Country News

Cities With the Biggest Year-Over-Year Increase in Residential Construction

The U.S. housing market, which cooled off in 2023 ...

13h ago

The Rolling Stones Announce Opening Acts, Including Country Artists

The Rolling Stones revealed a list of support acts...

Apr 26, 2024

Audio: Cole Swindell Sharing Special Times With Family And Friends

Cole Swindell's career has given him more unique e...

Apr 26, 2024

Audio: Darius Rucker Reveals Mystery Duet Partner Jennifer Nettles

Darius Rucker just released his new single, "...

Apr 26, 2024

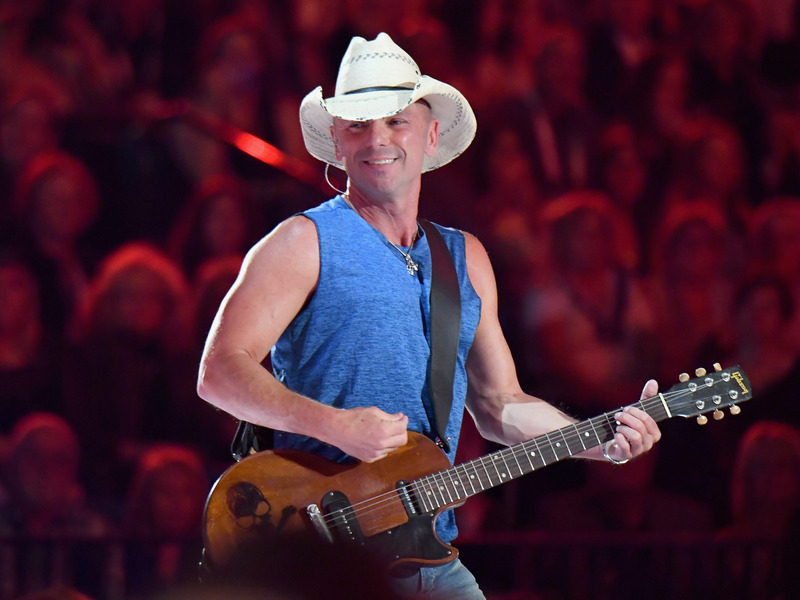

Audio: Kenny Chesney Looking Forward To Charlotte NC This Weekend

Kenny Chesney's tour is off to a great start, last...

Apr 26, 2024