Homeownership stands as a cornerstone of the American dream, providing individuals and families with the opportunity to accumulate wealth and maintain relatively consistent housing costs over time. The financial stability derived from homeownership is regarded as a key avenue for economic advancement and security. However, the realization of these benefits has not been uniform across demographic groups. These disparities, particularly along racial lines, have persisted for decades, resulting in substantial wealth gaps and reduced financial security among various minority groups.

The affordability of homeownership is now further strained due to a persistent undersupply of housing resulting from more than a decade of low levels of residential construction. Limited housing inventory has driven up home prices, creating additional barriers for lower-income buyers—who are disproportionately people of color.

While the minority homeownership gap has narrowed since 2000, these affordability challenges threaten to slow or even reverse that progress. Elevated mortgage interest rates and systemic disparities in access to credit continue to make homeownership less attainable for many minority households, even as overall homeownership rates have improved. As cities across the U.S. struggle with housing shortages and high costs, sustaining and further closing the racial homeownership gap will continue to be a critical challenge.

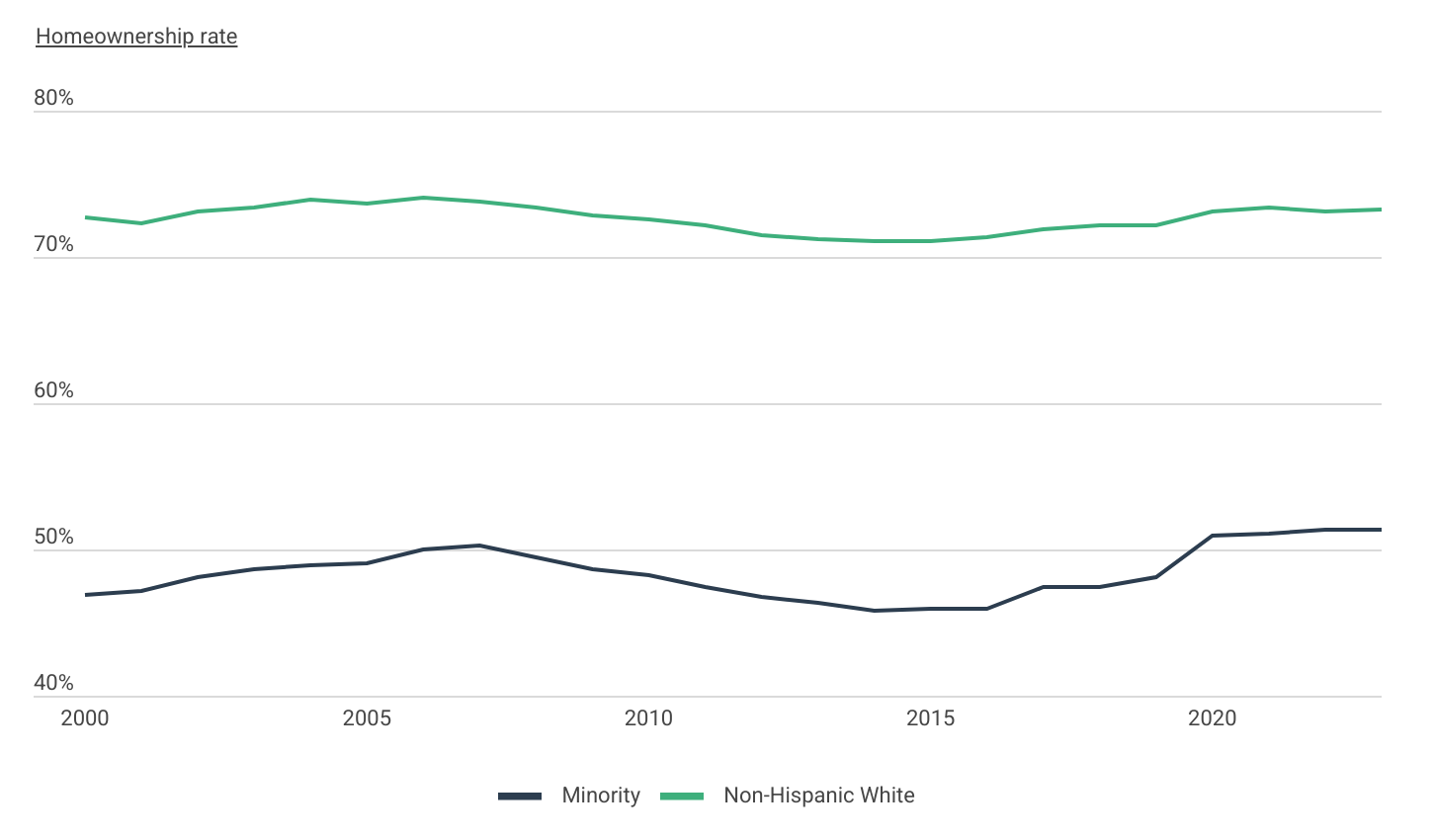

Minority Homeownership Rate Over Time

After increasing between 2016 and 2020, the minority homeownership rate has plateaued

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

The minority homeownership gap—defined here as the difference between the White homeownership rate and the minority homeownership rate—has exceeded 20 percentage points for at least the past two decades. While the gap narrowed slightly during the housing bubble of the early 2000s, it widened following the housing market crash in 2008. The financial crisis and subsequent recession disproportionately impacted minority communities, leading to higher rates of foreclosure and home loss compared to their White counterparts. As a result, the gap remained wide throughout much of the 2010s.

Unlike past economic downturns, the COVID-19 recession proved to be an exception in its impact on minority homeownership. A combination of rapid economic recovery, government stimulus programs, and targeted housing support helped minority households regain financial stability more quickly than in previous crises. Between 2016 and 2020, the minority homeownership rate steadily increased from 46.0% to 51.0%, while the White homeownership rate rose from 71.3% to 73.1%. This growth continued into 2021 and 2022, with the minority homeownership rate reaching 51.4% and the White homeownership rate peaking at 73.4%.

However, since then, both minority and White homeownership rates have plateaued. The minority homeownership rate remained at 51.4% in 2023, while the White homeownership rate dipped slightly to 73.2%. This plateau comes as home prices and mortgage rates have surged, making it more difficult for first-time buyers—particularly those from lower-income and historically disadvantaged groups—to enter the housing market. While the minority homeownership gap remains smaller than it was in the early 2010s, the lack of recent progress highlights the continuing challenges in achieving racial parity.

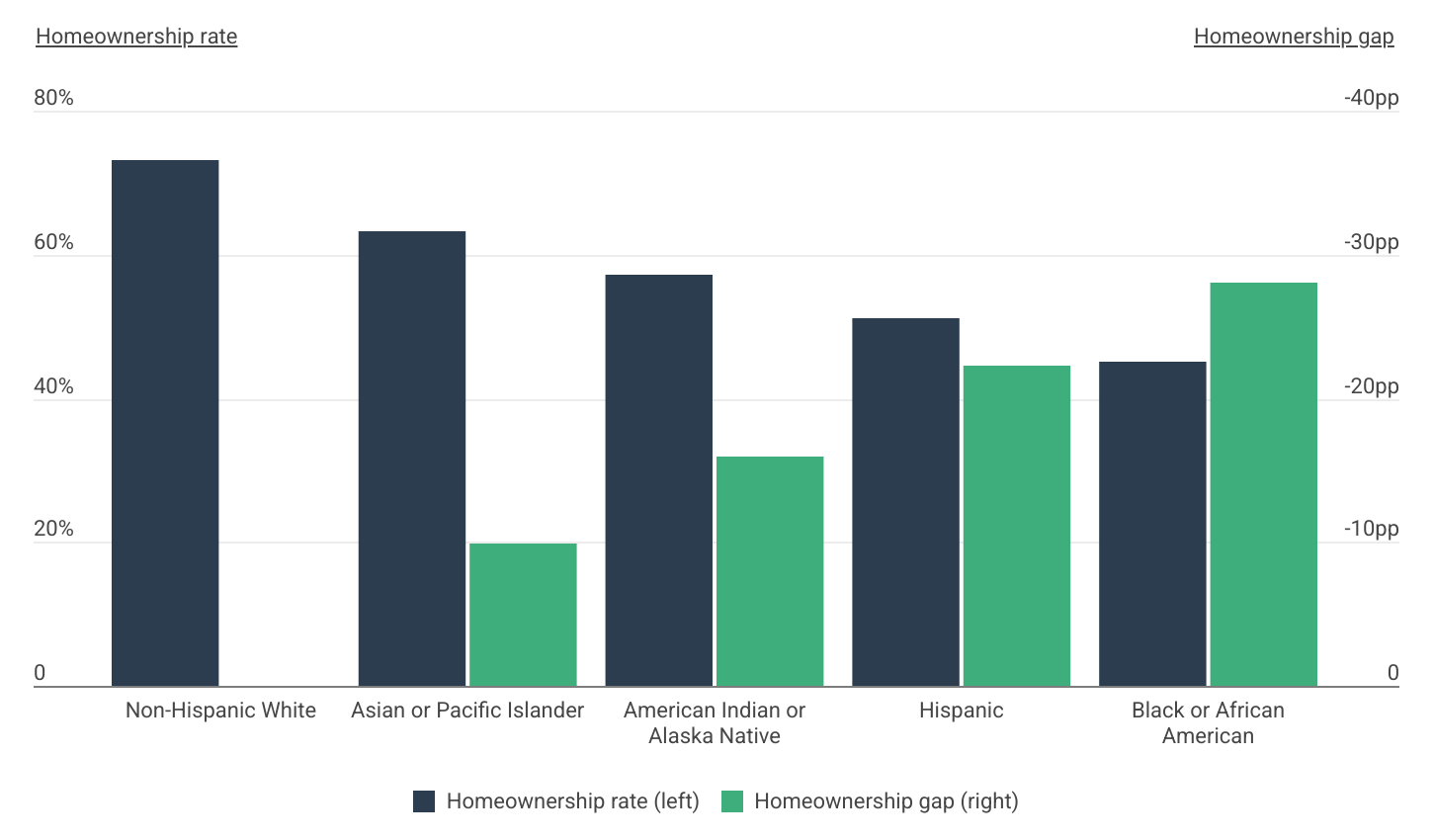

Homeownership Rates by Race & Ethnicity

Of the largest racial/ethnic groups, Black Americans have the lowest homeownership rates

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

Despite the overall minority homeownership gap narrowing to below 22 percentage points, the gap varies widely by race and ethnicity. Among the nation’s largest minority groups, Asians and Pacific Islanders have the highest rates of homeownership at 63.3%, followed by American Indian and Alaskan Natives at 57.2%. Hispanic and Black Americans have the lowest homeownership rates, at just 51.0% and 45.0%, respectively.

Even with recent improvements, the homeownership gap between Black and White Americans is actually wider today than it was in the 1960s when it was legal to refuse to sell a home to someone because of their race. More so than other demographic groups, Black Americans were hit especially hard by the housing crisis in 2008 because they more frequently purchased homes at the height of the bubble and were disproportionately the victims of subprime lending.

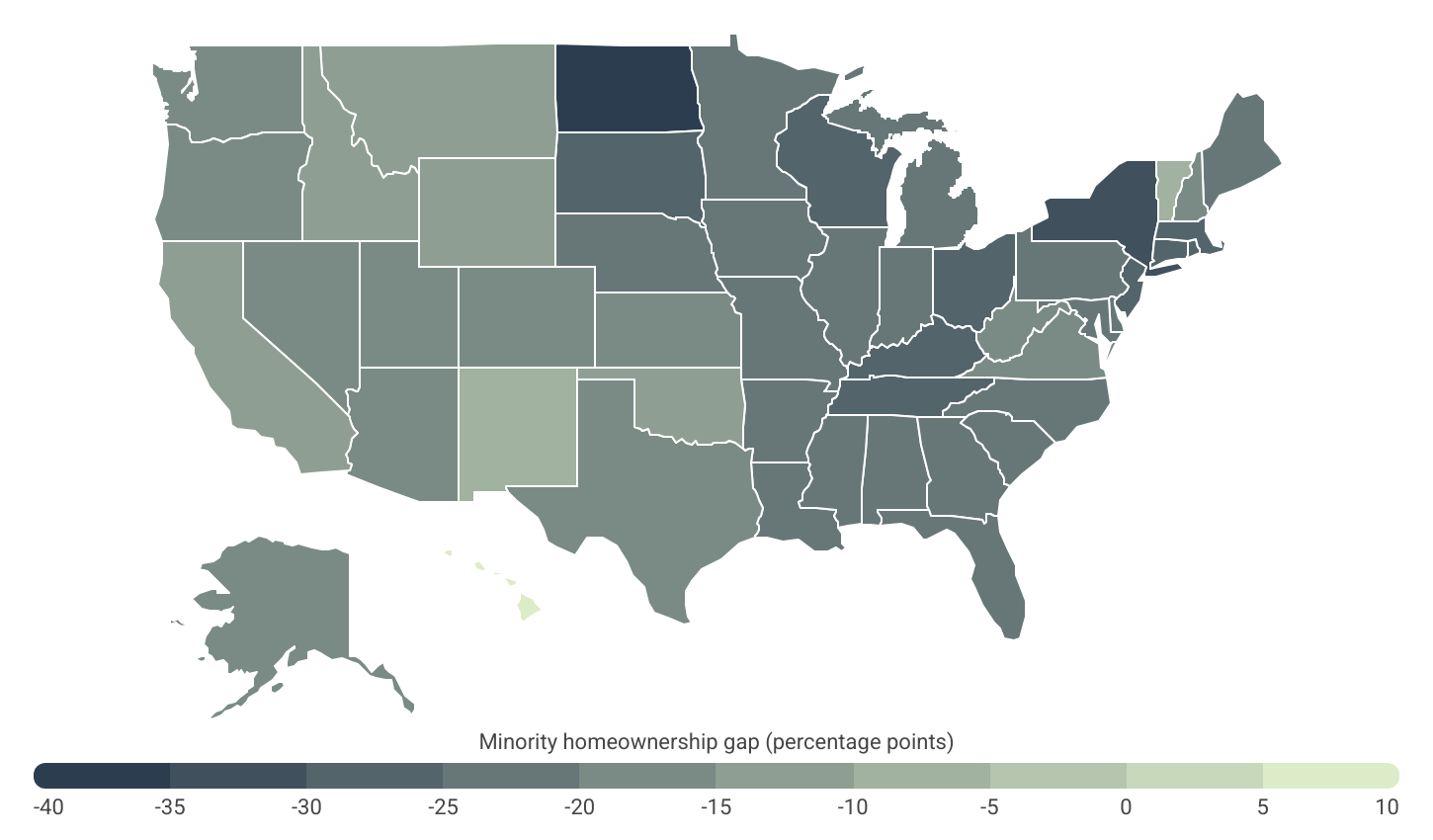

Minority Homeownership Gaps by Location

The Midwest and Northeast have the largest minority homeownership gaps

Source: Construction Coverage analysis of U.S. Census Bureau data | Image Credit: Construction Coverage

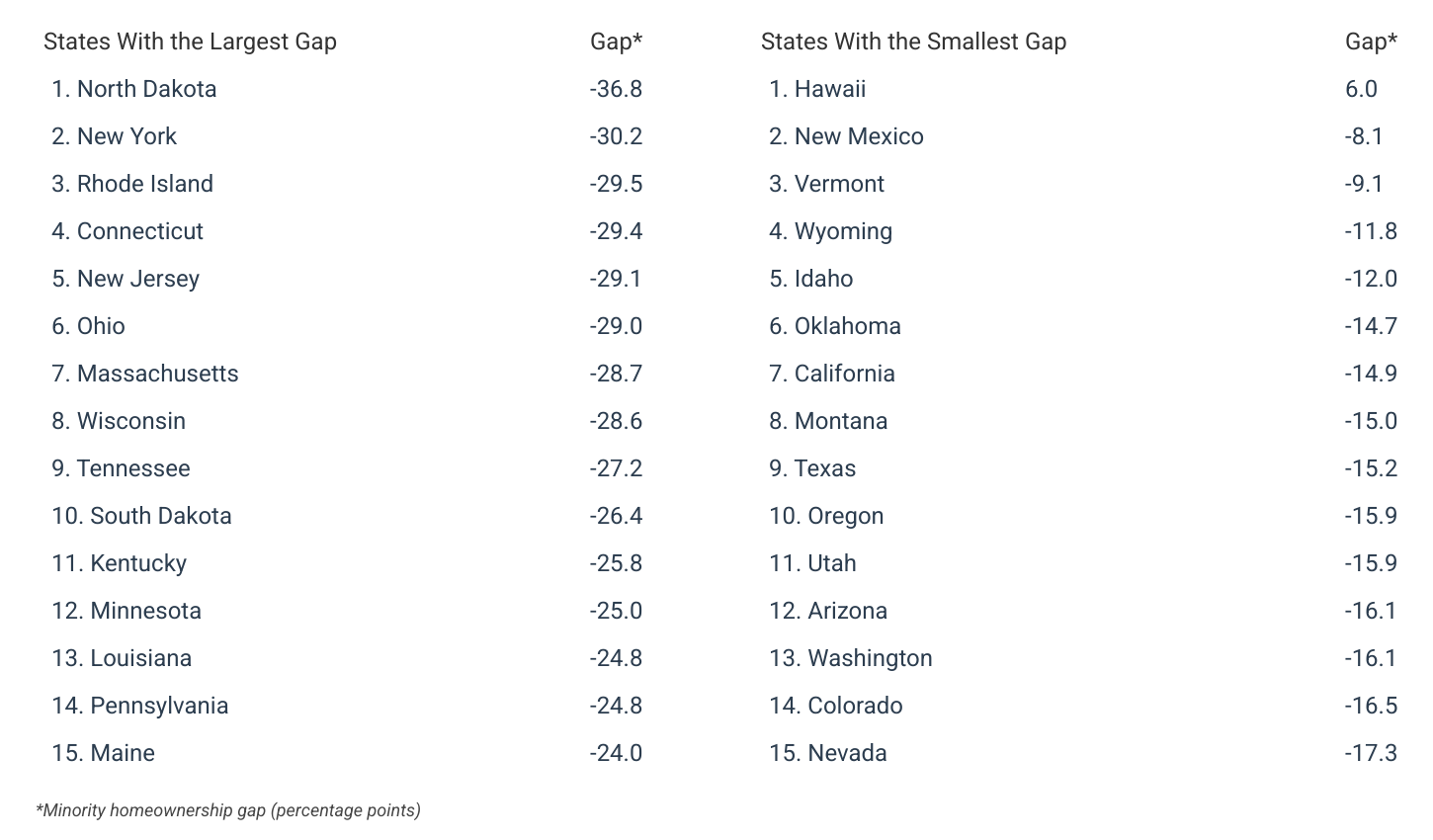

The minority homeownership gap varies across the U.S. due to factors such as local demographic makeup, housing costs, employment opportunities, and historical homeownership rates. On a regional basis, the minority homeownership gap is largest in the Midwest and Northeast. North Dakota and New York report the largest differences between White and non-White homeownership at 36.8 and 30.2 percentage points, respectively. These are the only two states where the gap exceeds 30 percentage points. Other states with large gaps include Rhode Island (29.5pp), Connecticut (29.4pp), and New Jersey (29.1pp).

Conversely, Hawaii remains the only state in which the minority homeownership rate actually exceeds that of White residents. More than 63% of minority households own their homes in Hawaii, compared to approximately 57% of White households.

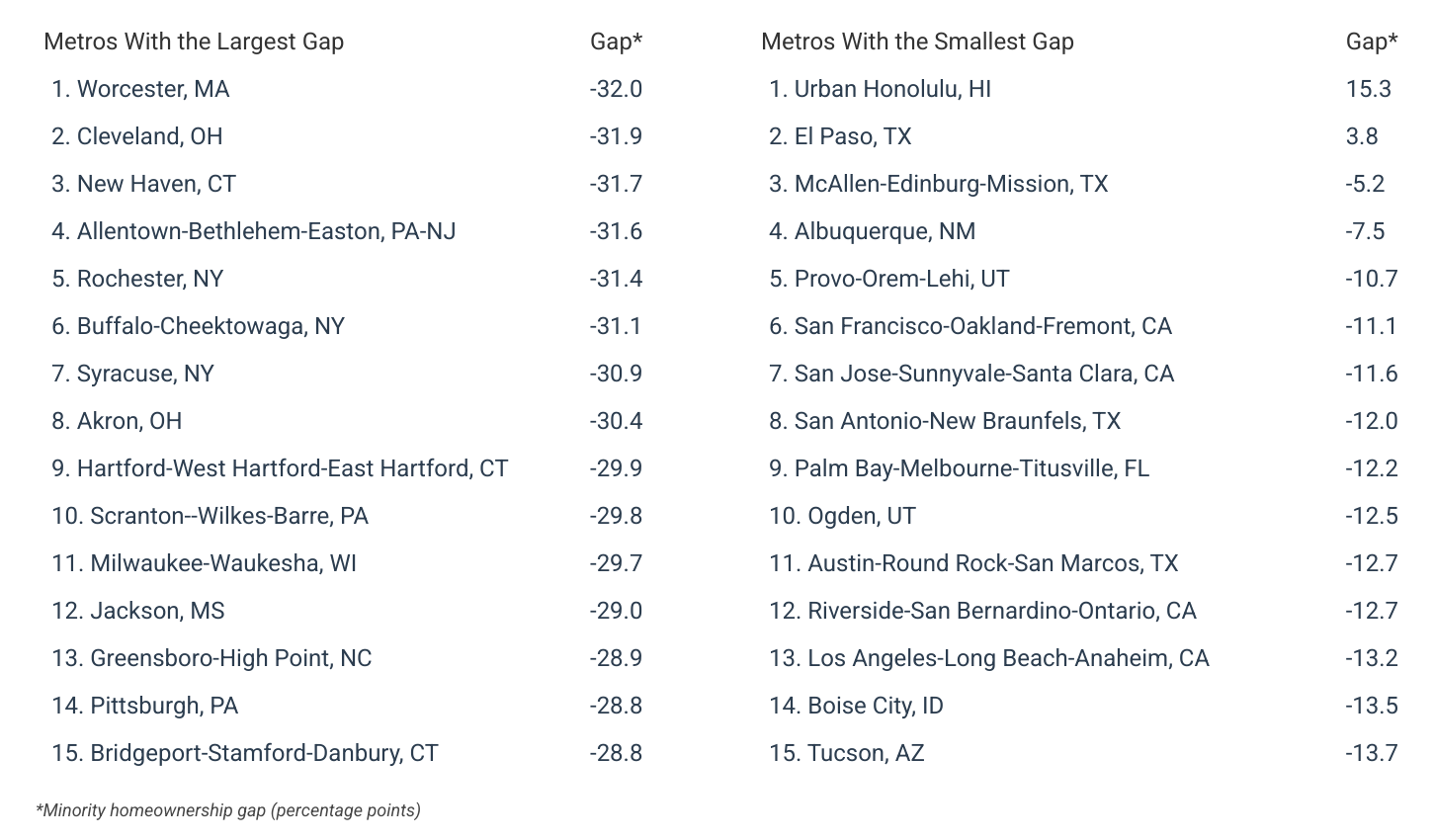

Similar trends hold true at the local level, with metropolitan areas in the Midwest and Northeast reporting the most significant disparities in homeownership rates. Among the nation’s largest 100 metros, Worcester, MA; Cleveland, OH; and New Haven, CT have the largest gaps—all exceeding 31 percentage points. At the opposite end of the spectrum, metropolitan areas in Hawaii, Texas, and California—such as Honolulu, HI; El Paso, TX; McAllen, TX; San Francisco, CA; and San Jose, CA—stand out for having some of the smallest differences in homeownership between minority and non-minority communities.

Below is a breakdown of minority homeownership gaps across the nation’s top and bottom metropolitan statistical areas and states. The analysis was conducted by researchers at Construction Coverage, a website that provides construction software and insurance reviews, using data from the U.S. Census Bureau. For the purpose of this analysis, minorities are defined as people who do not identify as non-Hispanic White. For more, see the original report: American Cities With the Largest Minority Homeownership Gap.

Cities With the Largest Minority Homeownership Gap

States With the Largest Minority Homeownership Gap

Methodology

Photo Credit: Fizkes / Shutterstock

To determine the locations with the largest minority homeownership gap, researchers at Construction Coverage analyzed the latest data from the U.S. Census Bureau’s 2023 American Community Survey. The researchers ranked metros according to the minority homeownership gap, defined as the percentage point difference in homeownership rates between the White population and minorities. Researchers also calculated the minority median property value and the White median property value. For the purposes of this analysis, minorities are those who are not non-Hispanic White.

For complete results, see American Cities With the Largest Minority Homeownership Gap on Construction Coverage.