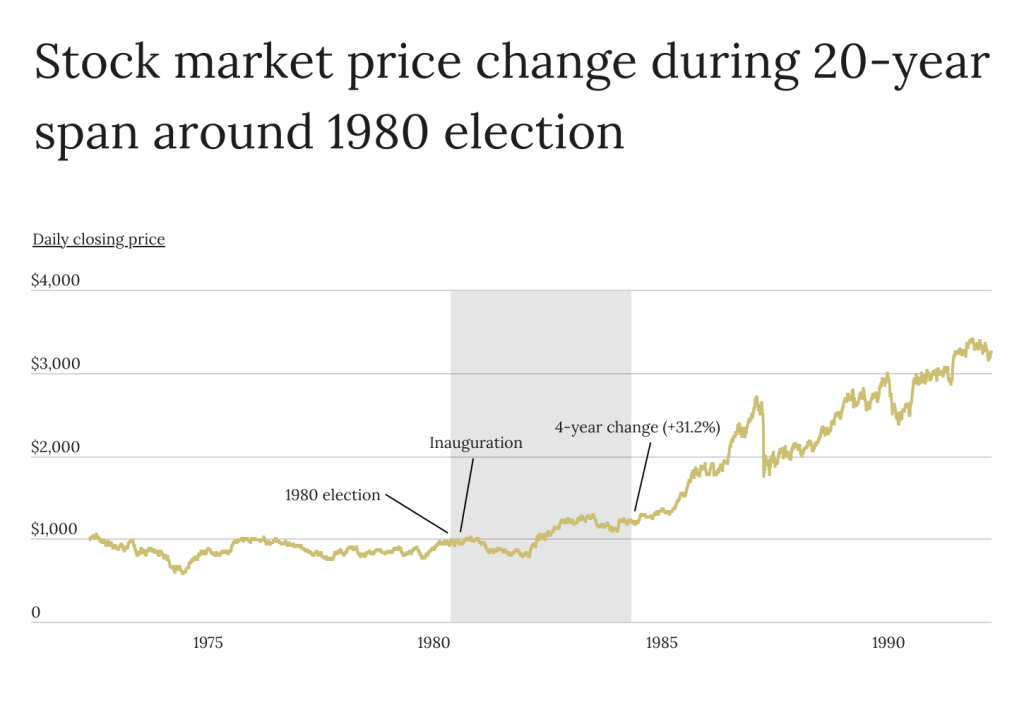

5. 1980 presidential election

- Stock market price change (2 weeks post-election): +6.5%

- Stock market price change (inauguration day): +1.4%

- Stock market price change (4 years post-election): +31.2%

- Elected president: Ronald Reagan (Republican)

- Runner-up: Jimmy Carter (Democratic)

Photo Credit: U.S. Money Reserve

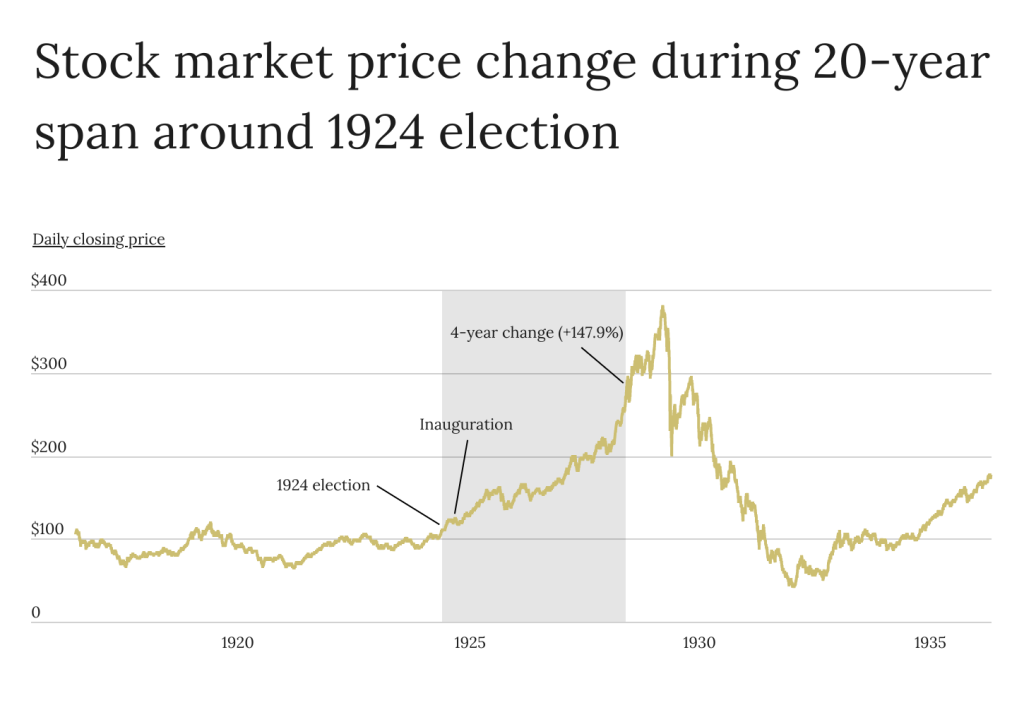

4. 1924 presidential election

- Stock market price change (2 weeks post-election): +6.6%

- Stock market price change (inauguration day): +18.6%

- Stock market price change (4 years post-election): +147.9%

- Elected president: Calvin Coolidge (Republican)

- Runner-up: John W. Davis (Democratic)

Photo Credit: U.S. Money Reserve

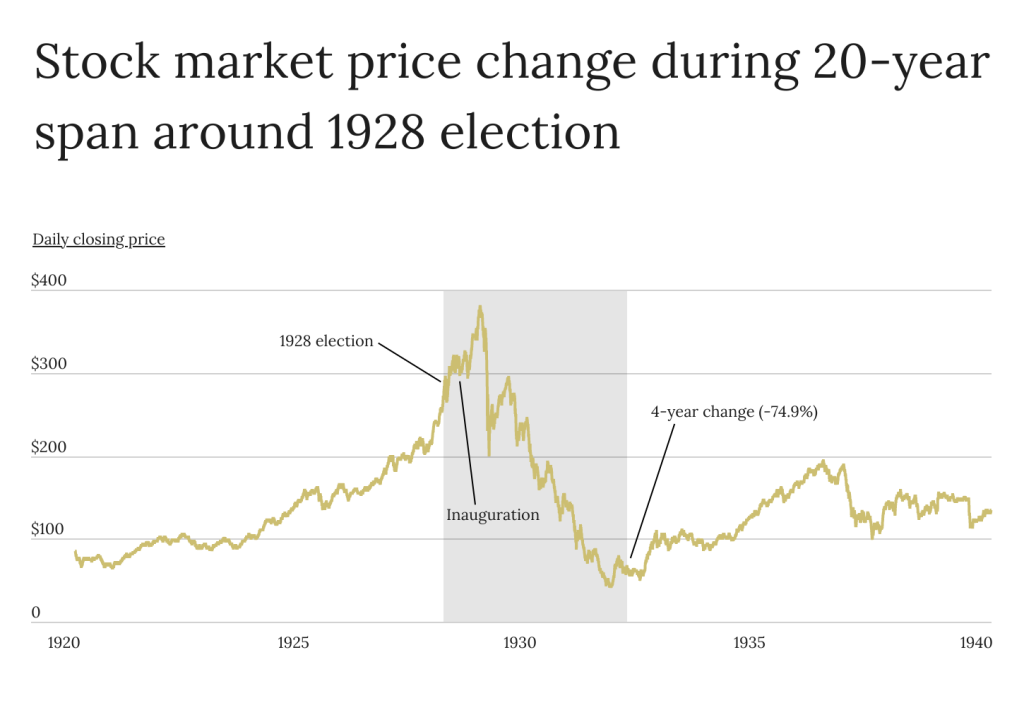

3. 1928 presidential election

- Stock market price change (2 weeks post-election): +10.2%

- Stock market price change (inauguration day): +23.9%

- Stock market price change (4 years post-election): -74.9%

- Elected president: Herbert Hoover (Republican)

- Runner-up: Al Smith (Democratic)

Photo Credit: U.S. Money Reserve

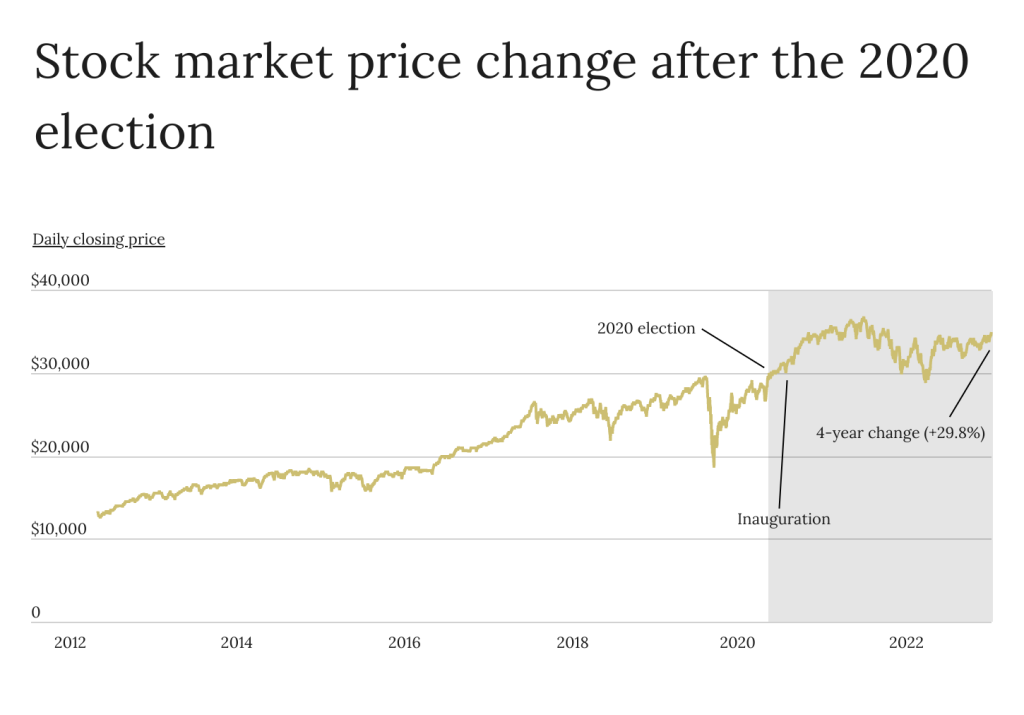

2. 2020 presidential election

- Stock market price change (2 weeks post-election): +10.6%

- Stock market price change (inauguration day): +15.8%

- Stock market price change (4 years post-election): +29.8%

- Elected president: Joe Biden (Democratic)

- Runner-up: Donald Trump (Republican)

Photo Credit: U.S. Money Reserve

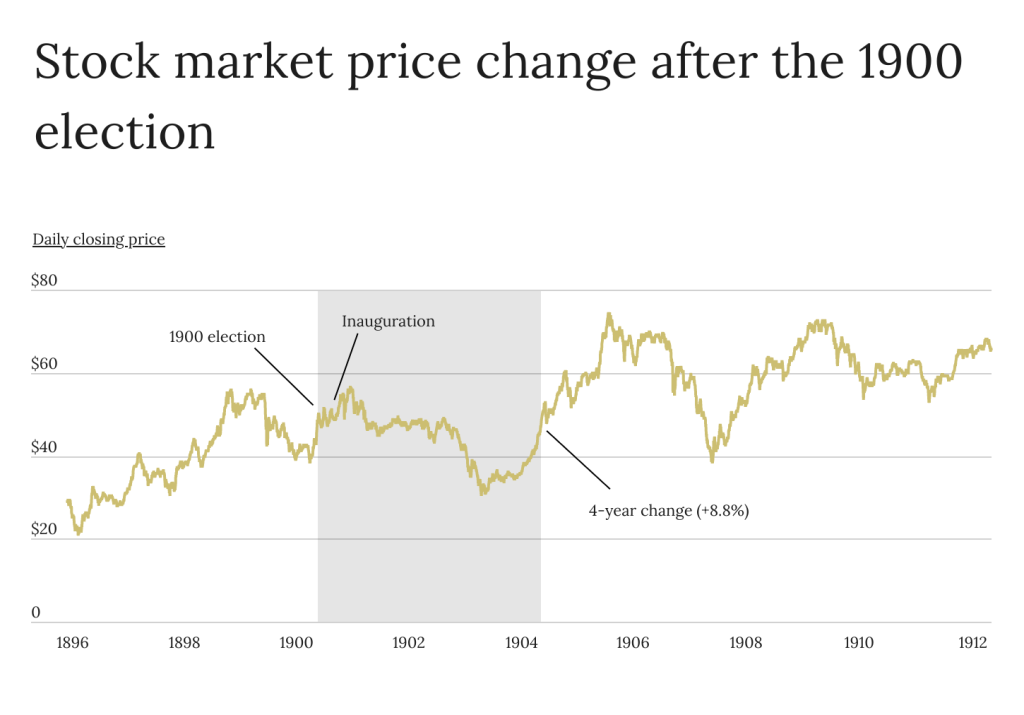

1. 1900 presidential election

- Stock market price change (2 weeks post-election): +13.4%

- Stock market price change (inauguration day): +11.0%

- Stock market price change (4 years post-election): +8.8%

- Elected president: William McKinley (Republican)

- Runner-up: William Jennings Bryan (Democratic)

Methodology & Detailed Findings

To determine the strongest post-election stock markets in history, researchers at U.S. Money Reserve analyzed the latest data from the Dow Jones Industrial Average®. The researchers ranked post-presidential election stock markets from 1896 to 2020 according to the percentage change in the stock market index two weeks after each election. In the event of a tie, the presidential election with the larger percentage change from election day to inauguration day was ranked higher. Researchers also calculated the percentage change in the index four years after each election.

For complete results, please see The Strongest Post-Election Stock Markets in History on U.S. Money Reserve.